Viventor review - will it survive 2021?

2020 has been a very tough year for Viventor - loans funded is still down close to 90% when compared to last year. How does it compare to other marketplaces? And will Viventor make it in 2021? Let’s have a look.

New owner

For those not familiar with Viventor - the platform was sold to Lotus 597 B.V. in June 2020. This created a conflict of interest, because the same party now owns both the platform and also it’s largest loan originator:

Lotus 597 B.V., a Dutch Investment company, part of the Gielen Group that also owns Atlantis Financiers NV, has obtained 100 % of the SIA ViVentor shares from the Prestamos Prima Group, which had been invested in by international investor Oleg Boyko in 2016 . The amount of the deal was not disclosed.

Viventor loan originators - financial reporting quality

I was critical of Mintos a while ago and concluded that only 50% of Mintos loan originators are audited by reputable auditors. What about Viventor? Only 3 loan originators from 18 are audited by reputable auditors. That is 16% or 3x worse.

New owner is kind of leading by example - if Atlantis Financiers cannot provide proper reports, why would any of their loan originators?

Viventor ratings - completely useless

Again, I previously was critical of Mintos ratings (and still think they are crap), but Viventor takes the rating process to new level. It sounds like a bad joke:

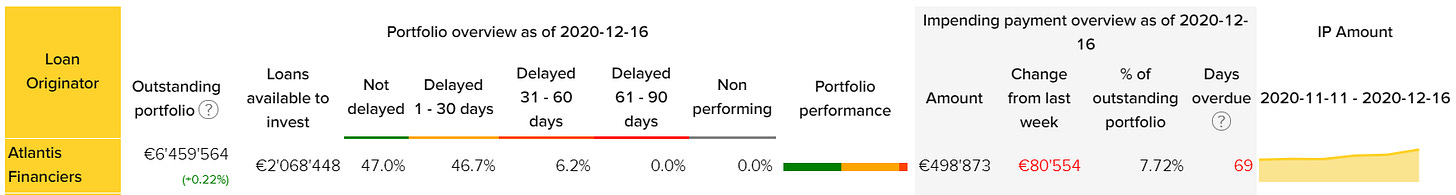

Why does Atlantis have a A credit rating, when they keep extending loans?

Loan extensions are not a reason to adjust a credit rating. Credit ratings are adjusted based on the portfolio and financial information provided by the Loan Originator. The latest Atlantis Financiers rating is according 2019 Q4 report. We are waiting for Atlantis Financiers to provide us the 2020 Q3 results so that Viventor could adjust credit rating accordingly.

Viventor is owned by same company as Atlantis, but they cannot force Atlantis to provide financial reports? Or the situation is so bad, that no one wants to look at them?

At the same time Atlantis is not paying back investors, it is not suspended, and there are no payment plans in place:

This is a good example why investors should be careful, when the same party owns not only platform, but also issues loans on it. No accountability and high risk for investors to turn into bag holders.

Volume: 2019 vs 2020

Some P2P platforms were hit hard this year in March, April and later somewhat recovered, but that does not seem to be case with Viventor. In November 2020 loans funded volume was down by 89% when compared to year before:

For comparison this is how other marketplaces look like:

Mintos loans funded in Nov 2020: € 92.6m (-68% vs Nov 2019)

PeerBerry loans funded in Nov 2020: € 22.3m (+37% vs Nov 2019)

IUVO Group loans funded in Nov 2020: € 4.3m (-34% vs Nov 2019)

Bondster loans funded in Nov 2020: € 1.5m (-42% vs Nov 2019)

As you can see, from 4 other marketplaces Mintos is struggling the most, but considering that they just raised € 6 551 040 in Crowdcube crowdfunding campaign, they will probably do just fine.

How was Atlantis Financiers advertised?

Email from Viventor to it’s investors, sent Aug 18, 2017:

Atlantis Financiers offer invoice financing solutions with Advance Rate between 30% and 80% (percentage of invoice paid out by the factoring company up front). Moreover, every single deal has been insured with such trusted insurance companies as Euler Hermes (member of Allianz Group) or Atradius.

Given the levels of Advance Rate, insurance and Buyback Guarantee provided, investments in invoices factored by Atlantis Financiers are very conservative.

Looks good, right? Buyback, every single deal insured, very conservative.

What happened to the insurance?

In a FAQ sent by Viventor on Dec 22, 2020 there is a following explanation:

How does the Atradius insurance works?

Depending on the credit risk, attached to the financed invoice, Atlantis might require it’s clients to insure the payments. As this increases cost and reduces profitability, this is assessed on a case-to-case basis.

And when an investor asked about the promise that every loan should be insured, here is Viventor’s response:

Currently, some of the invoice financing loans are insured with Atradius Insurance based on Atlantis credit risk for their clients. Atlantis is not using invoice insurance for every client at the moment.

Again, no accountability.

Insane discounts on secondary market

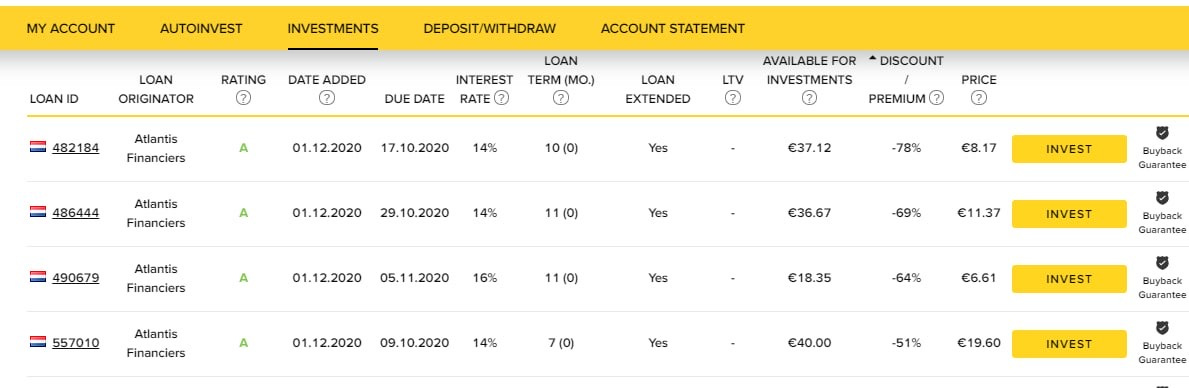

Maybe now situation is better, but a month ago this was shared in Telegram by Bulldog P2P:

This is an image of the secondary market at Viventor this afternoon. Atlantis Financiers at -78%. Panic is spreading. On top I got the platform balance sheet of 2019. A loss of (354,785). It might mean the end.

A rated loans sold at -50% to -78% probably gives a good picture of how much trust is left from investors side. Does not look good.

Update @ 18:25

Some changes in management are happening:

Comment from Bulldog P2P:

What actually happened at Viventor? The CEO and the CFO clashed with Atlantis Financiers. A couple of days later the liaison officer for the LO's left also. A ship without captain atm.

And some research done by Bulldog P2P, who left Viventor already in April 2020:

Why I get the creeps of Atlantis Financiers.

Out of the evaluation of dd 14.04.2020-18.04.2020

#1.Presentation of the Firm

I recall in the spring of 2019 Atlantis Financiers was presented as a more than 100 year old firm. It is a pity that I have not saved this presentation at the time, but it should be easy enough to look it up in your own files. Actually, the presentation of the firm says something totally different:

"We are established in 2013 and have experienced tremendous growth since 2017"

#2.Balance Sheet Atlantis Financiers

In the 3QBalance Sheet 2019 there is an item:

Receivables from related companies

----------------------------------

Receivables current account Paylex Curacao

Receivables current account Silver Payment Solutions B.V.

Receivables current account LG Investments B.V.

Receivables current account Krediet Expert B.V.

All Firms, except Paylex Curacao, are based on the address of Atlantis Financiers.

The only trace in the Dutch Register of Palex Curacao is, that it has been liquidated some two years ago. Why does it still appear in the 3Q Balance Sheet?

Who is "decorating" this balance sheet?

#3.Low buying rate of the offered Loans

I was remarkable at that time that the Atlantis Financiers offered loans, were only bought for 10% during weeks, notwithstanding 16% was offered. Coincidence? Covid-19? Perhaps.

#4.Reinsurers

In the Netherlands the finance reinsurers were in the press about limiting their exposure to new contracts. They didn't take on new costumers and increased unilaterally the tarifs for new contracts. In the video clip with the CEO of Atlantis Financiers, there was no problem, "MOST of the loans were reinsured".

In Dutch, we have a proverb:Shepherd, be sure you know the condition of your flocks.

Clear enough?

Key Takeways

Viventor is in a bad shape, not sure it will recover in 2021

Quality of loan originator reporting is much worse than in Mintos

Huge conflict of interest between platform owner and largest loan originator

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

There are news concerning the originator CBC (formerly KFP). Iuvo started legal actions against them. Insolvency proceedings might start soon. I add the mail, it's in German.

https://mailchi.mp/f8708f715bc0/durchbruch-im-fall-cbckfp-1669726?e=7fe98f73ee