Mintos in 2020 - how did it go?

I will share couple of charts about Mintos - loans funded, funds frozen because of problematic loan originators, active investors and average investment size. How was 2020 for Mintos and has it recovered after Covid? Let’s check it out.

Mintos loans funded in 2020

Mintos suffered a huge drop in March and April - loans funded volume went down from €317m to €45m - almost 86% drop in just 2 months. Since then volume has somewhat recovered, but still it is not even close to previous situation:

Mintos finished Dec 2020 with €118m in loans funded vs €274m in Dec 2019 (-57%):

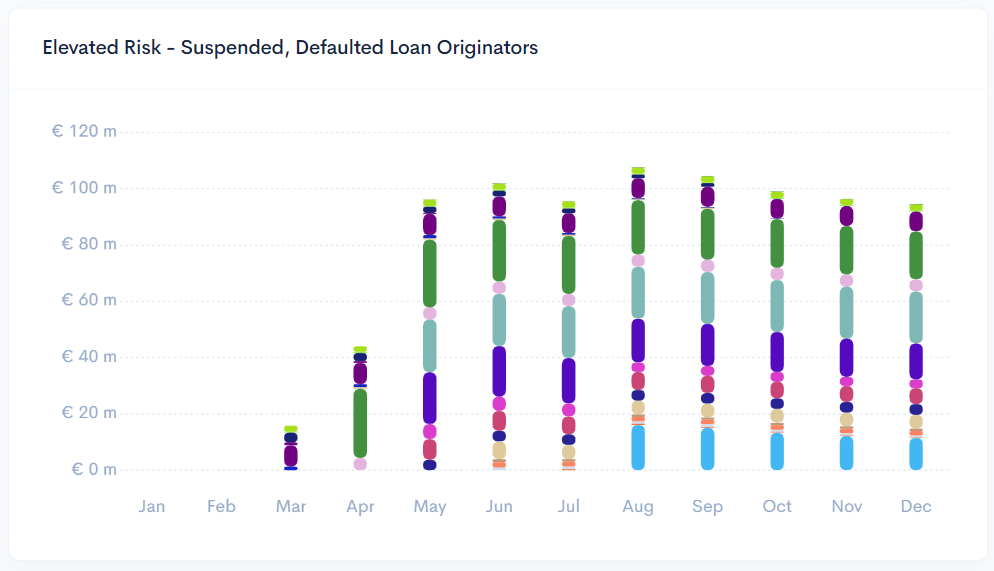

Suspended & Defaulted Loan Originators

Investor money frozen since May 2020 is close to €100m. Situation is improving a bit in last 4 months, but the process is very slow:

Will frozen money go below €50m in 2021 or ever? I don’t think so. At some point Mintos will have to write down the bad debt and hopefully take it into account when they show XIRR to investors.

Loan originators with almost no progress in recoveries are responsible for €43.55m:

Capital Service PL: €18.46m

Cashwagon PH, ID, VN: €7.39m

Monego XK: €7.10

Alexcredit UA: €4.31m

Getbucks ZM: €3.73m

Aforti PL: €1.94

Rapido Finance ES: €0.43m

Eurocent PL: €0.19m

On the other hand there are 2 loan originators where 100% of frozen investment was recovered:

Iute XK

Peachy

Active investors

Mintos has 364 027 registered investors and 162 999 active investors, so 45% of registered investors have invested at least 1 EUR in Mintos.

In 2019 active investors increased from 60753 to 118750, almost 100% growth

In 2020 active investors increased from 128443 to 162999, 27% growth

Average investment

In July 2019 average Mintos investor had invested above 5000 EUR. Since then the average investment has gone down to 2367 EUR.

My guess is that in mid 2019 some investors started to “diversify“ among P2P platforms and were looking for higher yields - that could explain the slow downtrend since then, which accelerated in March 2020 when Covid hit:

If there is one lesson to be learned - just like diversification does not work if you invest in P2P frauds, it also does not work if you invest in low quality loan originators:

Key takeaways

Mintos loans funded volume is recovering, but still down -57% vs last year.

Recovery process is slow, €95m still frozen from problematic loan originators

Average investment per investor has decreased 2x in last 18 months

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Mintos is a clown show. Viventor is a clown show. Bondster is pretty crap. The question is how long it takes good LOs to set up their own P2P platform and leave the multi LO ones. Then you're left with garbage LOs on poorly run platforms, and where to go from there.

In the overview of funds in recovery, Mintos provides their best guess on the expected recovery amount and the time frame. See the table on https://www.mintos.com/en/funds-in-recovery-updates/

For instance Mintos expects to recover 0% of funds outstanding to Rapido Finance or Eurocent. But does expect to recover 100% of Varks (Finko AM) by end 2022. Time will tell how reliable their expectations are for recoveries.