Is Binance similar to FTX?

After FTX exploded many shocking facts came out - everything was controlled by few individuals, there was no record keeping, customer funds were used for purchasing real estate, and making bad investment decisions. Lot of lies and deceipt. What about Binance? Is it run in a similar way?

Complicated company structure

At first let’s look at FTX corporate structure - Financial Times compared it to Lehman Brothers Holdings Inc. saying: “The SEC’s post-mortem diagram of Lehman’s corporate structure looks a model of simplicity in comparison to FTX“:

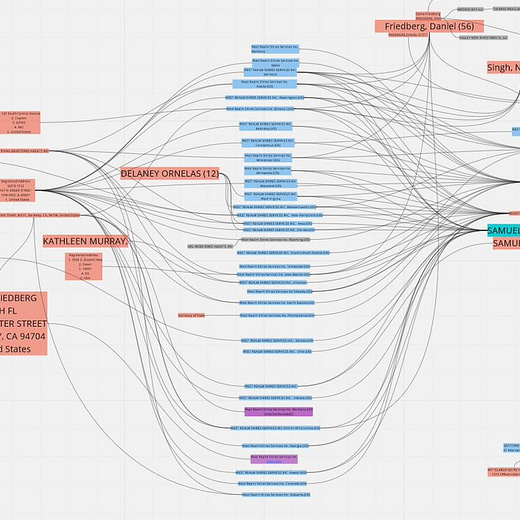

What about Binance? As I mentioned in my previous post “Is Binance safe? Where is it based?“ - Binance has 50+ legal entities that we know about, but in reality - could be many more.

Here is one attempt to visualize them:

Improper use of customers funds

In case of FTX everything was controlled by Sam Bankman-Fried and he secretly transferred $10 billion of customer funds from FTX to his trading company Alameda. And he ordered Gary Wang to open a $65 billion secret backdoor line of credit for Alameda Research. In short - Sam used customer funds as his own with no oversight.

What about Binance?

Late last year, as crypto markets were struggling to regain their footing, the world’s biggest cryptocurrency exchange quietly moved $1.8 billion of collateral meant to back its customers’ stablecoins, putting the assets to other undisclosed uses. They did this without informing their customers.

It is difficult to ignore similarities to the transactions that contributed to the crisis and collapse at FTX. While FTX allegedly ran into trouble by misappropriating customer deposits to the benefit of its sister hedge fund Alameda, in this circumstance Binance seems to have taken funds that customers had reason to believe were dedicated collateral and used them for its own purposes.

Source: Binance’s Asset Shuffling Eerily Similar To Maneuvers By FTX

In short - Binance was responsible for holding billions of USD in collateral for it’s so called stablecoin, but in reality - it secretly moved $1.8 billion of these funds around and it is not clear how they were used.

So far this has not caused any damage, but it resulted in following:

New York regulators have ordered the cryptocurrency firm Paxos to stop issuing Binance USD (BUSD) — over concerns that it can’t “safely” issue the token

And the only response from Binance CEO? Ignore the FUD:

Concentration of control

Although at some point Sam Bankman-Fried declared that he is no longer involved in daily operations of Alamada Research and appointed a new CEO there, in reality he made all the decisions till the end both for FTX and Alameda, and there was no real separation of both companies.

And who was the CEO of Alameda? His fuckbuddy Caroline that uses meth instead of math, is comfortable with risk and does not use stop-losses:

Even worse - customer funds were commingled with FTX and Alameda investments and daily expenses, and there was almost no record keeping. Complete clusterfuck.

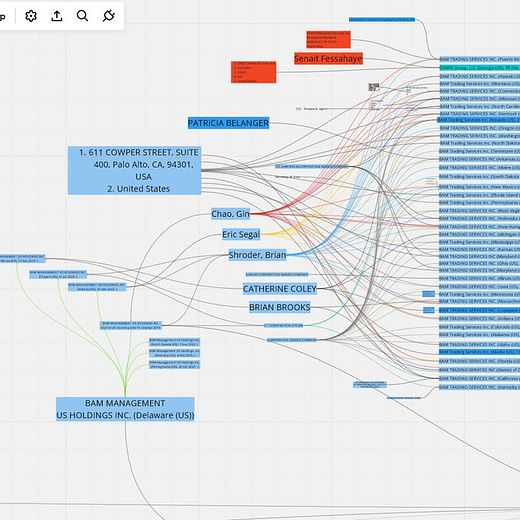

What about Binance? The only guy that seems to be making any decisions and talking to media is Changpeng Zhao. Other C-level positions seem to be a joke:

Binance’s former CFO worked for 3 years and did not have access to full financials

Catherine Coley, who was CEO of Binance.US for two years, just dissapeared one day, and is still missing for 300+ days.

Brooks, who took over from Coley, only lasted a few months at the helm of Binance.US before stepping down.

And just like in FTX, also in Binance commingling funds of different entities is standard practice - Binance and Binance.US have transferred billions of dollars in crypto between each other, while claiming that they are separate entities with different management teams.

Hidden financials

There were no audits or financials available for FTX. In case of Binance - CZ is even actively trying to hide their legal entities, changing them and cannot respond, which is the main company behind Binance?

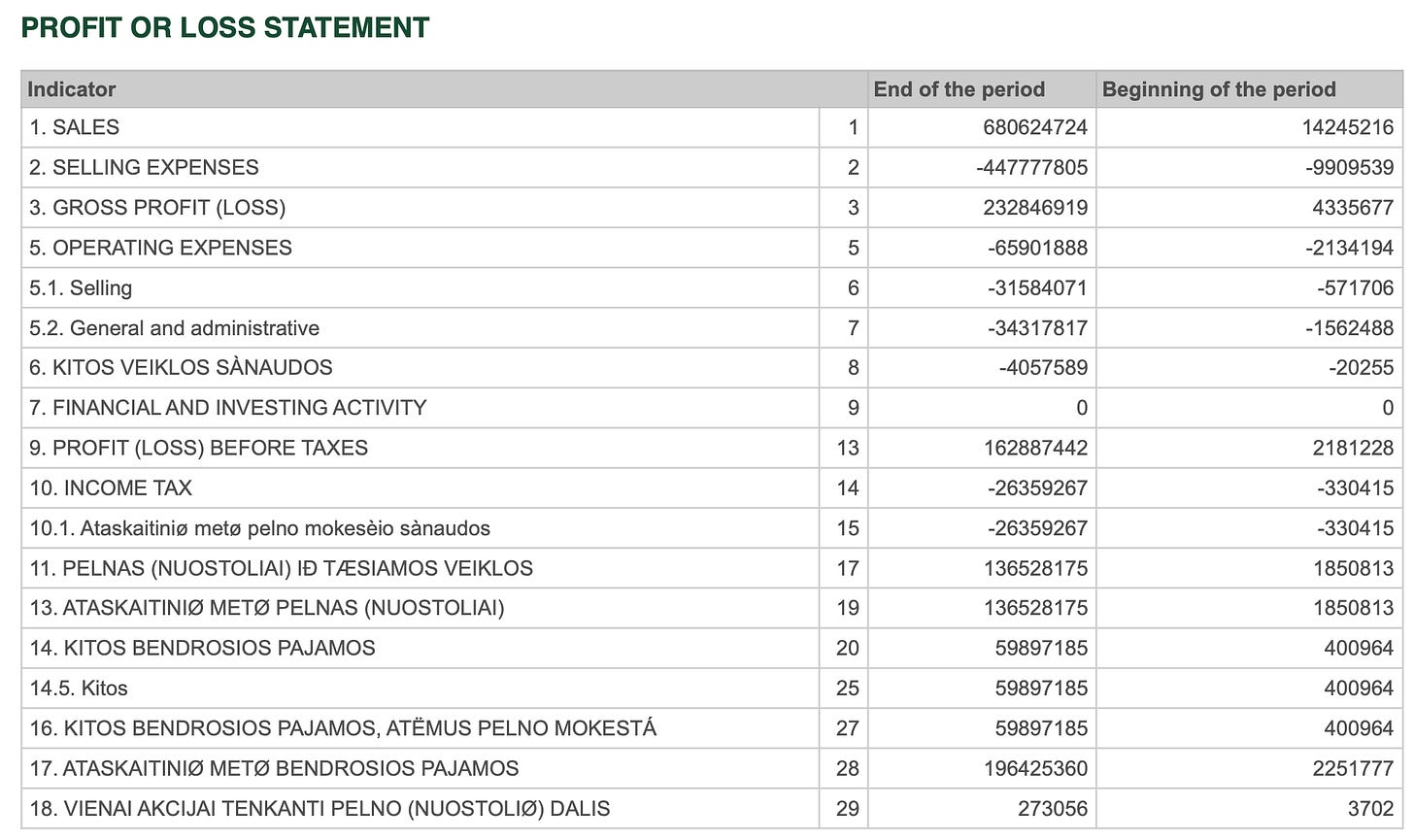

The only insight that is available - report for 2021 of their Lithuanian entity Bifinity UAB:

Interesting to note that “general and administrative” costs were EUR 34 317 817. Assuming that in 2021 Bifinity UAB had the same amount of employees like now, that would mean a spend of 1.7 million EUR per employee.

Binance also failed their own audit: Binance auditor withdraws from working with crypto company

Key Takeaways

There are many similarities between FTX and Binance, lot of red flags

Binance is operating like a black box, everything is based on trust

Mt. Gox filed for bankruptcy in 2014, recovered funds still have not been returned to customers. If Binance shuts down for some reason, you will be waiting for a long time to recover anything

Hey Kriss,

That's all very interesting and def a must have information, so investors can make up better decisions on which exchange to use.

I have an account at Nexo, Kraken, Coinbase & Binance, but I've recently transferred all my funds from Nexo to Kraken & Binance with fear of something happening to Nexo. But am considering now removing all my funds from Binance too.

Between Kraken & Coinbase, what are your opinion on these 2? are they trustworthy? and between the 2, which would you recommend more?

Thanks :)