Envestio – what is behind high-yielding projects?

In last couple of years I have tried out different P2P platforms – Mintos, Twino, Swaper, Viainvest, EstateGuru, NEO Finance, but have always had a strange feeling about 2 of them: Kuetzal and Envestio – I saw that they had many projects from Latvia, offered much higher returns, but some of the listed projects just did not make any sense to me, so I did not even try to invest there.

Well, turns out – it was not a bad decision, at least in case of Kuetzal – because some of their projects were fake and after that got discovered, they shut everything down with following email as explanation:

Can Envestio be next? Who is behind them?

Recently there was a big change in management and ownership. This is Envestio’s new owner and CEO. Is he the guy to take blame or a legitimate owner? No one knows.

If we look at Envestio SI OÜ, it is interesting to note – that at this point Arkadi is the only employee:

Well, to be honest, we also must take into account Latvian branch “Envestio SI filiāle Latvijā” that is 100% owned by Envestio SI OÜ:

So maybe we can assume that all employees listed in team section are working in Latvia’s branch together with their new CEO, but in that case – why the secrecy? No phone numbers, no email addresses and no mention of Latvian branch in Envestio’s website:

What about projects? Are they real?

Let’s find out. I cannot comment on all of projects listed in Envestio, but I had a look at this one: “Financing of refurbishment of hostel- Mezaparks”, which raised 900 000 EUR in total:

Hostel in Mezaparks? And that kind of building? I live in Riga and Mezaparks is not a big area, so I was sure – if this is a real project, I should be able to find it easily:

I tried searching for “ezermāja Mežaparks”, “lakehouse Mežaparks” or “Hostel Mežaparks” – but with no luck, and it seemed odd that someone wants to build a hostel in the most expensive district of Riga – where people have a hard time paying their property taxes.

And if I open project details, it does not offer much help. Envestio claims following statement in their homepage: “Transparent business culture is one of Envestio’s key values“, but what the fuck is this?

If I invest in a property, I would like to see address, cadastre nr (registry nr), an appraisal report and info about collateral, so I would be able to answer following questions:

Where exactly is this object located? Can I visit it?

Who owns this building? Can I verify it?

What collateral is provided? Is it the same building, land or other properties? Can I see their appraisal report?

Ok, so information in website is very limited, but they have a support chat, right? I tried it – but no one is online. Ok, maybe the team is busy with more important things, so I filled out a form to create a support ticket, later received this reply:

Finding answers myself

So I did some research, and found out following – it is not a hostel, but university dorms that were shut down in 2014, and most likely will be used as dorms again after renovation.

Address is Viskaļu 48, Riga and cadastre nr: 01000850021, and you can even find it on Foursquare.

The building is owned by Latvian government, Riga Technical University, so if anything goes wrong with the project, there is no collateral to be sold, but investors might get some value out of these things:

The owner of Spade SIA has given a personal pledge to Envestio

The company shares of Spade SIA are pledged to Envestio

Spade SIA owns 50% of Ezermalas 6 SIA that in turn owns rights to rent this building till 27.05.2044

Another interesting fact that I found out today: the same project was proposed to EstateGuru P2P platform and it got rejected, mainly because the risk is too high – in case of any issues there is no property or land that can easily be sold.

I also visited the location and can confirm that renovation is in progress:

So the good news? At least this project is NOT fake, it exists and can be visited by anyone.

The bad news? There is a reason why investors get paid 19%. It comes together with high risk.

What about Envestio? Is it safe? I might do some more research, but with this level of “transparency” I would not trust them with my money.

Part 2: Who is behind the loans?

There was one fact I did not mention in first part of this blog post, because I thought that is none of my business and not related to Envestio, but turns out – I was wrong.

So here it goes: another red flag that came up – Spade SIA, Ezermalas 6 SIA and 2 other companies (Mīlgrāvja Māja, SIA and Dr.Beauty SIA) are all owned by a woman called Madara, but when I called the number listed in Lursoft for Spade SIA, a man answered and was able to comment on Envestio project, but did not want to get into too many details.

So who was the person that answered? My guess – it was Madara’s husband and actually the real person behind all the real estate development. His presence can be seen in 2 places – there is a marriage agreement:

And Sergejs is listed as a procurist for Spade SIA. So legally speaking the beneficial owner and member of the board for Spade SIA is only Madara, but Sergejs as procurist has full rights to make any changes to company since 07.11.2019:

So who is Sergejs?

Why would he want to distance himself from Spade SIA? Well, this could be one of the reasons: Gvano vs Swedank – article is in Latvian, but in short Gvano SIA is accused of evading a 7.7 millions EUR debt by using out of court protection process and possibly a corrupt judge. The argument between both sides is also mentioned in this document (in LV). Another article (LV) where Gvano SIA plans to go to court with Swedbank also mentions the company representative – Sergejs Sergejevs. My guess – the same person as above.

I am not a fan of banks, so I don’t really care if Swedbank was fucked, but I guess this raises a question – could a similar thing repeat? And did this not raise any concerns from Envestio team when they approved the project? Maybe there are some agreements that only Spade SIA and Envestio know about, and that provide good enough security for both Envestio and investors, but again – there is no transparency.

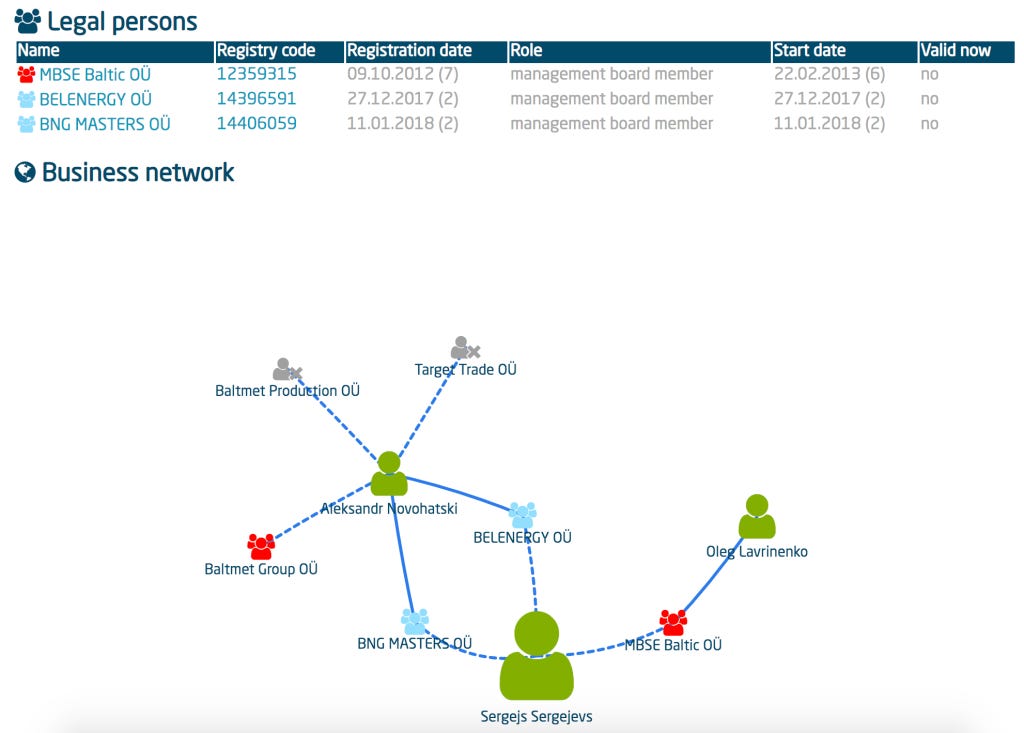

Also – another interesting, random fact – the same Sergejs was connected to 2 companies: Belenergy and BNG Masters:

And now let’s view their profiles:

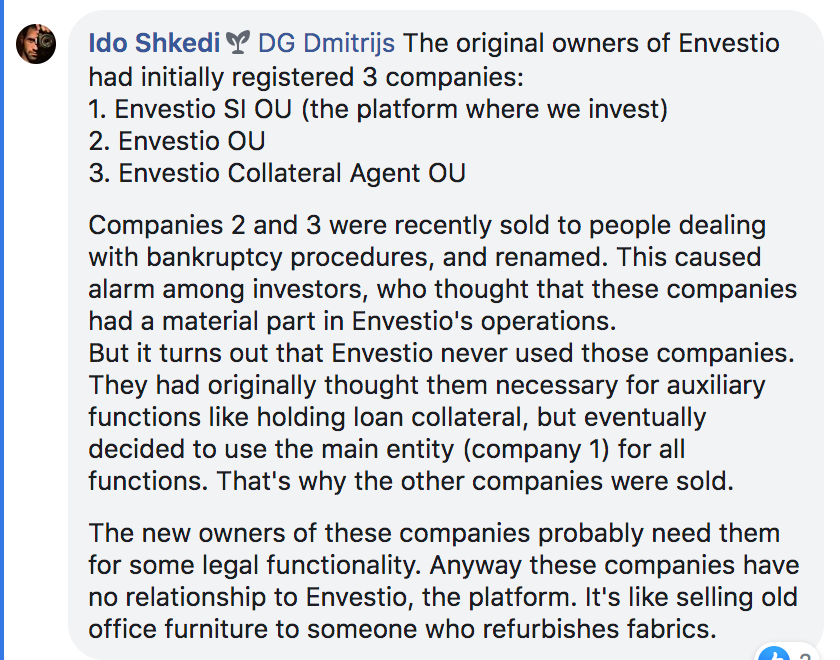

So the same guy was connected to 2 other companies that previously were owned/created by Envestio. I have no idea, if there is some deeper connection between Sergejs and Envestio business or if we can trust this explanation below:

But in any case, lot of open questions remain:

Why was Envestio sold?

Who is the buyer and what are his plans for future? Will he be involved in day-to-day operations? Can I meet him?

Why does Envestio provide so little info about this project and at the same time does that in a misleading way, concealing important information? Was any due diligence done?

What does “insured repayment of Loan Interest” mean? How is it insured and by who?

What will happen if the project fails? Will Envestio cover both the loan and principal to all investors? If so, how many projects have failed before and how many can fail, before Envestio runs out of money?

Do Envestio plan to provide at least some “transparency” that is promised all over their marketing materials? Correct contacts, more detailed info about projects would go a long way.

Does Envestio consider funding it’s own projects a normal practice? How is conflict of interest avoided? See screenshot below of a project where borrower is Envestio themselves:

Part 3: Envestio response

Dear Kristaps,

Thank you for sharing the link to your blog. Regarding some of your questions, (as to why the company has been sold, to whom, which plans it pursues, there was an interview with updates in Ido’s blog (https://colminey.com/envestio-calming-news/), have you seen it? It seems to cover most of the questions you have.

As for the due diligence, sure, Envestio team evaluates each investment project from different perspectives, which are essential for getting an insight into the venture, main of which are business, financial, legal, and reputational aspects. Prior to publishing the project at Envestio portal, its owner must prove that the business concept or idea is clear and stable, financial flows, contracts, and timeline are transparent and reliable, local legislation is observed, all necessary approvals are in place, etc. Last but not least is the reputation of the business and its owner. We obtain sufficient guarantees from every borrower, so that the funds may be recovered in a case of a project default. So far we do not have defaulted projects and will do our best to deliver the same level of performance.

Bearing in mind the panic on the market, caused by Kuetzal’s breakdown, our former COO Eugene Kukins is currently conducting negotiations with the new owner of Envestio regarding his return to the position of COO with me moving to the position of the Head of Sales. Negotiations are going quite well, and we hope that the respective announcement will be distributed later this week.

The team has recently moved to a new office building in Riga, Latvia (approximately in 1,5 weeks we will finish the final arrangements for visits). We are planning to conduct a series of blogger events as part of our marketing policy for 2020, so should you have a free day your schedule during the upcoming weeks, we would like to invite you to visit Envestio new office and meet the team. Besides, it will be possible to see some real investment projects, being accomplished with the help of Envestio in Riga.

Kindly note that Sergejs Sergejevs is not a beneficiary of the platform, the current sole shareholder is Mr. Ganzin.

Regarding the companies you mention in the article, please note that these two companies were never active, and Envestio did not use them for its activity. Those were registered at the moment when everything only started and we considered another legal scheme (and we kept them in case of any changes in legislation). As we found a legal way to have all mortgages and pledges registered to the name of Envestio SI OU, those two companies remained empty (no bank accounts, no activity that could be seen in Estonian company register), and eventually, as changes in legislation are unlikely, they were sold to a third person, who is not related to Envestio platform. There was no business connection between Envestio SI OU and these two companies except the name, which had to be changed after the sale.

Sergejs Sergejevs was taking part in negotiation before Envestio platform launch (and this is the reason these two never active companies showed him as a member). He has never took part in Envestio development once the platform has been launched.The only connection to Envestio operations is his project (SIA Spade) financed by Envestio participants. From the comments on your blog we see that you have been contacted by Sergejs and that he proposes a meeting for further clarifications.

Kind regards,

Eduard Ritsmann

Some questions are answered, but not all, so I sent a follow up on Jan 14th:

Will update blog post when I get a reply.

Part 4: Meeting with Sergejs from Spade SIA

Sergejs called me and asked to meet. I suggested to do a video interview, which we still might do, but at first we met in person on the property.

He showed me the demo room that is meant for 3 persons:

We also did a tour of the building – he told me about the insulation works that were done from inside, all kind of details about the renovation and after he left – I was allowed me to go anywhere I like on my own, so I checked out the first 3 floors:

But the most important part – Sergejs answered all of my questions and provided lot of background info on many things.

This same project was funded previously in Crowdestor in 2 parts: 200k EUR + 450EUR, correct?

YesThe goal of existing project was to return 700k EUR to Crowdestor investors + 200k for additional renovation?

YesIn total the plan is to raise 1.2 million EUR from Envestio, 900k is already raised, and with additional 300k in February?

YesHow much % of total renovation is done? When is it planned to finish all work?

All works are approved with necessary permits and going according to plan, about 65% of work is already done. The first 3 floors will be finished till June, and the rest till end of summer.How will investors get paid back their 1.2 million + %, in total about 1.4 million?

Project will be refinanced by a bank with about 6% interest rate. We already have ongoing discussions, bank requirement to send our project to credit commission is following: they want to see cash flow from clients, and see 60% of space used. So the goal right now if to get first 3 floors finished as soon as possible and rent them out. We have space for 500 people, 100 in each floor.How will the building be used after work is finished? For students just like before, or for someone else? Till what stage is renovation planned? Completely finished with furniture, etc.? How will the cashflow look like?

Renovation includes furniture and everything else needed for anyone to come & stay there. University has priority if they decide to use part of building as student dorms, but the main business plan and focus is to rent out the available space to companies, who want to provide low cost accommodation for their workers. Potential clients include construction & transport companies, factories, shopping centres. Some of them have already visited the location to check it out. Many of these big companies use workers from Ukraine and other countries, and have a big issue of finding them a place to live and transport to work place. For example, one construction company spends time from 7AM to 10AM just by going around Riga and collecting workers and bringing them to workplace. Instead they could rent out 1/2 or whole floor of the building and provide 50 or 100 beds in one location. And with big projects like Rail Baltica on their way – the need to attract more workers from outside Latvia and provide accommodation will just increase. Estimates about cashflow – right now we pay 2000€ for rent, after renovation that will increase to 6000€/month, land tax is 3% from 2 million €, so 2500€ /month, utilities are 8000€ in winter, 2500€ in summer. After finishing administration costs will be 4000€. For one person price to stay per month will be around 100€, so with 60% capacity income is estimated to about 30 000 € per month, will full capacity – 50 000 € per month.Can you provide some info about Andris Riekstiņš, who owns 50% of Ezermalas 6 SIA?

It was not easy to get the rights to rent out this building, there was a contest, we won by bidding the highest price, but we also had to prove that we have the financial ability to do renovation. I am responsible for developing this business and all operations and Andris Riekstiņš participated as investor and promised to invest at least 500k EUR till end of 2021.Can you comment on collateral?

For this object mortgage is impossible, but we have pledged Spade SIA company shares and also a personal guarantee of 1 200 000 EUR. We have never hidden this and provided to Envestio all of this information together with business plan, permits, etc., but for investors they published maybe 5% of that.Can you comment on why Spade SIA owner is Madara, not you?

In 2008 I had bought a BMW X5 , it was insured. And just couple of days after technical inspection expired, it was stolen. In the same night 5 other similar cars were stolen as well, so it looked like a professional job. But the insurance company refused to pay for it because of this technical inspection, which in essence has nothing to do with the case. So since then we have a litigation process, and I won the court, but still the insurance company is refusing to pay and in case they find a way to overturn the court decision, I don’t want to be liable for about 47k EUR. So I don’t want this argument with insurance company to influence this real estate development, and that is why my wife is owner of it. Right now the case is in the Supreme Court and should finish within 1-2 years.Can you comment the situation in Latvian labor market – how easy or hard is it to get workers for this kind of project? How many people are needed?

It is very hard, we have some people from Latvia (mostly Latgale), but most of workers are from Ukraine – they are doing a very good job. We have a very strict construction supervisor and both him and me are pleasantly surprised by the quality and speed we see from Ukraine team. In total we have 35 workers. People from Ukraine have vacation now, but will be back starting from Jan 20th – then you can come and see all of them working here.Can you comment on Swedbank and Gvano case?

I was not owner of that business, but their representative when Gvano and Swedbank had a very serious fight – there were PR people involved, lot of publications, etc. Gvano had planned to build 2 buildings, one of them was finished and even Swedbank had a 5 year rental agreement in this building for their branch. The other building had everything approved, works have begun, but then 2008 real estate crisis started, and Swedbank tried to pull back – there was a mortgage for both of these buildings, but to build the 2nd one money was not provided anymore. Instead Swedbank asked for all money to be returned immediately – right at the time, when there was zero liquidity in the market. It looked like they had a potential buyer for the project and they wanted to make a quick deal – force Gvano to take losses, sell everything for 2 million, take it over and resell at much higher price. Swedbank increased the pressure even more by refusing to pay rent payments, moving out and ignoring they had a 5 year rental contract. So Gvano was not happy and fought back any way they could – used this ĀTAP process, which was completely legal, but of course – it was clear, that there was a hole in law that was later fixed. The building later got sold for 9 million and a settlement was reached with Swedbank in 2015.Can you comment on your connection to companies that used Envestio name?

Initially this was my business idea, in 2017 I created this business, asked to create software, registered companies, but later understood that I will not be able to succeed on my own, as it will required lot of marketing spend to attract investors. So I sold the software to Jevgenijs Kukins, but he did not want to use any of legal entities I had created, and just created a new LLC. So later I also sold the 2 companies that I had created and asked to change their names – but these were just empty companies, they had no involvement in any of Envestio business operations.Do you know the new Envestio owner? Have you met him?

I studied together with Jevgenijs Kukins in SSE, I also know Eduard and Liene, but I have not met Arkadi and have no info about him.

Summary

This project is a legitimate business and has a very impressive investor behind it – he is a shareholder in 10 companies or so. Sergejs as a manager also gave a good impression and provided detailed answers to all questions. Even if Envestio would fail to provide needed resources to finish this project, I have a feeling – that if the main investor Andris Riekstiņš will want to complete it, it will happen easily.

My main issue is with Envestio as a P2P platform – they still have not provided answers to my questions, and the info they show about projects on website is bordering on misleading. I also find it hard to believe 100% of projects they have funded – are going perfectly as planned, and not one of them have failed or are late on payments.

Want to get access to exclusive content? Become a paid subscriber:

Or join “High-risk investments“ Telegram group for an informal discussion.

This is an awesome work from you! Even today, after Envestio is long gone, it is still a great post-mortem lesson to learn something for the future.

Fantastic post. Read after I've lost 600€.