Mintos in 2020: 17 failed Loan Originators, €118 million at risk

Mintos has 70 Loan Originators, 17 of them have failed so far - either did not make payments on time, got license revoked or went into wind-down. Result for investors? €118 million at risk, big part of that frozen and much lower return than promised. Could investors predict these events based on Mintos ratings or blog posts? Let’s find out.

Mintos ratings

Let’s start with the description of Mintos rating system:

My impression from reading it: A and B rated companies should be fine, and if there are any issues - they probably should be downgraded to C and if problems persist, then these loan originators with “elevated risk“ might default or start a wind-down process.

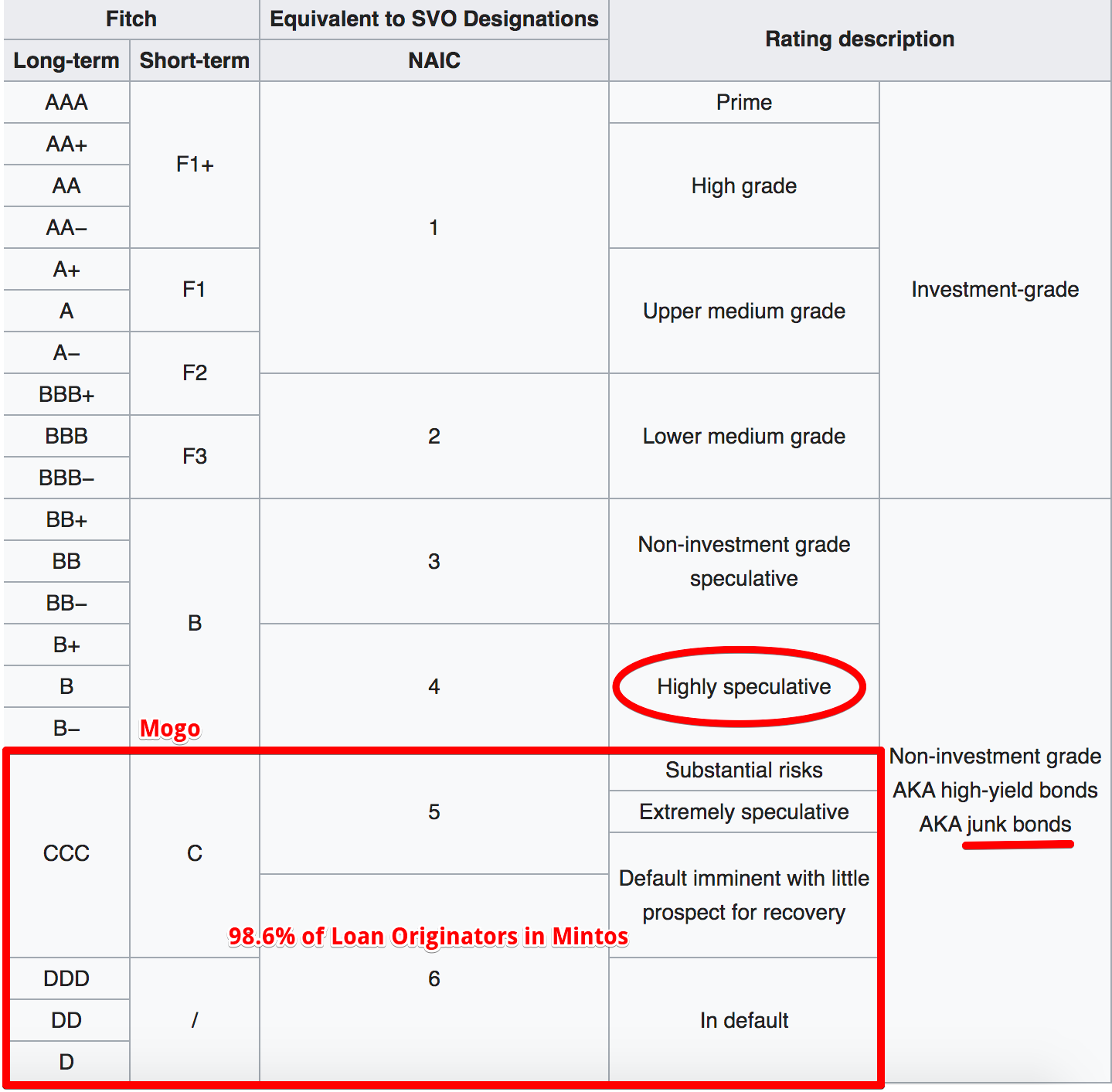

And as Mintos is using a very similar investment scale to the biggest rating agencies in the world (Fitch, Moody's and Standard & Poor's), then my guess is that other investors might think the same.

Problematic Mintos Loan Originators

What is the reality? I've compiled a list of 20 failed companies from 17 Loan Originators - I checked the rating changes over time:

when LO was added to Mintos

at the point of failure

right away after LO was suspended

today (at time of writing: 09.08.2020)

As you can see, there is almost no connection between the assigned Mintos rating and the possibility of failure:

B+ rating, 3 failed LOs: IuteCredit Kosovo, Varks (Finko Armenia), Akulaku

B rating, 3 failed LOs: Peachy, IFN Extra Finance, GetBucks

B- rating, 8 failed LOs: Lendo (Finko), Rapido Finance, Metrokredit (Finko), AlexCredit, Capital Service, ExpressCredit, Cashwagon, Dziesiatka Finanse

C+ rating, 3 failed LOs: Aforti, Monego (Finitera), ID Finance

C rating, 2 failed LOs: Kredit24, Kiva (Finko)

This reminds me of comparison I used in my previous post about Mintos:

Loan Originator ratings are inflated. For example, Fitch rated Mogo as B-, but at the same time Mogo is the only “A” rated company in Mintos. If Fitch would rate all Mintos Loan Originators, result would probably be B- for Mogo, C and worse for everything else. What does it mean? I will let Fitch do the explaining:

When I wrote that, several people commented that I cannot compare bond ratings to Mintos ratings, etc., but looking from today’s perspective - the comparison (98.6% of Mintos LO = junk) seems to match the reality (24% of Mintos LO having failed already).

Realistic version of Mintos ratings

If anyone still relies on Mintos ratings, then I suggest to look at them in following way:

A rated loan originators: highly speculative

B, C, D rated loan originators: junk

Why? Because 24% of Loan Originators have run into issues and even after they are suspended and it is clear for Mintos and investors, that there is a substantial risk of losing money, Mintos is still keeping even B+ ratings for some of them.

Alternative Mintos loan originator ratings?

ExploreP2P is famous for creating it’s own Mintos LO ratings - and I trust them more than Mintos even taking into account that Mintos has much more data and much more resources (100+ people work there). But there is another issue to consider: situation in P2P changes so fast that looking at old data like financial reports can work in some cases, but overall it is not enough to make solid investment decisions.

And Mintos does not help - annual reports of Mintos Loan Originators are published with a 6-18 month delay. For example, the latest report from Capital Service is from 2018. Is situation at December 2018 relevant today? Probably not.

And how long does it take for a Mintos LO to run into issues? I checked - it is 627 days or 1 year and 8.6 months from the date when LO was added to Mintos to date when it failed:

What does it mean? In short - when you will see the financial report or latest update from ExploreP2P, there is a big possibility - it is already too late.

The ideal situation would be if anyone could get access to same data that Mintos has - the changes to portfolio quality each week, etc., but it is not realistic to expect that.

So if you consider Mintos as a place where to speculate with junk loans, then I think the best strategy right now could be:

Avoid Invest & Access, use only a custom Auto Invest strategy

Select only A rated loan originators

Pray that what Mintos advertises as “low risk“ is somewhat close to that.

And another reminder: don't focus on interest rates. 6-9% real return is better than 12-20% promise that ends up as 4-5% and frozen money for 2-10 years.

How much money is at risk?

According to my calculation on 09.08.2020 the total money at risk from these 17 failed Loan Originators is about 118 million EUR:

Of course, big part is expected to be recovered, and there are 2 examples with good outcome:

Lendo (Finko) - I could not find any announcement that company started a wind-down process (where is the transparency?), but Mintos did recently announce - that Lendo has finished wind-down and all investors have been repaid in full.

IuteCredit Kosove - IuteCredit lost license in Kosovo on 06.12.2019, but in next months the IuteCredit Group handled the situation very well and all investors who were affected, are repaid in full.

But at the same time - there are bad examples as well:

Eurocent failed already in 2017, but situation is not resolved yet.

Aforti is refusing to pay Mintos, but was able to repay bond payment early. Impression is that either Mintos is not able or not willing to get the money back.

Monego promised that all late loans would be covered by Finitera, but it has not happened.

Varks proposed to cover the amount due by the end of 2022. Better than Capital Service, but still - if you invest in short-term loans, and get promised a buyback & group guarantee, then end of 2022 is not what you have in mind.

Finko group guarantee “disabled“ - after Varks lost license, Lendo was announced as having finished wind-down, Kiva started a wind-down, and Sebo (the best asset left) was sold to Mogo. Cherry on top: biggest shareholders of Mintos are also the biggest shareholders of Mogo and Finko.

Capital Service recently suggested to Mintos investors cutting debt repayment by 40%, adding 2 year grace period and paying remaining 60% in next 8 years. WTF?

What is the real return of Mintos?

If we assume that about 50% of €118 million will be recovered, that would mean €59,3 million lost. Taking into account that total interest earned by all Mintos investors since 2015 is €110,1 million, we can calculate that the real expected return is not 12.41% what Mintos advertises, but closer to:

(110.1 - 59.3)/110.1 * 12.41% = 5.7%

And that does not take into account the secondary market fee or discounts you would have to use to get liquidity, if you want to get back your investment ASAP, not in 2022 or 2030.

It gets even worse - if a Loan Originator is suspended, then you have missed the opportunity to sell their loans, and will have to wait for who knows, how long. So far there has been no successful cases of Mintos recovering full amount owed from a Loan Originator that is acting in bad faith.

But assuming - if you could sell all your loans when needed, then adding the secondary market fee (0.85%) and some bonus on top (let's say 0.15%) in “normal market conditions“ to get back your investment, you probably should assume a 1% additional fee/cost.

So the real return of investing in Mintos based on current data and assumption of recovering 50% of loans issued by problematic LOs is:

Advertised return: 12.4%

Realistic return, if you can wait couple of years: 5.7%

Realistic return, if you want to access money fast: 4.7%

Is this good enough? Still better than bank deposits, but in no way - passive income with 12% interest as many had hoped for.

Conflict of interest?

Another thing I wanted to look at - how many of these problematic Loan Originators are connected to the biggest shareholders of Mintos: Aigars Kesenfelds, Maris Keiss, Kristaps Ozols, Alberts Pole (co-founders of 4finance and Mogo).

Mintos is not very transparent about this, and very likely this list is not complete, but some of the connected loan originators have run into issues as well:

Is that a problem? Depends how you look at it. From one side Mintos CEO and CEOs of these loan originators will say that even if they don't control the majority of shares, they run the daily operations and are very active in representing their own interests.

But from other side - it does not look too good that the same persons, who control Mintos and also benefit from 10-15 loan originators listed on Mintos, are partly responsible for almost 40 million EUR loan portfolio, that I would classify as “at risk“.

It raises questions like these:

Is Mintos acting in exactly the same way to all LOs? Or there are some advantages for those, who have overlapping shareholders with Mintos?

What happens, if Mintos CEO has one view, but the 4 Mintos big shareholders have a different view? Who has the final say?

What happens, if Mintos as platform wants to remove some of the connected loan originators, but that goes against interests of biggest Mintos shareholders?

What happens if Mintos CEO wants to start legal proceedings against some of connected loan originators? Will Mintos shareholders sue themselves?

Mintos blog - useful info or useless promo?

Just for fun - let’s have a look what Mintos wrote about some of the problematic loan originators before they failed and what happened after. Too often situation before failure was described as positive, and actions after the failure did not match the promises:

Rapido Finance:

22.10.2019: Rapido Finance’s rating has been downgraded from B- to C.

23.10.2019: Mintos temporarily suspends Rapido Finance from the marketplace

MetroKredit:

28.06.2019: Metrokredit’s rating has been upgraded from C+ to B-

19.09.2019: “The main goal for Metrokredit in the next six months to one year is to be in the top three market leaders in the unsecured consumer lending business in Russia.“

06.11.2019: License revoked

08.11.2019: “Company’s liquidity is stable, and for loans that reach 60 days past due, Metrokredit will continue to exercise the buyback guarantee”

Monego (Finitera):

06.12.2019: license revoked

30.12.2019: “Finitera as a guarantor will cover scheduled borrower payments to investors having investments in Monego loans once these payments are delayed for 60 days”

Capital Service:

18.03.2020: “Our collections are continuing as expected. We expect continued good demand. We will emerge stronger than ever.“

06.04.2020: Capital Service suspended on Mintos

07.08.2020: Capital Service offer to Mintos: “let’s reduce debt by 40% and we will pay it back within 8 years with a 2 year grace period”

Akulaku:

18.03.2020: “No major operational and financial impact from the virus. Growth and performance according to expectations.“

16.04.2020: Akulaku suspended on Mintos

Expresscredit:

23.03.2020: “We have not observed any changes in customer repayments. We see that issuance volumes are stable and we have not observed significant changes in demand for the loans. Our gross loan portfolio is EUR 39 million and provides the Group companies with stable and sufficient operating cash flows to manage the existing portfolio, debt and run daily operations without interruption.“

30.04.2020: Expresscredit suspended on Mintos

Cashwagon:

01.04.2020: “During times like this, micro-financial companies with strong, adaptable business models come out stronger.“

06.06.2020: “Due to an investigation on the company Cashwagon, a decision has been made to suspend the loans originated in Vietnam”

10.06.2020: Cashwagon CEO: “All our activities are fully compliant and in accordance with the current laws in place.”

10.06.2020: Cashwagon Philippines and Indonesia loans suspended

Am I still invested in Mintos?

No, since April I'm out of Mintos. As I wrote previously - risk/reward ratio seems too bad. Mintos was the only P2P platform where I had 20k+, but if they continue forward with same approach - inflated ratings, junk originators, pending payments, not sure I will be coming back.

And cherry on top - according to Mintos new user agreement, investors will now have to also pay for legal fees. So Mintos and some of the loan originators fuck up, but investors have to pay for solving their legal issues? Not cool.

Key takeaways

Mintos ratings in real life: A = highly speculative, everything else = junk

Mintos Loan Originators can fail before you get to read their financial report

If a company writes on Mintos blog that “all is fine“, it probably is not

Real expected return for Mintos investors is about 5-6%

118M EUR of loans are “at risk“ and 1/3 of that comes from loan originators that are closely connected to Mintos biggest shareholders.

Comment from Mintos (added 17.08.2020)

We appreciate the time and effort taken to deep dive into various areas of Mintos - there’s a significant amount of information gathered and while there are some parts we’d like to comment on, it nevertheless is a serious effort which we appreciate.

We noticed some parts of the article to be misleading for readers, as they provide limited or one-sided context, as well as we saw some factual mistakes. I share the corrections, as well as the answers to the four questions regarding the affiliated lending companies mentioned closer to the end of the publication.

To start with, when looking at lending companies with issues to transfer investors repayments in time, lending companies who fully failed to transfer the repayments and those who have made a decision to exit the market - we can’t look at all of them being the same.

For example, while some - Aforti, Capital Service - have failed to make payments to investors on Mintos and at some point have taken a hostile way, at the same time lending company Peachy had decided to discontinue their operations and have been acting according to commitments agreed with Mintos and has been making regular repayments. Also, Lendo - a lending company, along with dozens of other lending companies in Georgia, had to limit their operations in the country due to a change of legislation; and has recently settled all payments with investors on Mintos. It is vital to be clear of the reasons behind each of the cases and not call them failed, as you can see that repayments and recovery of investors' funds varies as well.

When looking at Mintos risk ratings - thank you for the detailed overview, we also see the room for improvement here and are in process of remaking the methodology. We believe when we developed the rating system it was appropriate to that time. We must look back on the time when the rating has been given to the company as it is the data driven approach taking into account the data that was available at that time. We do update them regularly. Also rating A doesn't mean that the company will never have any problems, the same is with B and C.

In general, when looking at ratings, they should be viewed within Mintos context, as they are relative to Mintos, not other different assets. For example, an A rated lending company on Mintos is not comparable to an A rated Fitch company - same as it would be among two different industry companies. Also, ratings are not updated after the lending company is suspended. They would be updated only in case any of the Primary or Secondary Markets would be reopened or the lending company is moved to Default status.

Some details to correct:

Current capital at risk is €95 million, according to information we share in two reports - Suspended lending companies and Defaulted lending companies and it is available to the public.

In the list of lending companies - not all ExpressCredit companies are currently suspended, only ExpressCredit Zambia due to a local government delayed payment to the lending company which has impacted its ability to make settlement payments.

About the recently shared User agreement and the confusion of its 10.4 and 10.5 points, we have compiled a FAQ page with more information specifically those two points. Below we export the questions related to those two points.

We’d also like to answer the questions mentioned in the article -

Is Mintos acting in exactly the same way to all LOs? Or are there some advantages for those, who have overlapping shareholders with Mintos?

All lending companies on Mintos receive the same treatment. Of course, if the lending company has a larger EUR volume and amount of loans on the marketplace, the treatment might vary as risks vary and more investors can be affected by its actions.

What happens, if Mintos CEO has one view, but the 4 Mintos big shareholders have a different view? Who has the final say?

The decision making sits with the Board of Mintos, who has a say and their opinion is always taken into consideration. Yet the final say rests with the CEO of Mintos.

What happens, if Mintos as platform wants to remove some of the connected loan originators, but that goes against interests of biggest Mintos shareholders?

As investors can see and it was also mentioned in the article - we already have suspended some of the affiliated lending companies on Mintos. All lending companies receive the same treatment.

What happens if Mintos CEO wants to start legal proceedings against some of connected loan originators? Will Mintos shareholders sue themselves?

If it is decided to take a lending company to Court, we pursue it whether it is an affiliated lending company or not.

We hope our answers will also bring clarity over some of the unclear points.

FAQ on latest User Agreement update

What kind of recovery costs are assumed in the 10.4. and 10.5 clause in the updated User Agreement?

Recovery costs are expenses we have if we need to hire third parties to potentially solve a situation to recover investors’ funds. For example, fees charged by a 3rd party loan servicer, or external legal fees.

When might such recovery costs be passed on to investors?

Before Mintos incurs any external costs related to recoveries, we carefully consider whether we believe they are in the best interest of investors and can potentially improve recoveries. These external costs might be passed and split among affected investors, depending on the severity of the case, potential resources needed to recover the funds, and the amounts to be recovered. There’s no specific threshold for passing external costs.

Mintos would withhold recovery costs from repayments to investors only in the case of successfully recovering full or partial repayments from loan originators. In any scenario, such compensated cost may not exceed the amounts recovered.

So far, Mintos has not passed any recovery cost to investors, and in the future we would only pass costs in rare cases where the external help necessary to recover investors’ funds would involve significant costs. Before passing any cost to investors, Mintos will explain what the cost is, why we believe it to be in the best interest of investors, and why Mintos passes the cost to investors upon recovery.

Why did Mintos add the two new points - 10.4. and 10.5. - in the User Agreement shared by Mintos on 30 July 2020?

The points 10.4 and 10.5 have been present in the Assignment Agreements investors agree to when investing in any particular loan, as well as the Article 2307 and Article 2308 of the Civil law of the Republic of Latvia. With this updated User Agreement, we share the same points, yet make them more clear and understandable, aiming to be transparent and proactive in our communication. We have underestimated the User Agreements update with the two points which have been and are present in the Assignment Agreements. We are sorry for the confusion this has caused. At the same time, we appreciate the feedback from investors and the opportunity to clarify the intent of these clauses.

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Can you review other P2P platforms? And the main question would be, can you recommend any?

Why use 2015 as the start date for adjusted returns? Who were invested in Mintos back then? Almost nobody. Most people joined after 2018 and thus have a negative return, unless they selected only the A rated LO. The average investor in Mintos has lost money.