How I made $12k gambling with $SSL

Today I will share results of my speculative trading with Sasol ($SSL) that I have done in last couple of months. I won't go into detail, why I chose to play exactly with this company, but here you can see a short comment that I wrote on March 31st in Telegram group “High-risk investments“. At that point $SSL traded at $2.00:

Trade #1 - buying 1000 shares

When I first bought $SSL - my expectation was that with all the shutdowns and incompetent leadership of US & UK, economy of the western world will be destroyed (that happened), and stock market would go much lower (did not happen).

My plan was to buy smaller amount of shares and when price drops more, increase my position:

March 19th: bought 500 shares at $2.00, total: $1000

March 24th: bought 500 shares at $1.47, total: $734

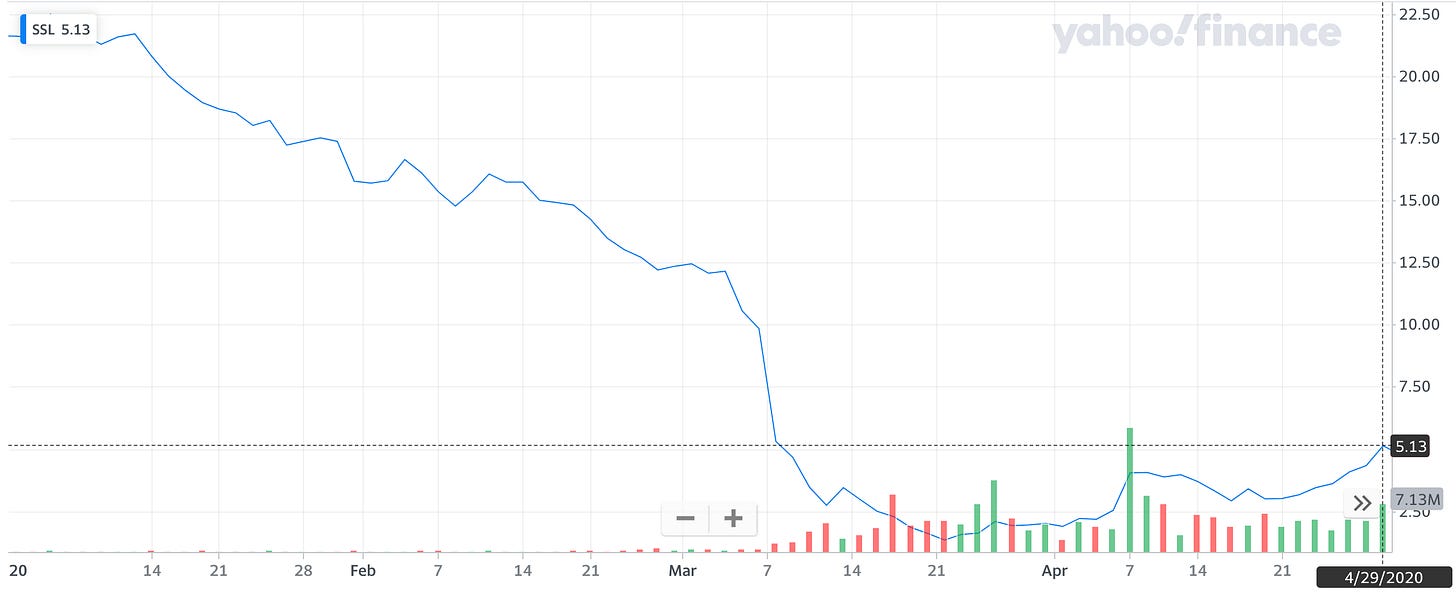

From beginning of the year $SSL had dropped from $21.60 to $2, more than 90% decrease:

The only problem? I was too greedy and stock did not go to $1 like I wished, but it went up to $4 and then a bit lower:

So I did not have the chance to buy much more at the lowest point like I hoped for, but as I was still in “all is doomed“ mode and oil prices were crashing below $20, I sold all my $SSL shares:

April 15th: sold 1000 shares at $3.13, total: $3132

Profit: $1387.89

Trade #2 - buying 1800 shares

Only 5 days later on April 20th oil prices went negative for first time in history, but $SSL stock just kept going up:

I was surprised, but if negative oil prices could not do any more damage, then I changed my outlook and got more confident.

At first I bought some shares:

April 29th: bought 800 shares at $5.05, total amount: $4040

But then I remembered about selling PUT options, so I did another trade:

April 29th: sold 10 PUT options with strike price of $5, expire date May 15th, price: $0.45

How does the PUT options work?

I sold rights to sell $SSL shares to me at $5 until May 15th, even if price would drop to $1 or $0. For this “insurance“ someone else paid me $0.45 per stock, and 1 option = 100 stocks, so I got paid $0.45 * 100 * 10 = $450.

When May 15th arrives, if $SSL is below $5, I would have to buy 1000 shares of $SSL at $5. If the price is higher than $5, then it makes no sense for someone else to sell me their $SSL shares for $5, and I get “free money“ - those $450 that were paid as premium.

But taking into account that I wanted to buy this stock, this is another way how to buy with a discount - if stock is assigned to me, my final price for each stock is $5 - $0.45 = $4.65.

What happened with my PUT options?

So May 15th arrived, $SSL had dropped a bit lower to $4.22 and I had to buy it:

May 15th: bought 1000 shares at $5, total amount: $5000

And almost another month went by, and I got a bit nervous - $SSL had gone from $1.25 to $11 in just couple of months and started dropping again, so I decided to sell my position and sell PUT options again:

June 10th: sold 1800 shares at $8.52, total: $15 340

In result I made $6737.49 from selling stock and $450 from options premium

Profit: $7187.49

Trade #3 - selling 30 PUT options

So on the same day when I sold my 1800 shares of $SSL, and when price of stock was $8.52, I also sold following options:

June 10th: sold 30 PUT options, strike price: $7.5, expire: June 19th, premium: $0.35

How do PUT options work in this case?

In this trade I sold someone else the right to sell me 30*100 = 3000 shares of $SSL for price of $7.5 (so $1.02 lower than current market price) in next 9 days (until June 19th), and for that I got paid $0.35 or in total: $0.35 * 100 * 30 = $1050

What happened with my PUT options?

On June 19th the price of $SSL was $8.10, so higher than the strike price of $7.5, which meant that I could keep the full premium ($1050), and did not need to buy 30*100 = 3000 shares of $SSL.

Profit: $1027.60 (some fees got applied)

Trade #4 - selling 30 PUT options again

On June 22nd price of $SSL was at the same level: $8.11, but this time I sold options with a longer expire date:

June 22nd: sold 30 PUT options, strike price: $7.5, expire: July 17th, premium: $0.8

How do PUT options work in this case?

In this trade I sold someone else right to sell me 30*100=3000 shares of $SSL for price of $7.5 (so $0.61 lower than current market price) in next 4 weeks (until July 17th), and for that I got paid $0.8 or in total: $0.8 * 100 * 30 = $2400

What happened with my PUT options?

On July 17th the price of $SSL was $8.74, so higher than the strike price of $7.5, which meant that I could keep the full premium ($2400), and did not need to buy 30*100 = 3000 shares of $SSL.

Profit: $2400

Trade #5 - selling 30 PUT options again

On July 22nd I repeated the same trade again. This time the stock price of $SSL was $8.6 and premium a bit lower:

July 22nd: sold 30 PUT options, strike price: $7.5, expire: August 21st, premium: $0.55

This trade is still open, but I am not sure if I will wait till expire date again. Maybe this time will try to close position sooner and use funds to gamble with a different stock instead.

What is the result so far?

Total profit from first 4 trades: $12002.98

Money at risk right now (Trade #5): 30*100*(7.5 -0.55) = $20850

What could I do better?

I probably messed up in the beginning. I started to feel much more confident when I saw $SSL stock price recover in spite of oil prices going negative, but if I had bigger balls and less greed, then buying a bigger position at $2 or $1.5 and holding till $8 or $10 would have produced much better result. For example, buying $10k worth of stock at $2 and selling it at $8 would result in $30k profit.

On the other hand - the last trades with selling PUT options and capturing premiums have worked very well. If instead of selling 1800 shares at $8.52 on June 10th I had kept them, then today they would be worth $8.16 (-4%), and I would have missed $3400 in gains from selling PUT options.

Warning about options

If you don't understand how options work, don't touch them. It is much easier to lose money with options than by making bad stock (or P2P) investment decisions. If you make mistakes, you can wipe out your account super fast! And in some cases losing money can be the least of problems, there are tragic stories as well.

Key takeaways

Buying a big company with 90% discount sometimes can pay off

Selling PUT options can be a way to buy shares with discount

Getting greedy = limiting your profit

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

The same game works with selling call options to sell owned stock at a specific point to earn the call premiums.