Who received money from Envestio?

This blog was started with: “Envestio – what is behind high-yielding projects?“. A week later after I published it, Envestio was shut down. I had looked at only 1 project, but since then journalists researched others as well. Who benefited from this fraud and is there any progress from legal action?

Who benefined from Envestio?

Latvian journalists from "de facto" have done very good research, below is a translation of article published in Latvian:

The money of the bankrupt investment platform "Envestio" went to the companies of Tenbergs, Mierkalns and Slobins

About 14 million euros have gone to Latvian companies from the crowd financing platform "Envestio", which went bankrupt in Estonia last year. Investors who have lost money are now trying to recover them. Most borrowers are little known. Among the best known are persons related to Mārtiņš Tenbergs, a businessman who was once influential in the security business, Uldis Mierkalns, a woodworker, and Eduards Slobins, who works in the field of logistics.

Over the past year, several platforms registered in Estonia have gone bankrupt, leaving investors without money. For one of them - “Envestio” - most of the attracted investments went to Latvian companies, but they have not been returned.

Approximately two million euros were received from Envestio by MP finance, which is registered in the Bolderaja market. "MP finance" raised money for the renovation of a residential building on Aristīda Briāna Street. The company renovated the building, sold almost all the apartments and is now being liquidated.

Matīss Rostoks, a lawyer representing Envestio's insolvency administrator who deals with loan recovery, says that MP finance had "forgotten" to send creditors information that liquidation was taking place: "This is a clear example of a member and board member who received 2 million euros in two months, he forgot about such a creditor two months later. "

You can see in the Internet archive that "Envestio" portfolio also included several other real estate projects, which have not been completed so far and the loans have not been returned. "Baltic Real Estate Holding" received money for the construction of a new residential house in Riga, on the corner of Krišjāņa Barona and Bruņinieku streets. The company "LVR" obtained funds for a housing project in Mārupe meadow next to Kantora Street. Through Envestio, SPADE raised a loan to renovate former RTU dormitories.

The company "Tukuma māja" offered two projects to investors in Jūrmala, Vikingu Street. "Tukuma māja" intends to build an exclusive mansion on a plot of land that previously belonged to a former employee of the Security Service of the President, businessman Mārtiņš Tenbergs. Later, Tenberg's wife Diāna Kubasova-Tenberga became the owner of the land. The company "Tukuma māja" also bought a plot of land for half a million euros from her.

At the end of 2019, "Tukuma māja" bought another plot of land nearby. But there is no movement on any of these properties.

The member of the board of "Tukuma māja" is Tenberg's brother Jānis Tenbergs. He explains in a written reply to "de facto" that the project will continue as soon as the shadow of suspicion is removed from the company.

"Following the public scandal, as well as the criminal investigations into the lender's activities initiated in several countries, the further implementation of the project is directly related to the results of the investigation. In particular, with regard to "Tukuma māja", it is currently being examined whether the project is feasible. Therefore, our work at the moment is focused on proving these circumstances” writes Tenbergs.

An investigation into the bankruptcy of Envestio has also been initiated in Latvia, and in the first days of this year, the State Police has seized both properties on Vikingu Street. This was new to Tenbergs, but he does not object to it, because it would not be right to sell the property until the circumstances are clarified.

However, he emphasizes that "none of our company has been suspected, even at the level of the assumption, that we may have acted in any way inconsistent with the loan agreements entered into."

It should be noted that in another case, the court sentenced Jānis Tenbergs to imprisonment in the first instance for fraud of the mandatory procurement component (OIK) from the state in the amount of 2.5 million euros by operating the cogeneration plant “Tukums DH”.

The real beneficiaries of the power plant, according to the data of the Register of Enterprises, are another former presidential guard Mareks Varnelis and a large donor for the party "Latvia's Development" Uldis Mierkalns.

Mierkalns company "KUBIT", through which he owns 24.99% of "Tukums DH", emphasized to LTV that "KUBIT" has never participated in the economic activity of the cogeneration plant: SIA KUBIT has always been a passive minority shareholder and never has participated in the management of the company, has not been represented in the board or council, nor has it had any cooperation with SIA "Tukums DH", it has not received any funds from SIA "Tukums DH".

Therefore, contrary to the information mentioned in the registers, Mierkalns does not consider itself to be the beneficiary of "Tukums DH". Mierkalns company believes that it is a "loser and victim of everything that happened to Tukums DH" and accuses the Tukums DH management of uneconomical behavior.

"Tukums DH", managed by Tenbergs, has also received money from Envestio, and its owners' shares have now been pledged in favor of Envestio.

Another borrower of the Estonian platform, "Rietumu Enerģija", is engaged in wood chip drying in the territory of Tukums DH.

Although Tenbergs claims that the companies he manages are not yet due, the representative of Envestio's insolvency administrator says otherwise. Rostoks says that in total, the Envestio platform in Latvia has 24 debtors, from whom the administrator is trying to recover the money.

It should be mentioned that the companies “K10” and “Ausekļa 9”, which manage an apartment house in Riga, have also received money from Envestio. The real beneficiary of them through another company is the lawyer Mārtiņš Kvēps. He is both Jānis Tenbergs defense counsel in the OIK criminal case and has previously cooperated with Mārtiņš Tenbergs security company "TM security".

However, Kvēps "de facto" denied any connection between the two companies and Tenbergs, expressed surprise that the company had received a loan from Envestio at all. After clarifying the information, he said that he had inherited the loan from the previous owners and promised to return the money to Envestio.

Rostoks, a spokesman for Envestio, said the current share of defaulters was high. "Moreover, according to our information, some of the debtors do not have the cover to meet their obligations," says Rostoks.

Not only real estate was raised through Envestio: 3.5 million euros were received by companies owned by logistics entrepreneur Eduards Slobins - "SRR", "WTS", "Zelta Jumts", "Transports nomai". No answers were received from these companies.

Another company called "Dreimanis" wanted to start developing gravel and dolomite quarries. The money was spent on equipment that no one had seen.

"EUR 2.5 million has been lent to a company which has subsequently used the funds to buy equipment from a Bulgarian company. When researching the Bulgarian company, it is clear that it is not engaged in machinery or trade at all" concludes Rostock, a representative of Envestio.

Haralds Velmers has been appointed as the insolvency administrator of the company "Dreimanis", to whom the management of the previous company does not provide any information. Velmers notes that he is cooperating with the State Police in this process.

The police did not comment on the Envestio investigation to the LTV program.

The total liabilities of Latvian companies to Envestio are almost 14 million euros. Recovery is hampered by the fact that many loans are granted without requiring collateral.

Any progress from legal action?

Another great work from Estonian journalists was published in postimees.ee, translation below:

Thousands of investors demand the return of their money through the Estonian court

Estonian-registered co-financing portal Envestio gained notoriety a few years ago when it became clear that the owners of the portal were wasting millions of investors' money, writes Postimees.

Investors did not want to leave everything as it is: more than 2,000 investors went to court and at the end of last year made an unprecedented deposit of 200,000 euros in an Estonian court so that the bankruptcy proceedings would not slowly dwindle. “And in order to prevent the withdrawal of assets of the companies involved in the scheme,” said Denis Piskunov, attorney at law of the Magnusson law office, representing the interests of the victims.

This has brought certain benefits: several luxury real estate objects and cars have already been arrested in Latvia. It is expected that through bankruptcy it will be possible to extract several million euros. Investors hope not only to get their money back, but also to restore justice, because, as one investor said, the fraud was committed by Latvians, and the shame went to Estonia.

Investors: we won't leave it that way!

But let's start from the very beginning. Envestio was registered in Latvia in 2014, but the portal was launched in 2017. In 2018, Anton Kaletin entered Envestio SI OÜ into the Estonian commercial register. In parallel, a co-financing portal was launched, which raised funds for projects that, it would seem, are being implemented in different countries. Investors were promised tremendous performance (in fact, they are still promising returns of up to 30 percent because the website works despite the bankruptcy of the company and continues to offer "investment opportunities"). This attracted investors from all over Europe.

The portal was promoted by several bloggers, for example, the Estonian Rahakratt, who himself lost money in this scheme and is now, together with other investors with the help of lawyers, trying to return it. At the beginning of last year, after a couple of tense hours, it became clear that the portal was closed, and the organizers with millions had disappeared in an unknown direction.

“It was a classic pyramid scheme,” says lawyer Denis Piskunov. In other words, interest was paid first on new investors' money to give the impression that everything was in order.

“There are people among us who have lost 1,000 euros, but there are also those who have lost 100,000 euros. People who have lost all their retirement savings. People have lost family members due to the stress of this scam. Most of us are ordinary European citizens who invested in co-financing when it was booming and several bloggers wrote about their success, ”said former Envestio investor Guillermo, who lost 13,000 euros.

More than 2,000 investors, mainly from Spain, Germany and Italy, did not want to leave the case as it was and turned to the Estonian police. In addition, the investors turned to the law firm Magnusson. Investors ran a co-financing campaign to pay the costs.

A number of real estate objects arrested in Latvia

The Estonian court stated that since there are several countries to be sued, a deposit is required to prevent the bankruptcy proceedings from fading, and by the end of the year, investors had transferred a deposit of 200,000 euros - one of the largest in Estonian judicial history.

According to Piskunov, his clients have claims in the amount of 15 million euros. The goal is ambitious: to get most of the money back.

Where did the money go? Piskunov said that a small part of the money was withdrawn from bank accounts in Malta and Latvia - this is several tens of thousands of euros.

However, most of the funds were safely withdrawn, and here investors have something to argue with the banks: “And the child should understand that co-financing cannot transfer money to organizations that are not related to the published project. But here a significant part went to fictional projects and companies, where no activity was carried out. The absolute winner in the case of transfers was SEB," the lawyer said.

The money was transferred to organizations in China, Bulgaria, Hungary, Czech Republic, Poland and Malta. According to Piskunov, most of it was probably withdrawn in cash later.

According to Guillermo, other investors think the same: the banks did not have procedures to combat money laundering. The involvement of SEB and Swedbank in problematic transfers also aroused interest from the Swedish TV channel SVT, which approached the banks, but received responses like “we did what we could”.

But surprisingly, about a third of Envestio's projects were associated with Latvian companies, some of which actually worked or had at least some support. The lawyers spoke against them.

“We were in a situation where these associations had to be immediately sued, and this required the appropriate financial resources,” Piskunov explained how the matter came to a deposit of 200,000 euros. Because, although Envestio was registered in Estonia and its bankruptcy case is pending in an Estonian court, the companies operated in Latvia and had to be dealt with immediately so that the assets would not be divested.

The first wave of coronavirus played a cruel joke with investors: then the state imposed a moratorium on bankruptcy. “Filing for bankruptcy was banned and it was known that now, in December or January, the moratorium could go back into effect, allowing hard-core debtors to devastate their businesses so that there was nothing more they could do. But they should have gone bankrupt,” said the sworn advocate.

“Our plan of action was this: we will take on those from whom there is something to get. Due to the money deposited, several lawsuits and bankruptcy cases were initiated against companies actually operating in Latvia that have assets,” Piskunov said. By early January, a Latvian court had seized the property of the two main debtors. “There are tidbits of real estate,” Piskunov approved.

The lawyer expressed the hope that a significant part of the lost money will be recovered through the court. How much is too early to say.

Larger beneficiaries and more extensive schemes

Piskunov said that when studying the account statements, it soon became clear that Envestio had received large sums of money from well-known businessmen in Latvia. For example, from Martins Tenbergs, the owner of a security company and bodyguard of the former President of Latvia Vaira Vike-Freiberga, as well as from companies associated with Eduards Slobins and Uldis Mierkalns. Postimees tried to contact Eduards Slobins, but to no avail.

Although Estonian police said in a commentary that it was impossible to point to probable links between co-financing portals caught in various scams, Piskunov says one has to be blind not to see these links.

In particular, he pointed to three companies: Envestio, Kuetzal and Monethera. The law firm Magnusson acts against all three, and the lawyer estimates it looks like a criminal network: the same individuals and companies tend to pop up over and over again. Piskunov also suspects that in the case of Kuetzal-Envestio-Monethera, their creators and directors are not the real beneficiaries, but rather acted as tankmen. Neither the general director of Kuetzal Alberts Cevers, nor the owner Viktoria Gorchak, nor the head of Envestio Evgeniy Kukins, according to the lawyer, are the ones who really pull the strings in this case.

It is clear that the Estonian court will be hot, because investors from southern Europe do not intend to surrender without a fight to the Baltic hotbed of deception. “The point is no longer about the return of money to individual investors. It is a social warning to prevent future incidents and, in a sense, also feedback on regulations that can make European investment instruments safer,” Guillermo said.

Largest Beneficiaries of Envestio

1) The companies of Eduards Slobins: SRR, WTS, Zelta Jumts, Transports Nomai received a total of about 3.5 million euros.

2) Tukuma Maja and Tukums DH associated with Martins Tenbergs and Uldis Mierkalns received a total of about 2 million euros.

Behind this information is the law firm Magnusson, which had the opportunity to study bank statements. According to them, the companies associated with Slobins, Tenbergs and Mierkalns received a third of the money received by fraud from investors, that is, 5.5 million out of 15 million euros.

Source: rus.postimees.ee/7155654/tysyachi-investorov-trebuyut-vozvrata-svoih-deneg-cherez-estonskiy-sud

Are many Baltic P2P frauds linked?

According to Magnusson - Kuetzal, Monethera and Envestio were all part of a criminal network. But if you look at beneficaries of Envestio, another interesting name comes up: lawyer Mārtiņš Kvēps.

This is a familiar name to Grupeer investors. According to Grupeer blog posts and emails, for debt collection they hired this company:

Grupeer will ensure repayments in collaboration with our debt collection partner Recollecta, Reg.Nr. 40203255274. It is a highly professional legal team, which included legal and financial expertise. It will allow ensuring transparency when it comes to repayments, we will transfer the right of claims and funds to the attorneys of law.

And who are Recollecta clients? According to their website, they have only 1. No surprise, since the company was registered only in 26.08.2020:

And who is among the professional legal team? The same guy, who benefited from Envestio and who represents Envestio beneficiaries in criminal cases:

Martins Kveps

Martins is an experienced advocate in litigations, he has participated in many publicly known cases in more than 20-years long experience. Martins’ expertise and the unique ability to plan the strategy of disputes and litigations is the reason why clients trust him. His experience and ability to apply his excellent academic knowledge in law allows him to develop efficient and brave litigation tactics that help to achieve the result desired by the client.

Martins’ specialization includes M&A deals, commercial disputes and competition rights, bank and financial rights, energy rights, white-collar and economic crimes.

I think it is fair to assume that Recollecta is a special-purpose vehicle created by Grupeer to simulate “debt recovery“ process and delay, complicate the legal action from investor side.

What about other lawsuits?

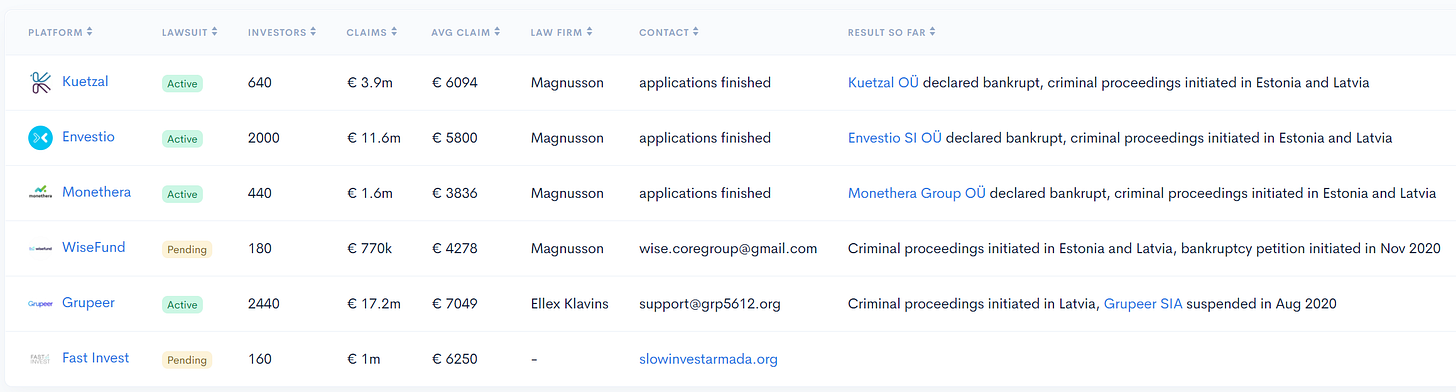

Envestio is not the only platform where investors have collected money to take legal action. Magnusson is also working to get something recovered from Kuetzal, Monethera, Wisefund and Ellex Klavins from Grupeer. FastInvest is probably next in line:

Key takeaways

Most of Envestio projects were fake, had no collateral. Journalists and Magnusson have found the key beneficiaries.

Banks failed with their AML process, big part of investor money was easily transferred away and cashed out.

Legal action in case of Envestio has real progress: several luxury real estate objects and cars have already been arrested in Latvia. Couple of million euros should be recovered.

Kuetzal, Monethera and Envestio were all part of a criminal network.

Grupeer debt collection partner is a beneficiary of Envestio.

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Fantastic work you are doing Kristaps!! Keep it up!!

Thank you for these translations. Thank you for sharing these articles. As they are in Latvian, I would surely have missed these articles without your blog. Great! Please continue.