Can I beat Bitcoin? Week 3: Helium

This week I looked at a crypto currency that on the one hand is very centralized - created by a private company and supported by ton of VC money, but on the other hand - offers users to build out a decentralized wireless network and earn money from keeping it alive. It is like a gofundme campaign, but for infrastructure.

What is Helium?

A recent NY Times article provides a good introduction:

On a basic level, Helium is a decentralized wireless network for “internet of things” devices, powered by cryptocurrency.

The network is made up of devices called Helium hot spots, gadgets with antennas that can send small amounts of data over long distances using radio frequencies. These hot spots, which cost roughly $500 apiece and can reach 200 times farther than conventional Wi-Fi hot spots, share their owners’ bandwidth with nearby internet-connected devices — like parking meters, air-quality sensors or smart kitchen appliances.

Anyone can use the Helium network, although most of its users so far are companies like Lime (which has used Helium to keep tabs on its connected scooters) and the Victor mousetrap company (which uses it for a new line of internet-connected traps). More than 500,000 Helium hot spots are in use around the world, with thousands being added to the network every day.

Here’s where the crypto part comes in: In addition to transmitting data, Helium hot spots reward their owners for participating in the network by creating units of a cryptocurrency called $HNT. These tokens can be bought and sold on the open market like any other cryptocurrency, and the more a hot spot is used, the more $HNT tokens it generates.

Source: nytimes.com/2022/02/06/technology/helium-cryptocurrency-uses.html

Is anyone using Helium?

I find it strange that Helium does not provide a good overview of network usage. They do provide some datapoints in their Explorer, but there is no way to check how these numbers change over time.

For example, I can see that $5m were spent in data credits in last 30 days, but it is not possible to see what happened 3 months or 1 year ago. Is the usage flat, growing or in decline? Are most fees generated from setting up new hotspots or for actually using the network?

By seeing that amount of Hotspots is growing, one could assume that also network usage is growing, but from Helium stats it is not possible to verify it.

So I tried to Google and check if someone else had looked at this data and found an interesting blog post: “Connecting the HNT price to demand for using the Helium network by analyzing data credit burns“.

A number of data credit burn categories are included in the data. I focused on the “Fee” and “State channel” categories to best approximate sustainable external demand for using the Helium network (the other categories are one-off fees or costs associated with establishing a new hotspot within the network). I started the analysis in October 2020, after the initial fees to open state channels have passed.

Immediately, we see usage of the Helium network has grown exponentially in the last year.

$10k per day is not much (data is from October 2021), but the growth looks good.

Data burn - misleading stats?

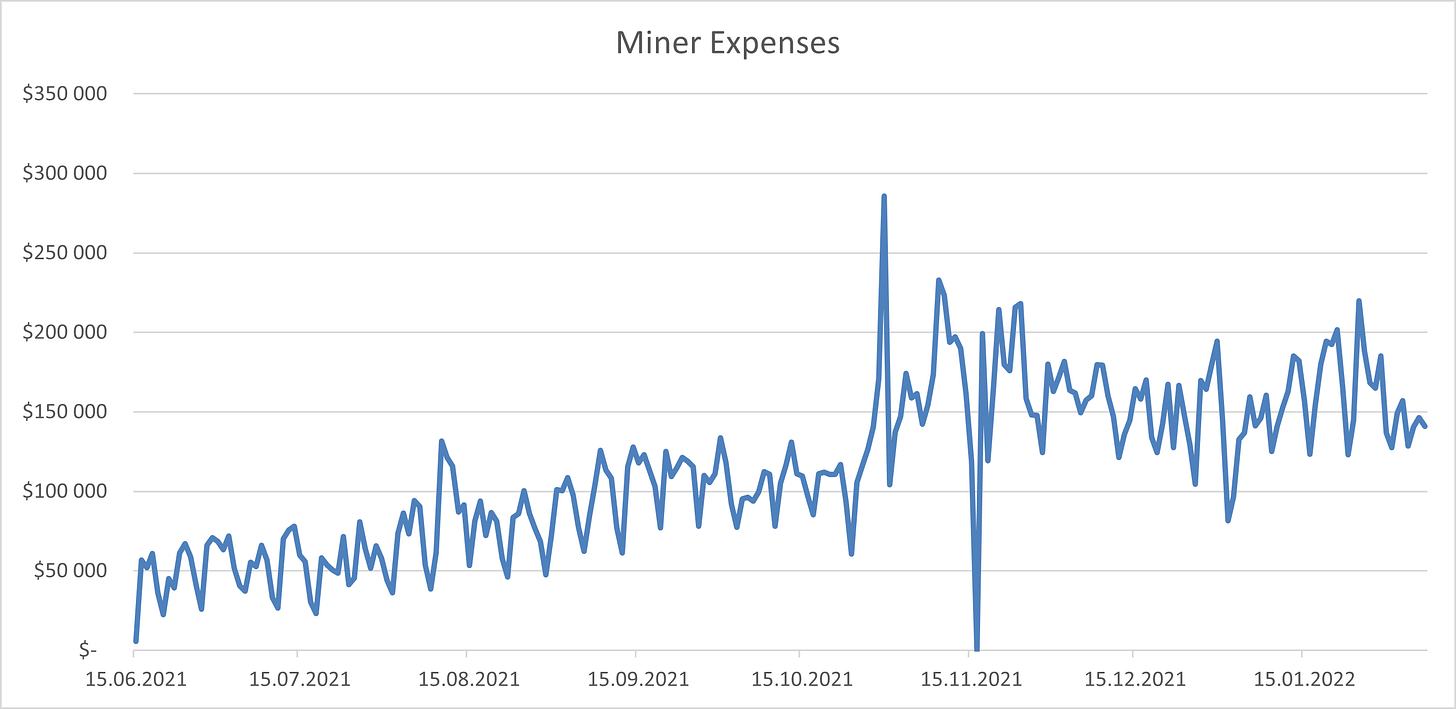

I used the Python script created by stin.eth to also check what is going in last couple of months. I was able to get data from 15.06.2021 up to today, and this is how data credit burn categories look like:

So when Helium says that $5 152 062 are spent in last 30 days for data credit burn and explain it with "Data credits are spent for transaction fees and to send data over the Helium Network.“, they are hiding - that only 5% of this number is related to fees for using the network, and 95% are spent by miner owners.

And this is how network usage fees spent looks like from June 2021 till Feb 2022:

And this is how miner expenses (Assert Location + Add Gateway) look like:

Last 3 months are flat, does not look so good anymore.

What happened in 2021?

In 2020 production of hotspots was done by Helium themselves + two third party manufacturers that relied on Helium Inc's firmware, staking servers, and customer support.

But this changed in 2021 - a proposal was introduced for a process for any manufacturer to participate in production, called Helium Improvement Proposal 19. You can track the progress in a Google Sheet.

Results seem very impressive:

We started the year with 14,000+ Hotspots on the Network. We now have over 25 approved Makers building Hotspots on the Network, and the Maker applications continue to roll in. Today, the Helium Network has coverage in over 34,096 cities and 161 countries thanks to nearly 450,000 Hotspots deployed by the community. Approximately 3,000 Hotspots are being added by the day and over 5,000 new cities are added by the month. By next year, we anticipate we’ll exceed well over 1 million Hotspots in the wild.

Source: blog.helium.com/2021-helium-breakout-year-cd90ebc843fa

How centralized is it?

Helium is trying very hard to focus on the aspect that the hotspot network is decentralized, but 100% control is still in hands of 1 company: Helium Inc.

In order to join the blockchain, every hotspot requires an onboarding code. This code is exclusively issued by and validated by Helium Inc’s staking server. On top of that Manufacturer needs to pay $40 to Helium for each new hotspot added to the blockchain.

Helium Inc is the only party that can issue the keys required to add a new hotspot to the blockchain and there is no plan for granting direct key issuance authority to any third-parties.

Any manufacturer that wants to produce hotspots, needs to also provide Helium Inc with following info:

Submit detailed hardware designs, including relevant parts and supply chain information

Submit a prototype for audit

Proof of identity for individuals owning 25% or more of the manufacturer

Proof of the capital necessary to fund the production budget

In short - if any government agency would like to influence or shut down the network, it needs to visit only 1 company or could just take over their staking server.

Another potential disaster that might happen - as network grows and also the internet bandwith used by hotspots, some internet service providers might limit service to either these devices or to clients who use them:

Putting a Helium hot spot in your house might also technically violate your internet service provider’s terms of service, since it involves reselling a portion of your bandwidth. The terms of service for Comcast Xfinity subscribers, for example, prohibit using your connection “for any purpose other than personal and noncommercial residential use.” So far, internet service providers haven’t cracked down on Helium users en masse, but that could change.

Source: nytimes.com/2022/02/06/technology/helium-cryptocurrency-uses.html

Helium in 2022

I think the most interesting development will be the roll out of the Helium 5G network. 5G miners are in such a high demand that even waitlist is closed.

Starting in September, FreedomFi began shipping the first batch of compatible gateways to consumers across the US with an incredible backlog of demand. By the end of 2022, FreedomFi predicts Helium 5G could span over 40,000 small cells, making it larger than many small cell networks to date.

Portfolio

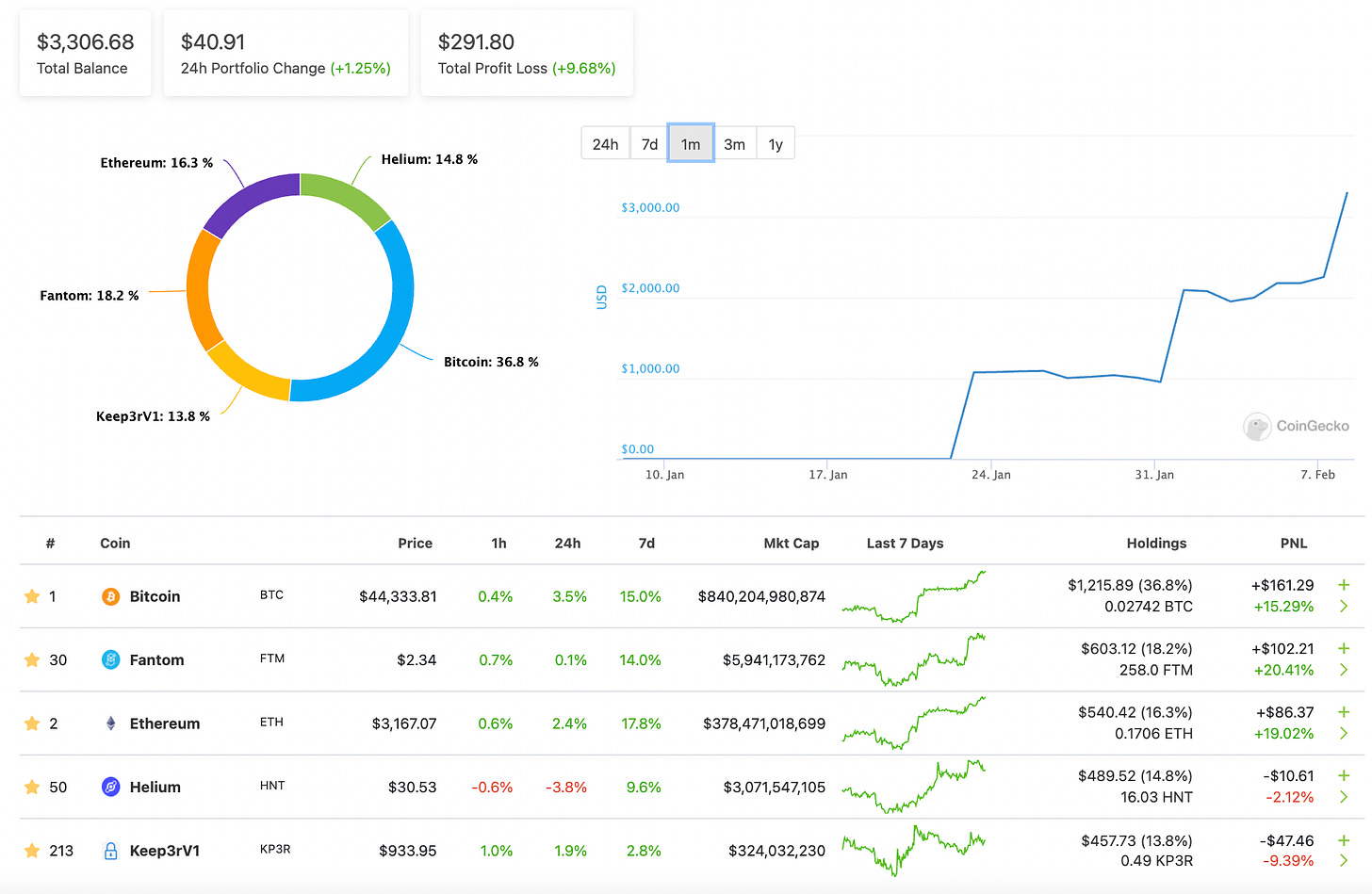

Just like 2 previous weeks, I invested another $1000, half in $BTC and $ETH, and half in a new altcoin:

$350 in Bitcoin

$150 in Ethereum

$500 in Helium ($HNT)

Snapshot of my portfolio is below. As you can see, $KP3R is still underwater, but $FNT is slightly outperforming $BTC and $ETH:

Obviously, $KP3R devs did not see my last post, so I will try again:

Previous posts:

Bitcoin news

KPMG in Canada adds Bitcoin and Ethereum to its corporate treasury

DOJ Seizes $3.6 Billion in Bitcoin Stolen in Bitfinex Hack

Key Takeaways

In spite of Helium Inc. being a very centralized operation, the HNT hotspot network and usage in 2021 has grown a lot, but last 3 months are flat

Helium is building out 5G as their second major wireless network and demand for miners is there. I am hoping the same will be true from client/user side and HNT can get more than $10k in fees per day

95% of data credit burn is done by miners, only 5% are related to usage fees. If growth of new miners stop, it will have 20x larger influence on data credit burn than actual usage of the network

P.S. Join “High-risk investments“ Telegram group for more discussions