Crypto winter for Bitcoin mining industry

What happens when Bitcoin price crashes -77% from all time high?

Just 14 months ago price of 1 Bitcoin reached $69 000, then in November 2022 it had crashed below $16 000. If anyone had bought $GBTC (like I did) that is now trading with about -40% discount to assets, you could enjoy even more pain.

What about Bitcoin network?

Since November 2021 Total Hash Rate has increased from 165 EH/s to 270 EH/s (+64%), so even with price crashing -77% security of Bitcoin network just increased.

The only time in last 3 years when Total Hash Rate significantly decreased, was in May 2021 when China announced a ban on Bitcoin mining, but even then Total Hash Rate recovered after 6 months and has almost doubled again.

Bitcoin mining companies

Bitcoin network is as healthy as ever and that likely won't change, but what about companies doing all the mining? Largest mining operations right now are based in US, and all of them are struggling:

Compute North Files for Bankruptcy - Sep 22, 2022

Iris Energy to cut mining hardware after defaulting on $108M loan - Nov 22, 2022

Greenidge Generation Holdings on the edge of bankrupty - Dec 20, 2022

Core Scientific Files for Bankruptcy - Dec 21, 2022

Argo Blockchain Will Avoid Bankruptcy With $100M Bailout - Dec 28, 2022

Even those companies that are not bankrupt yet, are burning cash like crazy and might still run into serious issues later. For example:

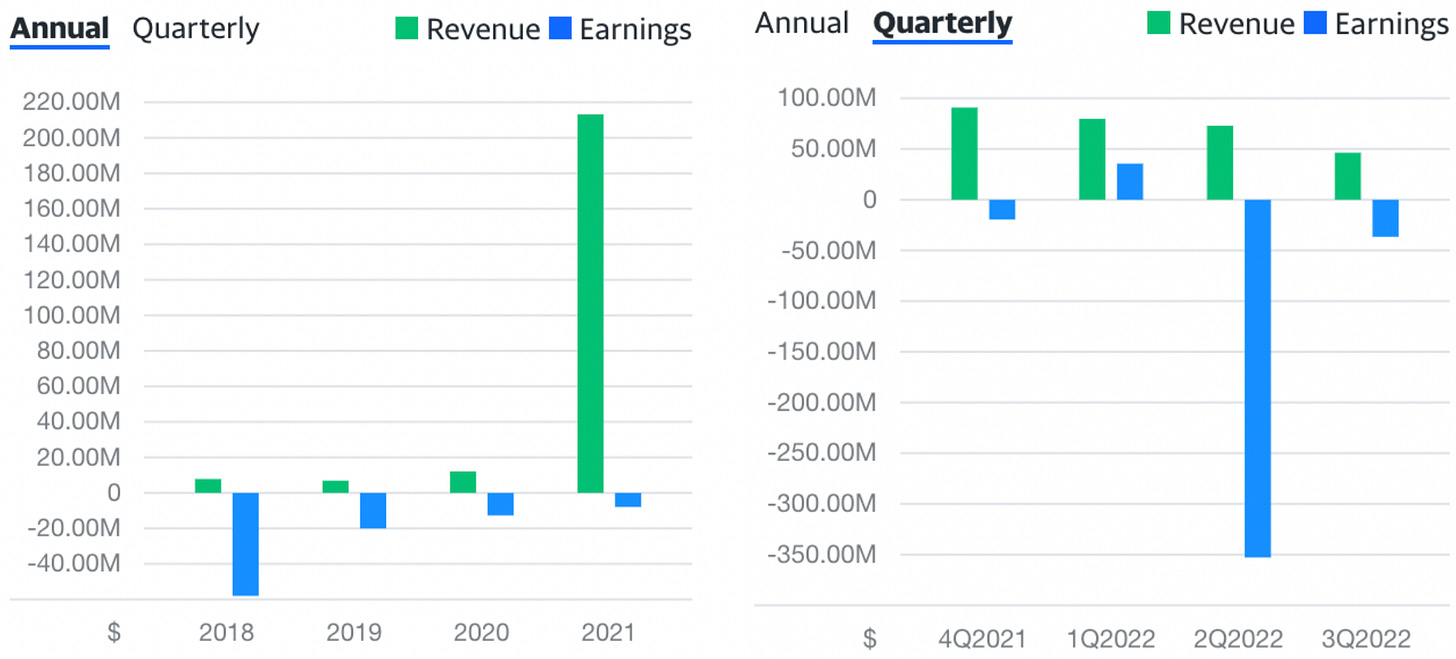

Marathon Digital Holdings, Inc. ($MARA)

Stock price in Nov, 2021: $51.07, right now: $5.37 (-90%).

Riot Blockchain, Inc. ($RIOT)

Stock price in Nov, 2021: $44.19, right now: $5.37 (-88%).

Crypto mining in Europe

If the situation seems bad in US, then it certainly is way worse in Europe - the most critical thing in crypto mining is access to low cost energy. But in last couple of years Germany, Spain and Belgium were busy shutting down their nuclear power plants and France is so bad at maintaining their nuclear fleet that it runs only at half capacity.

After Russia’s invasion in Ukraine and reduced use of Russian gas, now many countries are struggling with energy shortage. Germany was forced to revive coal just to keep the grid running and energy prices sky-rocketed in Europe in 2022.

So with this bleak background it is actually surprising how the biggest crypto mining company in Europe - Northern Data - has managed to still keep going with no financial debt:

In 2022 #NorthernData produced 2,798 BTC, generating EUR 77.7 million in #Bitcoin revenue alone. Northern Data also expanded its #CloudComputing capacity in a capex-friendly manner. We have started 2023 securely and free of any financial debt.

But even with their exceptional management they still sold more Bitcoin than they generated. In 2022 they generated 2798 BTC and sold 3005 BTC. So if they were forced to sell 207 Bitcoins, that would mean losing about 3.5 million EUR at current prices.

Northern Data AG ($NB2.DE)

Stock price in Nov, 2021: Є97.10, right now: Є7.97 (-92%).

Very likely that energy problems in Europe won't be solved any time soon, so unless Northern Data AG moves their data centers, I expect that 2023 will be another challenging year.

What about Power Mining?

I am a co-founder of a Latvian company called Power Mining - at the beginning we tried mining Bitcoin ourselves, but have no active farms right now. We learned the hard way that energy prices are too high in Baltics and in Europe in general, and when we tried operating in a Middle East country with cheap energy, it backfired later with different kind of challenges - like difficult import process, unstable grid, unreliable partners, lost shippments, government seizing equipment.

Turns out - if you want access to cheap energy and low labour cost, you will have to operate in a 3rd world country and face other kind of risks like crime, corruption, unstable environment, etc.

So in last couple of years our focus is on building crypto mining containers for those companies that have access to capital, low cost electricity and ability to manage these risks. In June 2022 we used 800m2 of space for our operations and even that was not enough.

But as the crypto market crashed, so did the demand for new containers. So right now we use 200m2 of space for storage and are waiting for market to recover.

How bad is the current situation?

For a successful and profitable crypto mining operation you need following things:

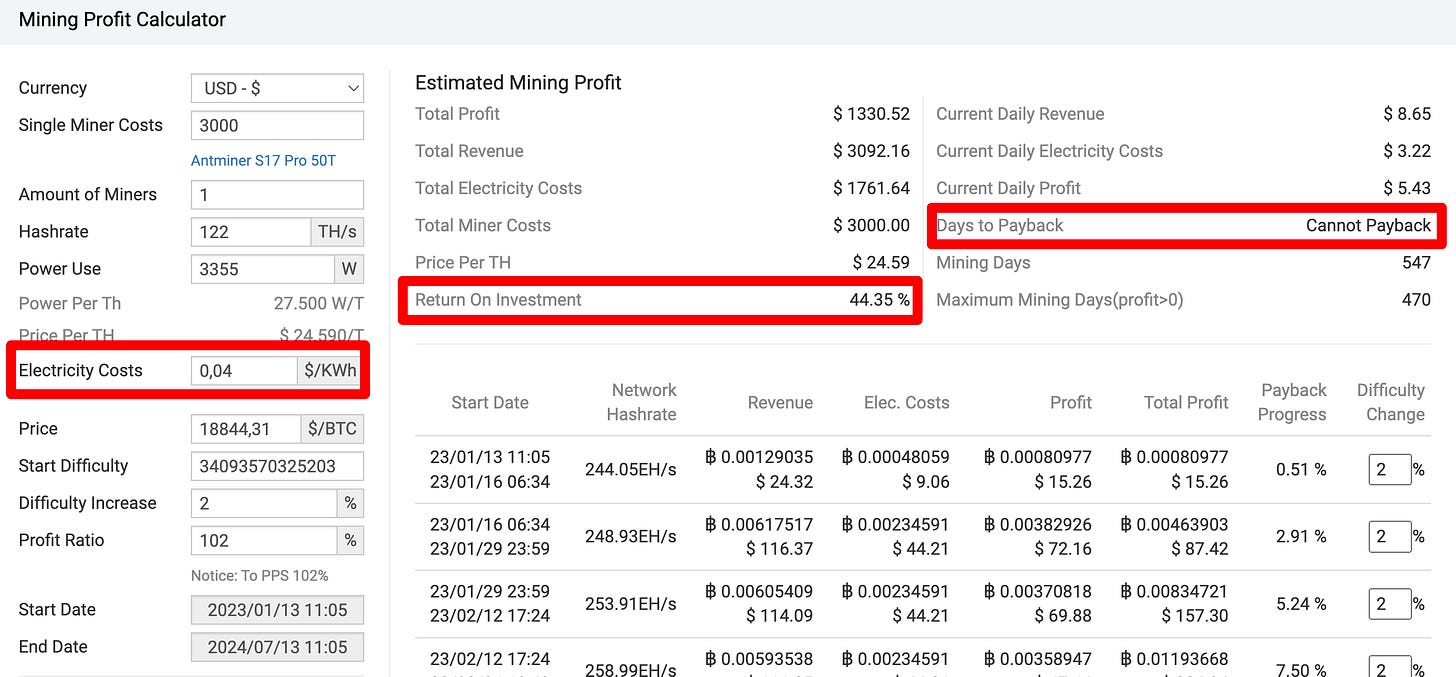

Low electricity rate - that means $0.04/kWh or below. For comparison - global average is about $0.14/kWh and European average was about $0.27/kWh in first half of 2022.

Low-cost labour - for example, you can get cheap energy in Iceland or Norway, but everything else - paying salaries, building mining facilities - that will be very expensive.

Stable grid - in some developing countries you can find both - cheap energy and low-cost labour, but it often can also mean unstable grid and unexpected down times. If miners are operating, for example, only 70% of time, it will be harder to recoup initial investment - mining difficulty grows all the time, and miners must be connected and working from the moment you buy them. Any delay or any downtime will mean higher chance of losing money.

Large scale - so that operating expenses per each miner would be as low as possible.

Taking these factors into account, now let’s look at the current market situation. If you would buy the latest generation ASIC miner, it would cost you $2379:

If you add costs related to shipping, import fees, taxes - it could end up costing around $3000. Assuming you can get a very low electricity price of $0.04/kWh and 100% uptime, your ROI would be: 44.35%, so you would lose more than half of money invested:

To actually get any profit at all, you would need so low electricity cost, it is almost for free. With price of $0,002/kWh you could operate miner for 1.5 years and then earn back the $3000 that was spent on it:

And this is not taking into account costs for miner hosting (containers or facilities), pool fees, maintenance, internet connection, etc. So situation right now is really, really bad for anyone in crypto mining business - specially considering that in this example I took the latest generation miner, but existing operations have older miners that are less efficient.

So I am not surprised at all, that right now our space is almost empty:

What will happen next?

Most of existing crypto mining operations will go bankrupt. Total Hash Rate might decrease for a short period of time.

New companies will be created that will take over assets and start again with clean balance sheets, Total Hash Rate will continue to go up.

This cycle can continue forever - and only few, very efficient operations will actually make any money. Everyone else will be donating time and money to support the Bitcoin network.

Key Takeaways

Even 14 years after creation, Bitcoin is still volatile and you can expect -80% moves once in a while.

Bitcoin mining is extremely competitive, and unless you have every single thing nailed - from cheap energy to stable operations, you will lose money. Do not invest in crypto mining companies. Publicly traded companies might have fancy facilities and access to low cost capital, but they are competing with everyone around the world - including those, who get (or steal) energy for free and have very low overhead.

Not your keys, not your crypto! As we see from $GBTC case, even a regulated trust in US can trade with 40-50% discount relative to their assets. And it is almost expected that once in a while crypto lenders and exchanges will blow up. The only rational way to get exposure to Bitcoin - buy it and store it yourself.