Will Crowdestor take over Crowdlendio?

A new P2B platform has been created - Crowdlendio. Looks like a direct competitor to Crowdestor. And no suprise there - the owner of Crowdlendio had 13 projects in Crowdestor with total amount of more than 1 million EUR. Try to guess - is the money paid back to investors?

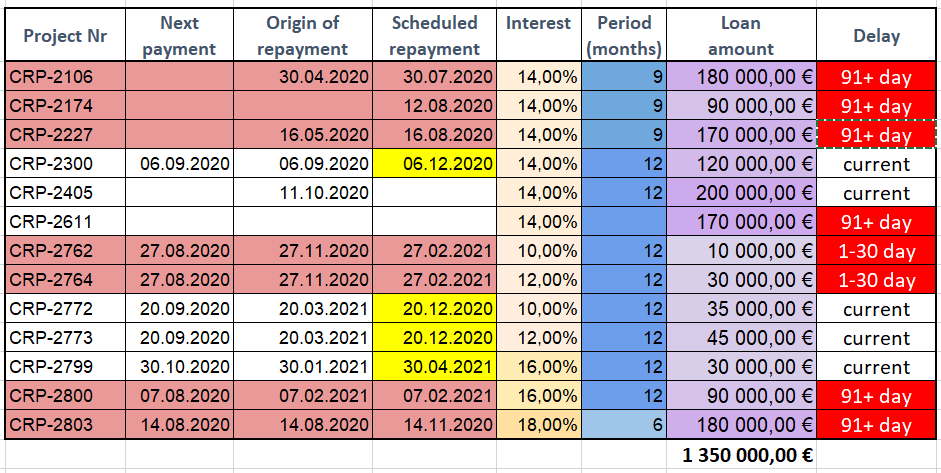

Meža Enerģija SIA - 13 projects, 1 350 000 €

I counted 13 projects in Crowdestor platform that were related to Meža Enerģija SIA, and most of them have couple of things in common:

Situation in company is described in a very positive light:

The year 2019 has been bountiful for the company ''Meža Enerģija''. It has grown significantly in all areas of the forestry business – portfolio management, cutting capacity, and attracted new experts in the field. Cutting capacity was carried out according to the long-term investment plans in new machinery units. The firm 2019 has doubled employees’ number in 2019, attracted experts in the forestry field, and in the customer relations field to cover the growth of the company.

There is a reference to management with big experience:

Management has 19-year experience in the forestry industry;

All loans are secured with both a personal guarantee and also a forest land pledge. For example:

The loan is secured by a private guarantee by shareholder of the Company;

The loan is secured with 19.20ha forest land pledge.

There have been several unfulfilled promises from Meža Enerģija, for example:

The Borrower “Meža Enerģija” has given us a short status update on the following projects:

Project CRP-2106 “Forest exploitation” – The project is being finalized and the principal will be repaid to investors around at 18.08.2020

Project CRP-2611 “Renewable energy” – the late interest payment will be made until 12.08.2020.

Best regards, CROWDESTOR

I tried to compile info both from Crowdestor Google Sheet + Crowdestor statistics page:

Does not look good, right? If the CEO & previously - only owner of Meža Enerģija SIA cannot pay back his loans on Crowdestor, but is instead launching a new P2B platform instead, that does not inspire trust at all.

Questions to Crowdlendio

But before I add Crowdlendio to “questionable“ platform list (previously: WTF platforms), I sent some questions to Ivo Šteinbergs, Crowdlendio owner & CEO:

As a CEO and previous owner of "Meža Enerģija" SIA, can you comment on the situation with Crowdestor? Why are there delays and unkept promises about repayments?

Crowdestor approached Meža Enerģija last year with an offer to finance projects. We got familiar with the webpage and gave it a go with a few projects. I do not know the exact numbers now, because I have left Meža Enerģija quite some time ago.

The delays are directly caused by the impact of Covid-19. In Spring economic situation slowed down and only now it is picking up the pace. Everybody is more cautions with buying properties and material.

Why was "Meža Enerģija" SIA owner changed on 28.08.2020 from you to Artis Šteinbergs? Is he now responsible also for the Crowdestor situation?

Ivo Šteinbergs and Artis Šteinbergs were in executive positions all the time. Now I left Meža Enerģija, because the company was set up, my expertise was not needed in Meža Enerģija anymore and Crowdlendio takes up most of my day. Artis Šteinbergs is in touch with Crowdestor since last year and is managing Meža Enerģija.

What do you mean with "executive positions"? Are you saying that owner is someone else? According to the company register you were 100% owner of the company from 27.05.2019. to 28.08.2020, and Artis Šteinbergs is 100% company owner since 28.08.2020.

No, I am not saying that owner is someone else. For Artis Šteinbergs to take over in 28.08.2020 after me, he had to be kept in the loop of company organization. He has been close to upper management.

I hope I explained this clear enough.

From 2019 report I see that "Meža Enerģija" SIA turnover was 624 114 EUR, production costs were 701 754 EUR, losses: -226 981 EUR. On top of that company has 40504.80 EUR in tax debts. To me it looks like a distressed company. Can Crowdestor investors expect to get anything back at all?

Crowdestor investors should not worry because the company is working and growing and will double its turnover this year and increase profit. The company remained loyal to its employees and didn`t lay off any workforce. Since the start of pandemic Meža Enerģija hired three more employees while I was with Meža Enerģija.

What is the situation with tax debt, have you worked out a payment plan? Or can company be shut down any time soon because of that?

Last time I was with Meža Enerģija, I was in touch with Latvian SRS and we cooperated towards a repayment schedule. I am certain that the company will not be shut down and will continue to grow.

If your company won't be able to repay it's debts, do you think it is a good idea for you to launch another P2B investment platform?

I am not working with Meža Enerģija anymore, but while I was there I had no doubts about making repayments.

You are 100% owner of Crowdlendio, how did you fund it's development and promotion? Could expenses related to Crowdlendio be somewhat responsible to why "Meža Enerģija" SIA investors are not being repaid?

The costs of production were low and it was financed by a private person - me. The expenses related to Crowdlendio has nothing to do with Meža Enerģija commitments.

Why is Crowlendio registered in Estonia? To avoid regulation?

Crowdlendio was registered in Estonia because, from experience in the previous companies, it is easier to find a talented workforce and the banking system is more open to Crowdfunding and business in general.

What kind of projects do you plan to list in Crowdlendio? Will they have collateral?

Crowdlendio will focus on niche projects - specific to my experience in previous companies. We will have real estate projects as well to appeal to mainstream investors. All projects have and will have collateral, I think that there is no other way at these times.

How much money has Meža Enerģija borrowed so far, how much is paid back? Last promise was that in October all will be repaid, it is December now. Is there a new estimate or “repayments will be made” is the only answer I can expect?

As I am not with the company anymore, it is better to ask Artis Šteinbergs.

His email address is artis@mezaenergija.lv

Note: I sent questions to Artis, but he did not reply.

What will happen next?

I might be wrong, but my impression is following:

If Meža Enerģija SIA cannot keep it’s promises about repayments, lost money in 2019 and cannot even pay their 40k EUR tax debt, it is very likely - that Crowdestor investors might lose up to 1 million EUR.

Crowdestor failed to perform due dilligence. Will they be better with debt collection? And is there anything left to recover? Not sure.

If the private guarantee by shareholder was real (and Ivo was the only shareholder of Meža Enerģija SIA) and Meža Enerģija fails to repay the debt, then Crowdestor will need to go after Ivo’s assets, including his shares of Crowdlendio.

In short - Crowdestor does not need to worry about Crowdlendio as a competitor, because it looks like doomed from the start. If Meža Enerģija SIA fails, so should Crowdlendio.

Another interesting thing to note - Ivo is 26 years old, does he really have “19-year experience in the forestry industry“? He was the owner of Meža Enerģija SIA, but probably not the decision maker, and that goes together also with his comment about “upper management“.

Key takeaways

Meža Enerģija SIA could be another disaster for Crowdestor

The only owner and CEO of Meža Enerģija SIA probably was not the decision maker

If Crowdestor tries to do any debt recovery, that should include Crowdlendio

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Dear Mr.Mors and your blog readers,

I waited for this article to be published and did not reply to your email questions as I wanted to bring clear view of Meza Energija and leave place for no doubts and speculations from my words.

Our company is 1st FSC FM 100% certified company in Latvia, by now with 18 employees, what brings together every willing private forest owner to join more sustainable forestry, by now our community have 196 forest owners, growing monthly and they valuate service we provide – before knowing us they had forest ‘’somewhere’’ in Latvia, and the best thing was not to touch it as it is comfortable due to lack of knowledge, after joining our community they have visited their forests, learned new things that they didn’t know before, had a possibility see every process of forestry(survey, planning, cutting, planting, reconstruction of non-working reclamation, etc.). Although after sharing their experience with their friends, who approach us afterwards as our work is our business card.

Before we became certified company, 7 months in year 2019 to get written procedure and mechanism of our community group, 3 month for meeting an auditors, visiting forests, etc. to finally in November 2019 we get our FSC FM 100% certifificate. Meanwhile working on attracting forest owners. You mention 640k turnover and losses, yes, true! But why not to mention year 2020 where having turnover ~2.4milion eur, and approximate 10% profit after expenses! With expected growth of 1.5x in 2021.

In year 2020 we did have opportunity to become a supplier of wood chips to one of the biggest heating plants in Europe, because we were able to provide our vision of having such contract volumes, we are doing good - 2 vessels have sailed, 3 more on the way in beginning of 2021.

Wondering about 19 year of experience is possible, if not knowing that we were born in foresters’ family, and already by age of 6 we were in our family forests helping our parents to cultivate new planted forests. Now we will think that we should change our experience to more than 45years, as our father in age of 60 is Meza Energija head of forestry department.

We are not proud of having tax debt of 40k by now, but we are proud that since complete lockdown March 2019 – Juny 2019 we provided job places for every employee and did not fire any employee, and if we had to make hardest decision by that time pay salary or taxes – We will do the same, and tax office respects our decision as we are in close communication with them. Our value is our employees which are in the same passion for the work as I am. But also, good to mention that since November we are paying all actual taxes and covering delayed ones.

Ivo always was more interested in computers and IT than I, he did a lot for Meza Energija IT, GPS systems, and always solved every task for more automated and easier every day live for all of us. So, it led to having knowledge of forestry and IT, having a possibility to create his own platform Crowdlendio, which will be meant for supporting forestry sector in Baltics, in my opinion it is fascinating that he never stops creating and working, so I have no doubt that it is right decision use his mind and knowledge. Also good for every investor to have possibility to join platform runed by known person.

Nobody is happy when failed to fulfil promises or payment terms, neither do I, so we have met with Crowdestor Janis multiple times, discussed solution for late payments, and I am incredibly happy that Janis not only listened to our story but also heard our story. Contracts concluded, Operative financial data for 2020 had been provided, and all this information were delivered to investors. So, I do believe that investors will be way happier seeing company who had several hard months, in situation nobody even dreamed about, is not throwing away work have been done. We do not aim to become Crowdestor success story, but we are sure we will not let down them, as since October, November repayments have been done, and more on the way in December.

Sometimes instead of spreading rumours is wiser to come and have a chat with me in our forests.

Have a peaceful Christmas time,

Artis Šteinbergs

Meza Energija SIA

Member of the Board

1) in link to www.sudzibas.lv in first comment it mentions "his insolvent brother". Maybe the guy is under formal insolvency proceedings, then personal guarantee is worth zilch.

2) developers listed in Crowdlendio "About us" section look totally legit :)