Portfolio update, October 2020

Five months ago I started an investing experiment to see if I can create an “all weather portfolio” that would perform well in different market conditions, and at the same time beat S&P 500 index and Warrent Buffett’s Berkshire Hathaway.

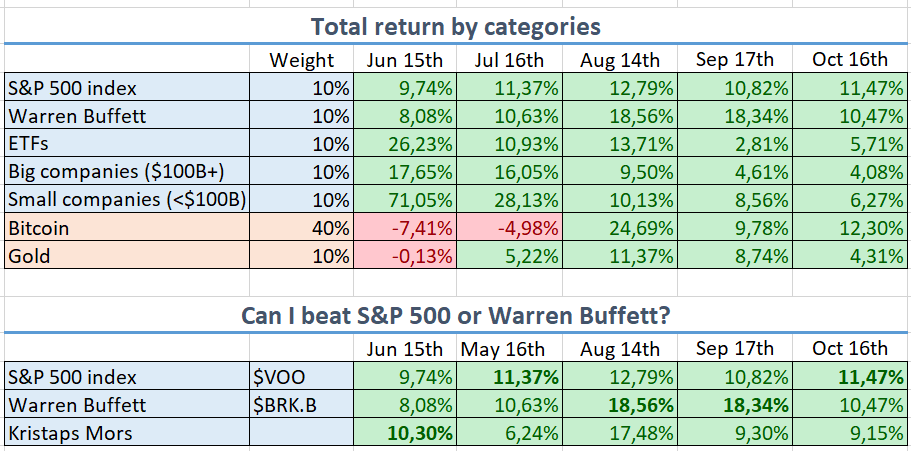

So how is my portfolio performing so far? September was the first “red“ month when it lost 5.65% of value, but overall annual return is still above 20%:

Did I beat S&P 500 or Warren Buffett?

Since starting this experiment, situation has changed all the time, but overall my portfolio is underperforming both S&P 500 and Warren Buffett in last 4 months, so I have some catching up to do:

What are my September stock picks?

I followed the same rules described in first post about this experiment and in September I invested another $2k, so $1.4k or 70% went to:

10% in $VOO (Vanguard 500 Index Fund)

10% in $BRK.B (Berkshire Hathaway Inc. Class B)

10% in $GLD (ETF to invest in physical gold)

40% in Bitcoin

And the rest $600 were split evenly among these stocks:

What are my October stock picks?

$1400 were invested as usual. And the rest $600 were split among these stocks:

ETF: $GDX, Gold Miners ETF

Small company: $LLOY.L, Lloyds Banking Group

Big company: $XOM, Exxon Mobil Corporation

Reasons behind my portfolio selection

I did not spend much time when deciding about the new positions, but the main idea was to get more exposore to tech/e-commerce ($QQQ, $BABA), and invest in companies that have already suffered big losses, but should do fine in long term. So that is why I picked up more big oil companies ($BP.L, $XOM) and another bank ($LLOY.L).

The only exception was $GDX - an ETF that covers gold mining companies. It already has increased in value a lot in last year, but if the money printing continues and I expect it will, then gold, bitcoin and gold mining companies should do well in next couple of years.

All investments made during this experiment

If you want to read more about this investing experiment from beginning, check out previous posts:

Or you can see all investments made during this experiment:

An overview of total portfolio value, and how it changes each month:

If you want to follow my portfolio for this experiment, you can do it here.

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Hi Kristaps, I joined you on eToro a while ago but now I decided to quit the platform because of this https://imgur.com/a/VPZYvce :(