Investing in P2P again

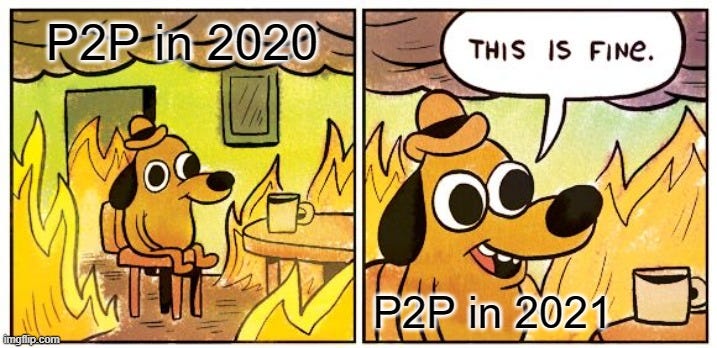

In 2020 I had decreased my exposure to P2P platforms by 90%. In 2021 investing in P2P is still like walking through a minefield, but stock market valuations seem a bit high and crypto is in another bubble for sure. So I’ve decided to get active in P2P again. Which platforms did I select?

General risks

Before investing in any P2P platform, do your research and consider following risks:

No rules: Most of P2P platforms are not regulated. They can change the rules any time. Any promises you read in websites or agreements are just that - promises. In practice investors don’t have any claim on any loan receivables. And even those platforms that are regulated, can still be bad at managing money and cause a negative return.

Empty promises: There is no enforceable buyback guarantee, group guarantee or insurance. Just more promises to make you feel more comfortable.

No control: In case of real estate and business loans - yes, projects might have pledges, but collecting debt and selling any collateral is still in control of the platform/loan originator and if they are bad in managing that or not honest, investors can still lose big part or all of the money invested.

No safety: You are not investing, but speculating. You are sending your money to a private company with limited liability. If you get lucky, the company (platform) will pay you back. If not, not much you can do.

Higher risk, same reward: Professional investors invest in bonds and for higher risk they get paid higher premium. P2P investors have no idea about the risks and are treated as “dumb money“ by most of platforms - financial reporting quality is low, focus is on marketing. Investors are not properly compensated for taking higher risk.

EstateGuru

The best real estate P2P platform in Europe - run by experienced professionals, who are good at filtering out scams and have good debt collection process in place.

It might get harder for EstateGuru to offer the same risk/reward in future as they grow, but so far they have found the sweet spot - risky real estate development projects with low LTVs and high interest rates.

If projects fail, most of risk is taken by too optimistic developers, not by investors. Collateral is sold and so far investors have not lost money in any project. The worst case was a potential loss of 10% from principal, but even there EstateGuru will try to collect this money from a personal guarantee.

EstateGuru was the only P2P platform where I was active in 2020 - new investments were stopped, but I did not sell anything on secondary market. In 2021 I plan to increase my EstateGuru portfolio to €10k or so, and I am using following Auto Invest settings:

Any drawbacks?

Exiting platform can get expensive: 2% platform fee + discount to attract a buyer. But if you can wait up to 12-18 months until loans are repaid back, that should not be a concern.

Covid impact?

In April and May of 2020 EstateGuru experienced some slowdown, but overall funding volume has grown almost 3x when compared to last year:

Dec 2019: €6.6 m in loans funded

Dec 2020: €18.3 m in loans funded (+277%)

But there is an impact on portfolio quality, amount of late and defaulted loans have increased. Could it get worse? Sure, but if the debt collection works as good as so far, then I am not worried:

Learn more about EstateGuru: p2p.holdings/estateguru

Viainvest

Viainvest

Viainvest is one of the few P2P platforms that is keeping things simple:

no fees, no changes in rules

no conflicts of interest

12% return

proper financial reports

Since it was launched in Dec 2016, platform has attracted 20 000 investors. The volume of loans funded has decreased in 2020 when comparing to 2019, but there is no problem with investor confidence - some even complain about cash drag.

In short - demand for Viainvest loans is bigger than supply, and the only issue for Viasms Group - expanding their customer base.

Any drawbacks?

There is too big demand, and all loans are picked up by Auto Invest portfolios. If you want to invest there, start with a smaller amount, set up Auto Invest and check after couple of days/weeks - if the money is invested.

Another issue: there is no secondary market. To get your funds back you need to wait until the loan agreement is closed or a Buyback Guarantee is activated. But as majority of the loans are short-term (<30 days), this is not a serious issue.

One way to “fight“ with cash drag - set a high limit for max investment in one loan. I’ve invested €10k in Viainvest, and these are my Auto Invest settings:

Learn more about Viainvest: p2p.holdings/viainvest

Mintos

I’ve been critical of Mintos in 2020 and they deserve it - freezing close to €100m of investors money in suspended and defaulted loan originators is not a joke. I expect that at least €60-€70m will be lost.

If you have missed my previous posts about Mintos, here is an overview:

Mintos - affiliated loan originators, complicated recovery process, Sebo deal

Mintos in 2020: 17 failed Loan Originators, €118 million at risk

And just couple of days ago Latvian journalists from Re:Baltica published a detailed insight into key person behind Mogo, Mintos, Varks, etc. - Aigars Kesenfelds, recommend to read it as well:

On other hand I invested in Mintos crowdfunding campaign and I really like the liquidity of Mintos secondary market - no other platform comes close to it.

And while I consider most of Mintos loan originators as “junk“, there are few companies that I like. After some research I’ve decided to invest in 4 of them: DelfinGroup, IuteCredit, Sun Finance, Mogo

I’ve selected only loans with buyback, and in case of Sun Finance - only those countries that have the so called “group guarantee”.

Learn more about Mintos: p2p.holdings/mintos

Potential conflict of interest

My wife works at Mogo, which is one of the biggest loan originators on Mintos

MaxTraffic, where I am CEO & shareholder, has clients from lending sector

I invested 2k EUR in Mintos crowdfunding campaign

There are affiliate links in this post

Key Takeaways

As I am getting a bit scared of what is happening in stock and crypto markets, getting active in P2P again does not seem like a bad idea.

Situation in P2P has not improved much. Don’t expect it to be a passive and safe income stream. Do your research and be very careful.

I plan to test more P2P platforms, but right now I am happy to start only with 3 of them: EstateGuru, Viainvest, Mintos

P.S. Join “High-risk investments“ Telegram group for an informal discussion

Kristaps, I love your reviews and thoughts, but with this article it feel you've been "bought" by some platforms. Estateguru - not once you shown high risks about it, but now you say like "yea, just best place to invest". I saw so many many fake looking projects last year, that it blew my mind how many ppl could loose money one day. Same p2p model, again Estonian, EvoEstate - I saw a Lithuanian interview with one of the owners, and I found it such a huge fake, lying platform. But some people, I think, believes it, and it is sad. I quit EstateGuru, Mintos, Viainvest and others as I feel they are all just pyramid, and the losers will be the last ones. I left a bit just in Lithuanian "Paskolu klubas" a bit, as it is more under control of gov and docs are more clear. Again, in my personal opinion, one day after more P2Ps failures, this business model could be banned at all (like in China) or will have to transform to other models, and I don't want to be in queue of hopeless creditors. Now it's way too many risks to keep money there, at least you just gamble.

great job ! tks