Portfolio update, November 2020

Six months ago I started an investing experiment to see if I can create an “all weather portfolio” that would perform well in different market conditions, and at the same time beat S&P 500 index and Warrent Buffett’s Berkshire Hathaway.

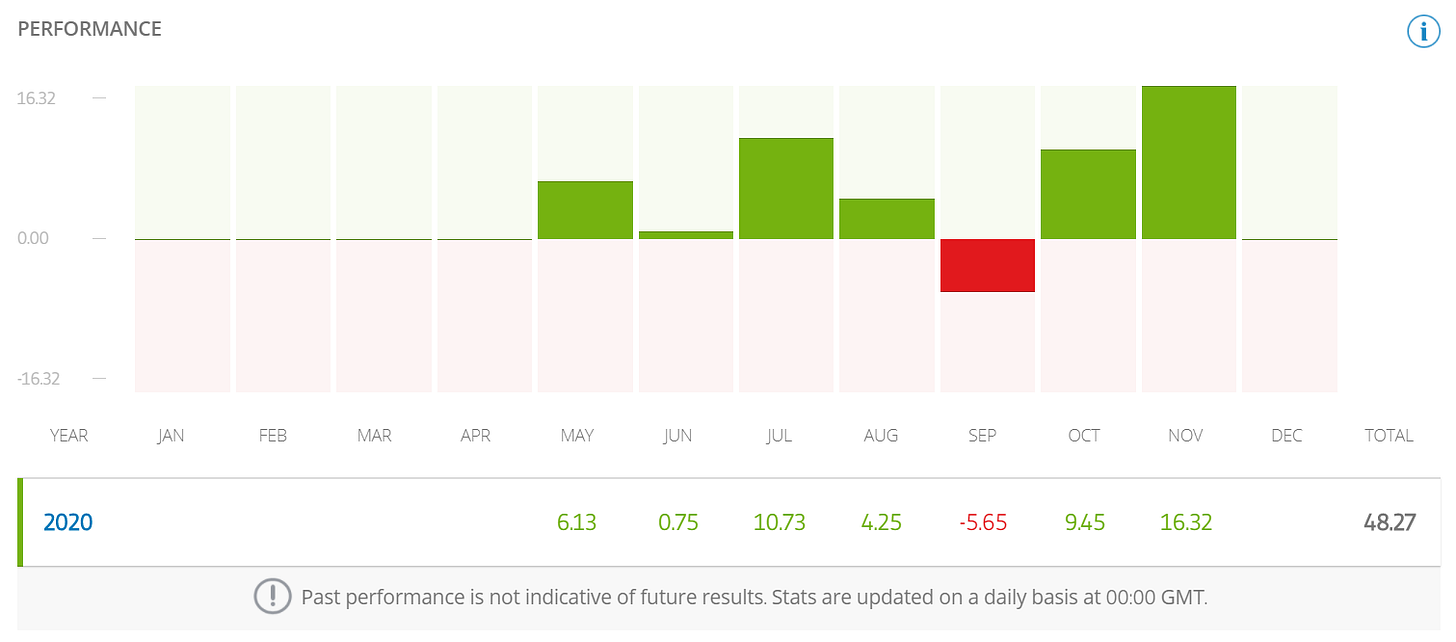

So how is my portfolio performing so far? I could not complain before, but it really exploded in November. It increased in value by 16%, and annual return right now is estimated to be around 48%:

And here is my current portfolio:

Did I beat S&P 500 or Warren Buffett?

Yes, looks like my 40% bet on Bitcoin is paying off, and I've managed to beat both S&P 500 Index and Warren Buffett. Right now my total return is 34.20%:

What now?

I have outperformed S&P 500 by 20% and Warren Buffett by 14%. No reason to continue, right? Well, not really - I was planning to continue this experiment for at least 1-2 years and hoping for a big market crash during that time to see how my “all weather porfolio“ would perform then.

But some regulation/rules have changed, and eToro investors are not allowed to buy US ETFs, except through CFDs, which means paying high fees. And even if I would do that, the minimal trade amount for a CFD = $500. But most of my positions are $200. Because of these changes I am not able to purchase $VOO (S&P 500 index) or $GLD (Gold) or any US based ETF, and that messes up the whole experiment.

So I am forced to stop it. Will I try to create a new version of this investing experiment to somehow work around these ETF problems? Not sure yet.

Any other eToro issues?

During this time I’ve noticed some other things that make me want to reconsider if I want to play around with eToro for longer period:

eToro has extremely bad TrustPilot rating and reviews. Even P2P frauds somehow manage to get more positive feedback.

If you don’t know exactly the stock or ETF symbol, then finding something on eToro is very complicated. Search function is a joke, and when you go through the list of ETFs - they don’t even show the full fund names. Want to find energy ETFs? Or search for list of all iShares or Vanguard ETFs? Not possible.

eToro has very limited selection of stocks and ETFs where to invest. It is better than in Revolut, but still - cannot compare with Interactive Brokers, for example.

Hidden fees. I still have not figured out completely when/how eToro charge the fees and on what are they based on. In my account report it says that I’ve paid $0 in fees, but that is obviously not true. For Bitcoin alone the spread/fee is 0.75%.

Bad support. As I have more than $10k, I am a “gold“ memeber and have an account manager, but when I sent him some questions about these new rules and ETFs, I’ve not received any reply.

I have to go through several step process to make a withdrawal. And get asked for a reason. WTF? And then the message that I will get money to one of my accounts, but no details about IBAN or anything… A bit confusing.

In short - eToro is really good for sharing your portfolio and being transparent about your positions, but otherwise - looks quite shady as a stock broker.

All investments made during this experiment

If you want to read more about this investing experiment from beginning, check out previous posts:

Part 5: Portfolio update, October 2020

Or you can see all investments made during this experiment:

An overview of total portfolio value, and how it changes each month:

Lessons learned

It is not easy to beat S&P 500 or Warren Buffett, but if you use DCA to invest part of your portfolio in Bitcoin, you will do much better.

Don’t be afraid of volatility - prices go up and down all the time, but if you have confidence in your strategy, there is no need to monitor daily changes or worry about it.

Risky bets on banks (LLoyd’s, $KRE ETF) and travel (Airbus, Carnival Cruises) can outperform Amazon and Berkshire Hathaways if you can buy it with the right discount.

My stock and ETF picks generated similar returns to S&P 500 and $BRK.B, gold underperformed a lot, but Bitcoin outperformed everything.

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Nice Stats, thanks for sharing.

I've been using eToro since 2016 and never had issues.

On eToro I only trade CFD's with leverage x5.

https://www.etoro.com/people/allik82/stats

I also use Revolut. It's basic but works. You can sell your stocks, immediately move the funds back to your account and spend it.

Now I'm testing IG.com higher fees but for CFD's I can start trading in pre-market and the visuals/graphs are better then eToro.

My favorite Latvian account on etoro is from Bobtheguy. All in on Tesla with leverage x5 🚀🚀🚀 Simply EPIC

https://www.etoro.com/people/bobtheguy/portfolio

Congrats on your performance, well done! I am also buying bitcoin since it had such a great performance this year.

Regarding your comment about Interactive Brokers. I had an account there, but I was not happy with the platform and closed my account.

I am afraid that the same EU regulation is present in IB and you will not be able to buy US ETFs as an underlying asset. The regulation affects all EU citizens.

Main reasons for closing the IB account:

1. User interface is awful and outdated. It is hard to get around it. The website is slow too.

2. If you have EUR as a base currency and want to buy US stocks, you will have to perform a Forex trade to convert the money to USD.

3. You can fund your account only via wire transfer.

4. And the last but maybe the most important one to me is the inactivity fee.

Here the answer from support regarding the inactivity fee:

"Please note that every IBKR PRO account is subject to a monthly minimum activity fee. This fee is capped at USD 10 for accounts with a balance greater than USD 2,000 (USD 20 for accounts maintaining equity of USD 2,000 and below). This fee can be waived for an account in any given month only if the commission worth of USD 10 (equivalent in non USD) generated or the Net Liquidation Value (NLV) of each account is greater than or equal to USD 100,000."