P2P or WTF platforms? How it's going?

2020 has been a tough year for many P2P investors. Several platforms have shut down or stopped withdrawals and that will result in big losses. So how is it going so far?

P2P lawsuits

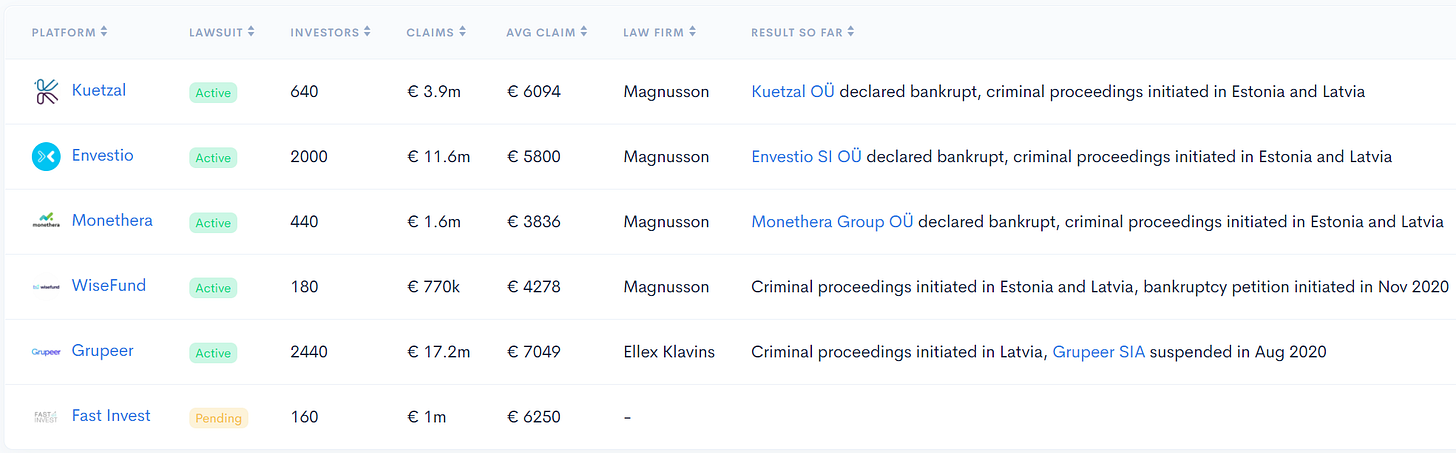

There are 5 active lawsuits and 1 pending. Not every investor joined them, so the total number of investors should be much higher, just like the total investment at risk. But from 5860 investors who decided to participate in legal action, we can see that average claim size ranges from €3.8k to €7k, and total claims have reached €36 million:

How much will be recovered? It will probably take years to find out, but my impression so far is that the law firms are taking these cases seriously, have done lot of work and if police, prosecutors and judges also do a good job, some part of investment should be recovered.

WTF platforms

I cannot be 100% sure which P2P platforms are scams, I will let investors or police to decide that later, but here is a list of investment platforms that have many similarities - not enough info about team or where money is invested, strange agreements, impossible guarantees, etc.:

Who promotes this stuff?

9 of 11 platforms mentioned above were or still are promoted by Target Circle affiliate network. So if you were influenced by blogs or other publishers who wrote super positive reviews to get commissions, don’t forget to send thanks to Target Circle CEO Dr. Heiko Hildebrandt.

Note that I warned Target Circle about Grupeer before it blew up, and I’ve written many emails to Target Circle account manager and CEO about IBAN Wallet, so they are fully aware of the issues and the type of platforms they promote, and to them it is business as usual. No action is being taken, profit is more important.

Example: IBAN Wallet

I sent some questions to IBAN Wallet 2 weeks ago:

Hello,

sending questions to Jorge Alberto:

1) Are you the real beneficial owner of everything that happens with IBAN wallet and IBAN online in Mexico? Do you control all the money, employees, bank accounts, etc.? If not, what are you responsible for, and who are the real owners and decision makers?

2) Can you confirm that IBAN Wallet in Mexico (https://www.ibanwallet.com/es-MX/) advertised to investors 10% return per day or 10% per month as described in several news articles:

https://www.etcetera.com.mx/nacional/fgr-investiga-iban-wallet-captacion-irregula-recursos/

https://www.cronica.com.mx/notas-fgr_investiga_la_instalacion_en_mexico_de_fintech-1166818-2020

https://heraldodemexico.com.mx/opinion/2020/10/26/investigan-iban-wallet-218704.html

3) When investors make deposits, which company receives them? What is the company name, address, and who owns it?

4) Can you comment on the investigation in Mexico?

5) Does Clearchoice Management S.A.P.I. de C.V. have any kind of license to offer investment service to retail investors in Mexico?

6) Does Clearchoice Management S.A.P.I. de C.V. or any of related companies in Mexico have any kind of license to issue loans to SMEs?

7) If you don't have any licences to operate an investment service or lending business, and there is an active investigation about it, why are you still advertising these services to investors and potential borrowers?

8) Why are many investors complaining that their accounts are frozen, and money not returned?

9) Can you provide financial reports of all Mexican companies that offer investment and lending service?

10) Who are the owners of global IBAN Wallet business? And why are they not owning any shares of Mexican companies?

The only response I got:

What a joke... No one wants to even sign his/her name under IBAN emails. And of course - I have not received anything else afterwards. But it is understandable - how can you explain away a criminal investigation or that company is owned by some random guy from Afghanistan? Not easy, so IBAN decided to just keep silent.

I’ve written 3 posts so far about IBAN Wallet, and shared all info with Target Circle, one of my last emails to their CEO:

1. Are you doing any due diligence on advertisers that you accept? Or can any scam apply and get promoted among all your publishers?

2. Do you think it was a mistake to promote Kuetzal, Envestio, Monethera, Wisefund, Grupeer to your network of publishers? If so, have you learned anything from these cases?

3. Do you take any responsibility for promoting frauds that have resulted in investors losing tens of millions EUR lost?

4. How much did you earn from Kuetzal, Envestio, Monethera, Wisefund, Grupeer? Do you plan to give this money back to investors like Crowdestor did with the Fertilizer loan (also a fraudulent project)?

5. If you don't plan to return money made from P2P scams, can you provide a comment for P2P investors, who lost money partly thanks to your "service"? Is promoting fraud part of your business plan?

6. Do you agree with Karlis Levensteins (your previous employee and the guy who Target Circle still supports) comment - that P2P investors are like drunk drivers?

7. Do you see any similarities, when comparing IBAN Wallet to previous P2P frauds that Target Circle promoted? ( Kuetzal, Envestio, Monethera, Wisefund, Grupeer)

8. When you have started to promote a new advertiser, and later you get info that it might be a fraud, how much info do you need, to stop cooperation? Or that is done only when the advertiser's website is shut down by themselves or the police?

9. Do you feel comfortable still promoting IBAN Wallet to your publishers, knowing these facts:

ibanwallet.com says that they are a Latvian company, but this company had 0 EUR revenue in 2019 according to their reports, and this company is not reachable in their address, and the phone listed does not exist

this Latvian company is owned by some guy from Afghanistan, who is a French resident. A person that does not own Estonian company, who Target Circle has an agreement with, and person that no one can reach

there is a criminal investigation in Mexico about ibanwallet.com about their illegal operations - collecting investments, and issuing loans without any licenses, and blocking investor accounts, not returning money

the owner of Estonian company own 0% of Latvian company and 0% of Mexican company - the only 2 legal entities mentioned in ibanwallet.com in Terms and Conditions

when investors deposit money to IBAN Wallet, no one really knows to which company the money is sent. And IBAN wallet is refusing to answer this or any other question. Sounds reasonable to you?

What was Heiko’s response? That we should sign an NDA agreement before he comments. From that I conclude - he takes no responsibility, does not want to answer to me or investors, and thinks that promoting IBAN Wallet and other shady platforms is fine. In fact - just recently Target Circle sent out another promotion for IBAN…

Key takeaways

There are 5 active lawsuits, 1 pending. Total claims: €36 million

There are 5 more active WTF platforms. Might blow up later, so expect more lawsuits.

Target Circle have no issue promoting a shady platform even when they are informed about disturbing facts.

IBAN Wallet and Target Circle are not responding to questions. Partners in crime?

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Wish I had found you before I got burned. High time for some healthy skepticism amid all the moronic hype.

Most (p2p) financial blogs are indeed fully running on affiliate earnings. The earnings with successful referrals is big, and in many cases bigger than the p2p return itself. Most of thee bloggers do not show their affiliate income at all (sometimes it is also not possible to share due to contract, but nonetheless).

TargetCircle is the largest player (at least on the EU side) for fintech advertising with a heavy focus on the various p2p marketplaces. I do remember that at the moment Envestio and Kuetzal were proven to be frauds, even TargetCircle announced they learned from the situation and launched (at least in words within that announcement) a overhaul of their due-diligence process to prevent this occurring in the future. As you can see with Iban Wallet so far, that were just empty words. I do understand that TC drives on the commissions that these companies pay to TC to market their campaigns to bloggers etc. But they should pause the campaign immediately when suspicions emerge which are not clarified publicly by their client.

The other side is that TargetCircle deals with many more sectors besides FinTech. However I have to directly admit that these mostly target the various Nordic markets (Finland, Sweden, Norway) or individual specific countries.