How to bet against a Bitcoin mining company?

In my last post I advised not to invest in crypto mining companies. This week I will try to find out if it is possible to make money from betting against one of them.

Which company could go bankrupt next?

All publicly listed crypto mining companies are suffering losses right now, so one way how to bet against them could be shorting Valkyrie Bitcoin Miners ETF - it consists of following companies:

Not sure why AMD 0.00%↑ is included in this ETF, but MARA 0.00%↑ and RIOT 0.00%↑ are missing, but an actively managed fund like this one can change the companies that are included in their holdings and I would expect that in normal situation they would want to select the most promising companies from crypto mining industry.

On other hand for me it is safer to short the weakest mining company, not a large pool of them - as some of them might survive current crypto winter.

After some research I decided to short Greenidge Generation Holdings Inc. - as you can see from these charts, it is very good at losing money:

And latest news don't seem promising:

In December Greenidge warned it may seek bankruptcy protection while entering into debt restructuring talks with NYDIG

It has $74 million debt with NYDIG, and needs to pay about $5.5 million per month to cover principal and interest payments

Greenidge’s average monthly cash burn rate in October, November, December was around $8 million

Company's cash and cash equivalents and restricted cash as of November 30, 2022 amounted to approximately $22.0 million, compared to $38.5 million as of September 30, 2022

In short - GREE 0.00%↑ looks like a zombie that has just couple of months left before it runs out of cash. Just like this guy, they need Bitcoin price to go up very fast:

Will NYDIG bail them out?

NYDIG provided funding to many Bitcoin miners and now - when miners are defaulting, NYDIG are forced to start crypto mining themselves:

NYDIG originated about $378 million in rig-backed loans to miners between October 2020 and May 2022, according to data compiled by TheMinerMag. Already it’s received about 26,200 machines from Stronghold Digital Mining Inc. to eliminate the miner’s $67 million debt, and it’s likely to take over another batch of machines from Iris Energy after it defaulted on $103 million in machine-backed loans.

Source: Bloomberg

Same scenario might play out also in case of Greenidge:

In December, NYDIG agreed to pay Greenidge Generation Holdings not only for its mining rigs but to operate them in exchange for debt reduction. The deal effectively made Greenidge — once one of the largest Bitcoin miners — a hosting firm while NYDIG became the miner.

More details are available on Greenidge investors news page.

But even if the non-binding term sheet gets signed, there are still some issues:

If Greenidge becomes a hosting provider for NYDIG, “a near-term increase in bitcoin prices, even a significant one, may not have a corresponding beneficial impact on Greenidge's business, liquidity or prospects”

To remain viable through 2023, the Company currently estimates it will require at least approximately $20 million of additional liquidity to fund its cash requirements, although this estimate is subject to a number of assumptions and may vary materially.

So even in best case scenario where Greenidge becomes a hosting provider for NYDIG and basically gives up most of it’s business, it will still need to find $20 million just to survive till end of 2023.

What can go wrong?

If price of Bitcoin has a sudden and big increase, Greenidge might become more attractive to potential investors or lenders. And that can result in stock price to increase several times.

To mitigate the risk, I will try to hedge it by buying Bitcoin. So in a bad situation I would lose money on shorting stock, but profit from price increase of Bitcoin. In good scenario - if price of Bitcoin stays the same or increases slowly, GREE 0.00%↑ might go bankrupt, and I could make profit from both trades.

In worst case scenario - Greenidge stock explodes, I close short position to limit losses, and then later Bitcoin goes down as well.

It is interesting that share price was $0.25 on December 23rd and then it increased up to $1.23 - so almost +500%, while at the same time Bitcoin price changed from $16800 to $21000 (only +25%):

My trades

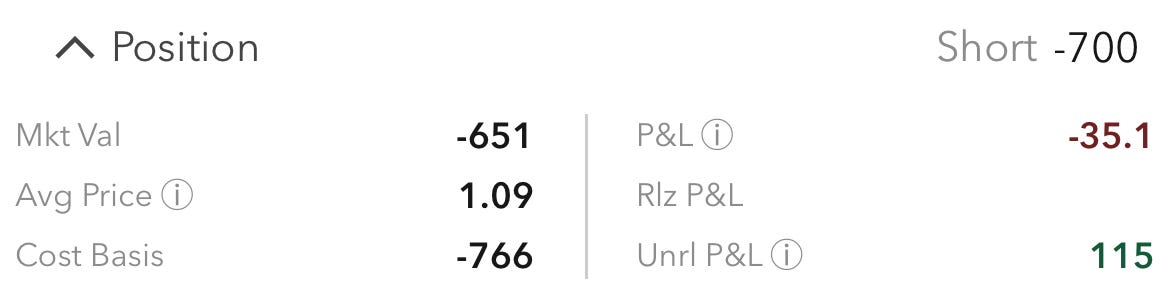

I planned to use about $2000 to short $GREE, but because Interactive Brokers has a margin requirement of 259.43% for opening a short position, I have about $2000 cash frozen, but actual position is worth only $766. I am shorting 700 shares at avg price of $1.09:

And to hedge it I bought 0.0933140400 Bitcoin for $2000 with avg price of $21433.

When to close them?

I plan to close both of these positions when one of these things happen:

Greenidge stock price increases by +300% (so $3.27 or higher)

Greenidge goes bankrupt or private

Or if none of these scenarios play out in next couple of months, then I plan to close both positions by end of June.

Guess the outcome

Let’s try a small competition - if you can guess, how much USD I will lose or make in total after both trades are closed, write a comment or reply directly to email with your prediction. For example: -$1000 or +$2000.

Person, who gets the closest to real outcome will get awarded 0.005 BTC

+1654

It will be interesting to see the outcome, any guess is as good as mine