TFG Crowd - too good to be true?

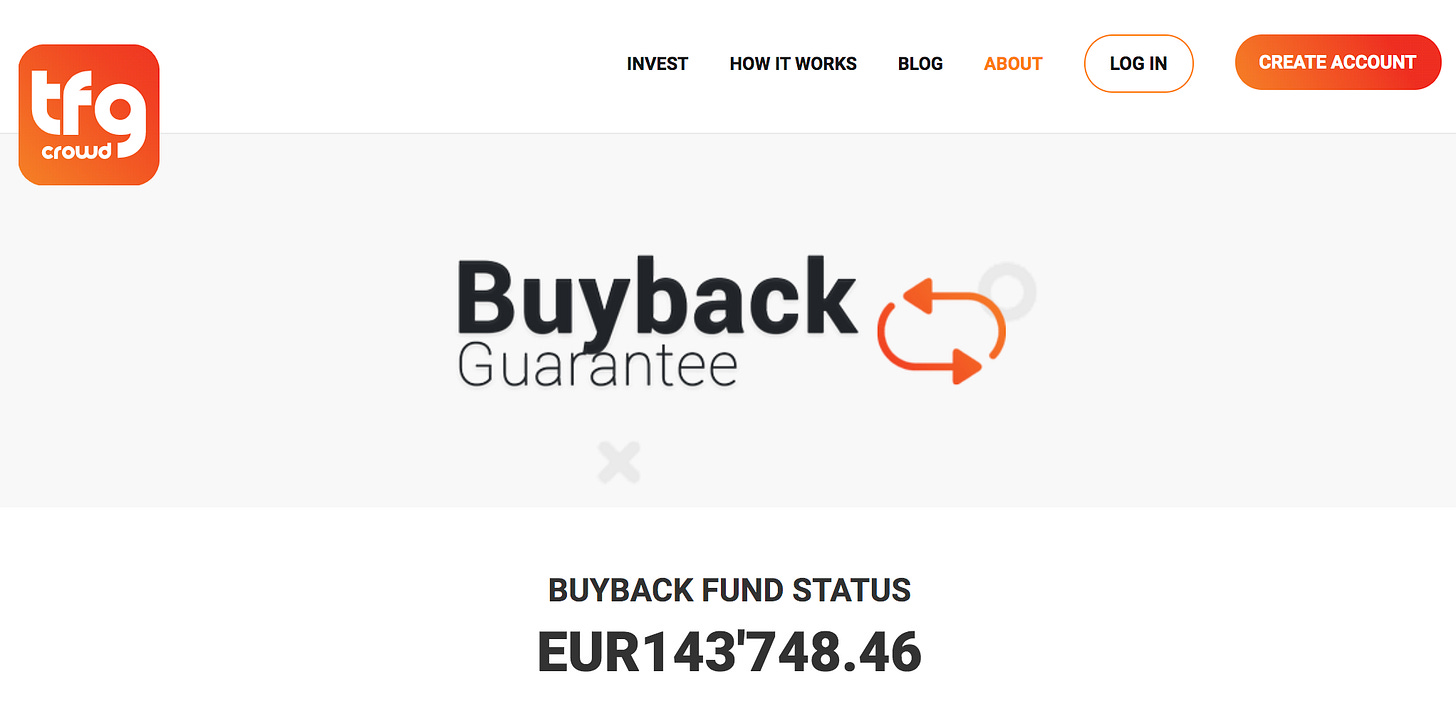

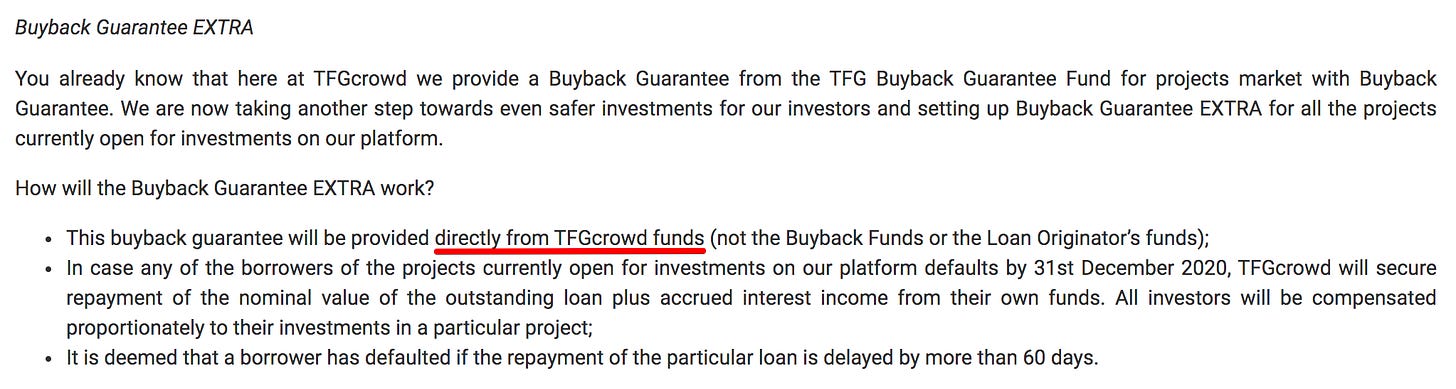

Only couple of days ago I had no idea this P2P platform even existed. But a Facebook post by Julien Hamon got me interested. The post was about TFG Crowd and their strange BuyBack Guarantee. So how does it work?

Buyback Guarantee

At a basic level they claim to have a special fund with 143.7k EUR that would be used if any project fails:

In case any of the borrowers of the projects marked with our Buyback Guarantee are subject to default, the monies held in the TFG Buyback Guarantee Fund will be used to secure repayment of the nominal value of the outstanding loan plus accrued interest income. All investors will be compensated proportionately to their investments in a particular project.

So far nothing too strange except that the fund is very small. One failed project could wipe it out and make this buyback promise worthless for all other projects. But the interesting part is their additional promise on top.

Buyback Guarantee EXTRA

In short - don't worry, whatever happens to any project, we will cover all losses. To me that sounds too good to be true and reminds of these platforms:

Kuetzal - promised an early exit option and a buyback guarantee with no backing, but idea that CEO would personally pay for it. CEO was changed, platform shut down, team disappeared.

Envestio - promised an early exit option and a buyback guarantee. CEO was changed, platform shut down, team disappeared.

Monethera - promised an early exit option and a buyback guarantee. Early exit option is paused, buyback guarantee is a joke, deposit account disabled.

Wisefund - promised an early exit option and a buyback guarantee. Early exit option is paused, buyback guarantee is a joke.

FastInvest - promises an early exit option and a buyback guarantee. Has issues with banks and keeps changing accounts, but promises are not broken yet.

So of course I was very interested when Julien and other investors wanted to get more details about the magical TFG Crowd BuyBack Guarantee EXTRA:

Which entity does provide the guarantee EXTRA? What are the reserves of this entity to ensure it’s effectiveness?

But so far TFG Crowd support have not given any reasonable answers, and are dodging the questions by copy/pasting texts from their website.

Is BuyBack important?

At first I thought - maybe this is just some aggressive marketing and if all projects are covered with pledges, good LTV ratio and TFG Crowd has good enough reserves on their own, and can assume that even in failed projects they will recover 100% of funds, then maybe, just maybe it could make sense - as a smaller platform to temporary take more risk on themselves in exchange for bigger trust from investors.

So I tried to check out some of their projects and find out, if sufficient collateral is provided?

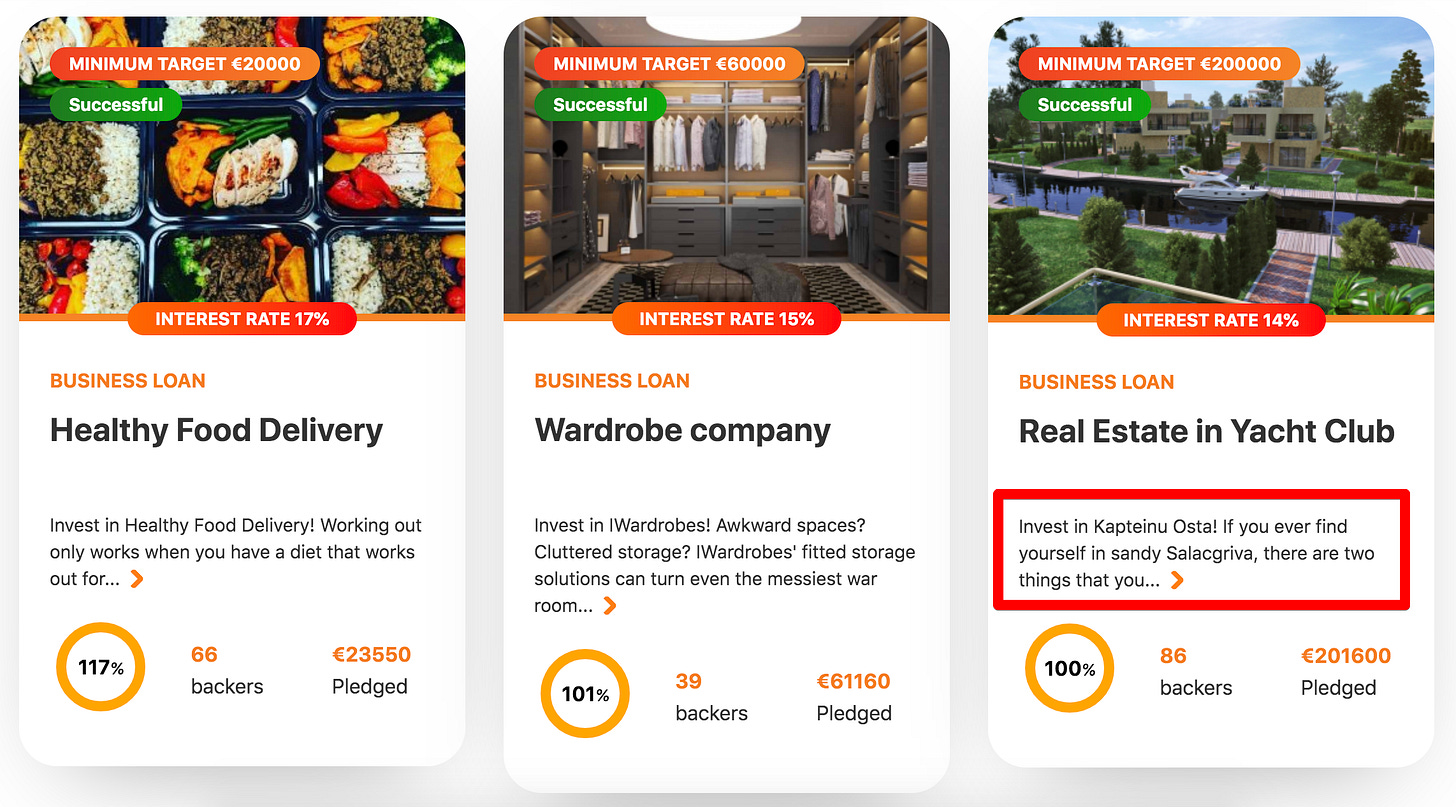

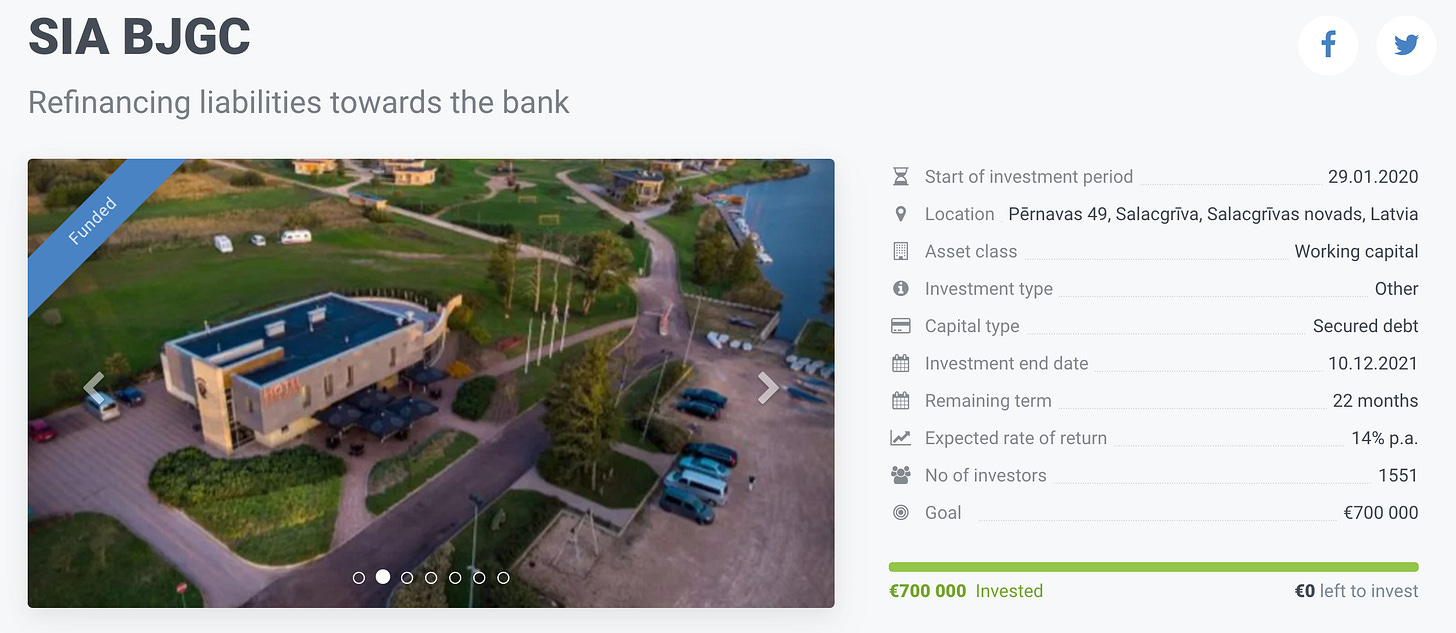

Project #1: Real Estate in Yacht Club

Could not get a lot of info from TFG website. Reminds me of the same “transparency“ policy as it was seen in Envestio - after project is funded, all the details are hidden.

86 people invested €201 600 in a “real estate in yacht club“, but no location is mentioned and even the picture in background looks like a 3D visualisation:

Hard to get answers to questions like:

Where is this real estate located?

Are there any guarantees provided? Pledges on other properties?

Can I see an appraisal report?

Who owns/manages the property?

What is the business plan? How will investors get their money back?

At first I tried TFG online chat to get some answers, but no one replied at all and seeing as they respond to investor emails only one week later, I did some research on my own.

I checked web.archive.org and found a snapshot of TFG Crowd site in November 2019 where this project had at least the name of location mentioned - “Kapteiņu osta, Salacgriva“:

There is only one place with such a distinct name and you can find all about them on their website: www.kapteinuosta.lv and there is also a link to their development plans - bgs.art3d.ru - where you can even see that same 3D visualisation used in campaign:

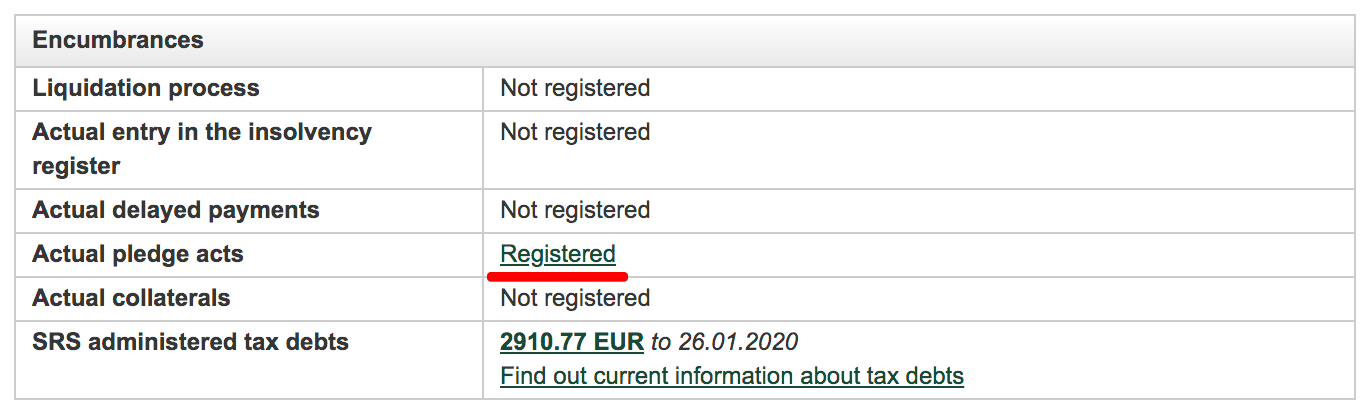

So the location is clear, what about guarantees? I checked the company named on website: SIA "KAPTEINU OSTA" - and yes, a pledge is registered:

But only a small issue - it was registered on January 15th, 2020 and to “CROWDESTATE COLLATERAL AGENT OU“ - a completely different P2P platform.

The CrowdEstate project looks like this:

In short - SIA BJGC raised €700 000 from CrowdEstate and provided many collaterals, including everything related to SIA Kapteiņu osta:

The loan is secured by a commercial pledge on 71,65% capital shares of BJGC owned by Jānis Tērauds through SPV SIA Kuiviži Marine and fixed assets of BJGC, including ships registered in ship register. As well as the mortgage on affiliate company’s real estate in value of 1 660 000 EUR and personal guarantee of Jānis Tērauds in the amount of 200 000 EUR, and commercial pledge on SIA Kapteiņu osta capital shares and assets.

So what about TFG Crowd? Maybe they had an active pledge before? At least I could not find it:

If all Kapteinu Osta SIA shares and assets are pledged to a different P2P platform, then is there any collateral at all? Is the project even real?

Projects #2 and #3: Wardrobe company

Wardrobe company raised €61 160 EUR in their first campaign and lucky for me I found some info about it in TFG Crowd blog:

Now a growth stage company that receives business from across London, it’s now looking into expanding its advertising abilities to maximize their reach.

And I received the project description of second €111 390k EUR campaign from an TFG investor. The interesting part and goal of second campaign is here:

Wardrobes is currently looking to bolster its working capital and has partnered with TFGcrowd toward that end. Specifically, they are looking to increase their ability to advertise beyond social media marketing, which is their sole means of advertising at the moment.

What? So the first 60k EUR were spent without any return? Because otherwise - if the business is doing good and the first 60k EUR helped to get more clients, why is not the profit used to buy more ads? But instead taking another loan and twice as big?

This seems very suspicious to me - second loan is given for the same purpose. If first loan would have been repaid, that could make some sense, but now? The risk for investors has just increased and in total they have “invested“ €172 550 to be spent on advertising.

What about guarantees? In project description we can find following:

The following pledges secure the loan:

A pledge on IWardrobes company;

Personal guarantee of the Borrowers’ shareholders & CEO;

A guarantee of the Borrower in writing

But none of these pledges were added as files that investors could verify. Not even company name or website is mentioned anywhere in the description. I tried finding a company with name “IWardrobes“, but no luck.

Ok, found their website: www.iwardrobes.co.uk - but again, company name is not mentioned anywhere, only phone number and address. Tried googling their phone number, and finally got somewhere. Turns out:

There is also a kitchen business with same phone number: www.ikitchens.uk

There is a business listing with this phone number, company name: Intelligent Furniture Limited

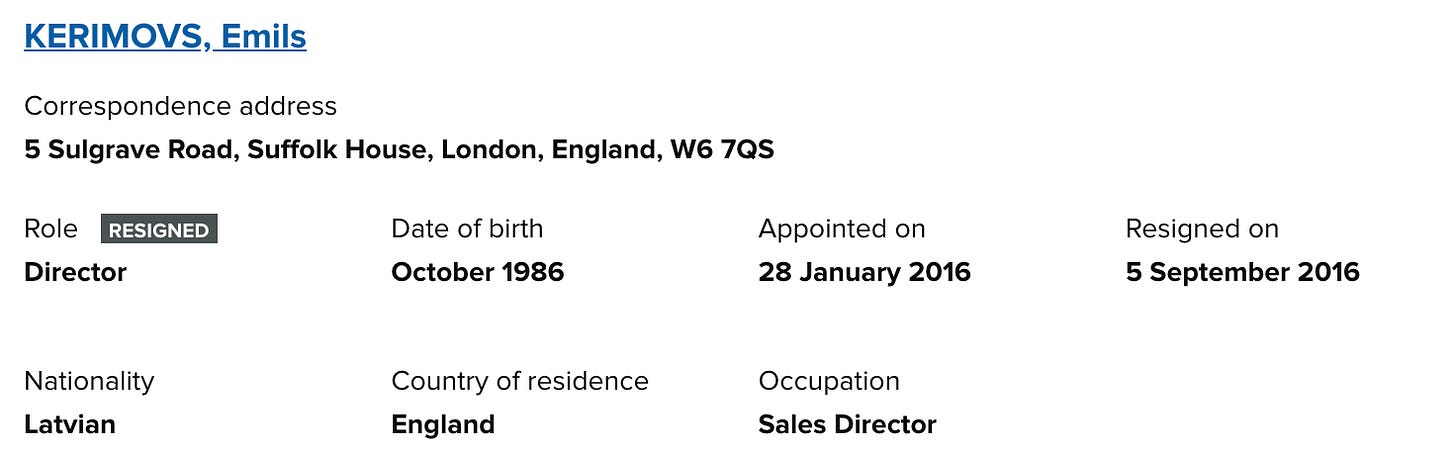

So what is behind the Intelligent Furniture Limited? Turns out - company name was changed 2 times, and now it is called INTER SOLUTIONS GROUP LTD

But the most interesting part in the end - who can we find among previous company directors?

Who is Emils Kerimovs? The current CEO of TFG Crowd. This raises some questions. In the blog post about Furniture company it was written:

Romans Gluhovskis, founder and owner of IWardrobes

So Romans Gluhovskis, who is described as founder and owner - was appointed as a director on the same date as Emils was terminated.

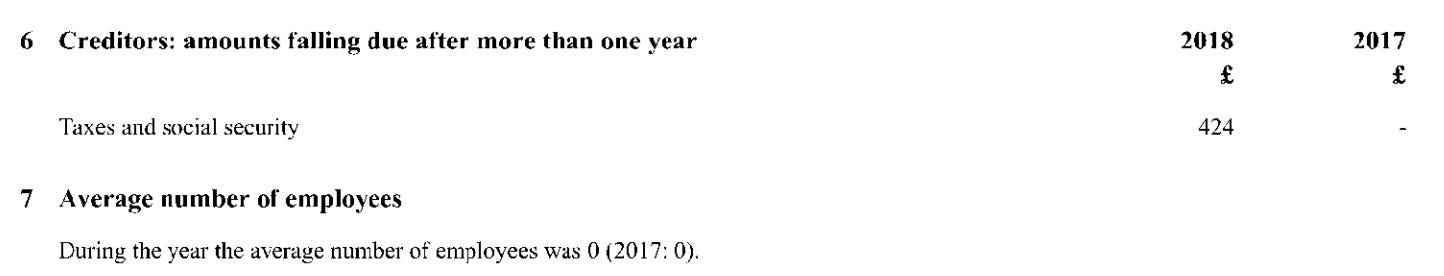

And from Company House register we can also find, how fast this company was growing in 2017 and 2018:

So total assets on 30 November, 2018 were £3 613 - this is not what I would like to see for a company that asks for €172 550 to do ads, and is operating 2 businesses - iWardrobes and iKitchens.

Someone might think - OK, but this is old data. Maybe in 2019 there was high growth? It could be possible, but if there were 0 employees in 2017, and the same in 2018, from where would this growth come from?

I cannot believe this will end well for investors. Guarantees or not, this just does not make any sense to me. Company with no employees and €4k EUR in assets raising €170k for ads? What can go wrong?

Project #4: Modern Compact Houses

This was another project with not much info on website, but I got it’s description from an investor. The main idea behind €150k loan is here:

The Real Estate company in Latvia has recently secured the rights to build three compact houses in Jurmala. At the moment, they have their sights set on developing these houses as tourist cottages, which are expected to generate cash flow.

The project is set to be launched in two phases, and this marks the first phase of the project.

What about guarantees? None of them were added as files, but this is promised:

The following pledges secure the loan:

A pledge on the real estate company;

Personal guarantee of the Borrowers' shareholders & CEO;

A guarantee of the Borrower in writing

Seems like a copy/paste text - already seen in the Wardrobe project. But in this case also the company name was mentioned in the project: ARI Co SIA

So it was easy to check, if there are any pledges on the real estate company:

Not registered? So at least in this case - it is clear that either false info was provided to investors or Lursoft database is not working. Which is more likely?

But for those, who might want to ask questions to TFG support, consider these:

Can you provide proof of pledges and rights to build mentioned in description?

Where will these houses built?

Does the company own the land on which they will be built?

When will the construction start?

What works are planned in 1st phase, what in 2nd? How much money is needed for 2nd phase?

Can investors visit the construction site?

Projects #5,#6,#7: Real Estate in Cambridge and London

Information about previously funded projects in Cambridge and London are hidden, but TFG Crowd blog comes to the rescue again:

LEKS Group, Ltd., an up and coming Real Estate Holdings Company in the UK, knows how the real estate game is played and intends to start strong by launching two real estate crowdfunding campaigns side by side on TFGcrowd.

So a company called LEKS Group got 2 loans funded already and is now raising money again for a 3rd property in Paddington:

At this point LEKS Group has raised already €768 880 - and if the 3rd project is as successful as first two, then this number might go up to €1 million. Sounds like a good partnership and if we can believe the blog - it was just a coincidence that LEKS Group found TFGCrowd. And it is also a bit surprising that TFG Crowd accepted to run 2 projects from a new partner at the same time:

To be honest, when reading the project description - and seeing that TFG Crowd is investing themselves 20% of capital needed, I found it hard to believe that this LEKS Group is just some random company with no relationship to TFG Crowd.

But first lets check about the guarantees:

The following pledges secure the loan:

• A pledge on the Real Estate Company

• A personal guarantee of the Borrower’s Shareholders & CEO

• A Guarantee of the Borrower

What is missing? The most important part - pledge on any real estate properties. 2 projects are funded, 2 properties should have been bought, but no pledges on them? But OK, let’s have a look at the company - LEKS Group. So according to blog the CEO is Sergejs Glanenko and in Company House he still is as the only Director of the company, but what about the shareholders? Well, recently there was a change:

This company has only 1 share and on 3rd October, 2019 it was transferred from Sergejs to The Finance Group Limited. And who is behind The Finance Group Limited? Emils Kerimovs, CEO of TFG Crowd.

And what about the previous director - Aleksandrs Gluhovskis? Well, he is now the director of already mentioned Wardrobe company.

In short - looks like a big mess and many if not most of the projects funded in platform are closely connected or owned by TFG Crowd. Real estate project is the best example:

So Emils is at the same filling out these roles:

CEO of TFG Crowd: providing 3 loans to LEKS Group

Owner of Finance Group Limited, which in turn owns LEKS Group

There should be a pledge from LEKS Group to TFG Crowd

There should be a a personal guarantee from Emils to TFG Crowd

In short - Emils is giving out 3 loans to himself and possibly providing guarantees to himself as well.

Key takeaways

Hard to verify if projects are even real

No proof of guarantees or pledges

Huge mess with ownership

Want to get access to exclusive content? Become a paid subscriber:

Or join “High-risk investments“ Telegram group for an informal discussion.

Together we can make a difference TFGcrowd don't fool us

Dear investors TFGcrowd is not a trustworthy company to invest and there are many delays and failures in processing payments. I am not the only person who has had problems with this platform, so I suggest that all those affected join forces on ,,Telegram TFGcrowd,, to discuss this situation that has arisen Greetings

I invested with them in this project. Do you if there is any action I can take against them bc I really need my money back. I’m 8 months pregnant and counting with this money.