Is Bondora the future of P2P?

Bondora is one of the oldest and largest P2P platforms - they claim to have 131 827 investors, who have invested over €378M and earned €47M. If you trust Bondora, average net return is 9.8%. What is the real return? Let’s find out.

My experience with Bondora

I have never invested in Bondora, so I cannot report any profit or losses myself. 3 years ago I had a quick look at Bondora, but investing there did not make sense for me, mainly because of following reasons:

Returns were lower or at best - similar to other P2P platforms

Risk seemed much higher: no buyback guarantees

Platform takes no risk, not aligned with investor interests

Here is my comment from May 2017:

I have not done any tests with Bondora, because their loans don’t have guaranteed buybacks. If the largest P2P platform in the world has done some shady stuff, I would not be suprised if smaller platforms repeat similar actions. For this kind of platform to make money, they need lot of loans to be funded and that might motivate platform owners to “improve” their loan scoring models and make everything look much better than it is, specially – if they don’t take any risk themselves.

So I am staying away from Bondora and would not recommend to invest there. Even if I trusted their management completely, it just does not make any sense to get 10% return they promise if I can get the same results from other P2P companies but with additional buyback guarantee.

Source: Would I invest 127k EUR in P2P platforms like Bondora, Mintos, Twino?

Has anything improved in last 3 years?

Not much. Bondora launched Go & Grow product with a promise of 6.75% return and instant liquidity, but when Covid hit, investors learned that “take your cash out at any time“ can mean “wait up to 2 months“.

OK, I must admit, one thing has improved a lot - the profitability:

From 2018, Bondora increased its revenue from €10.3 million to over €20.3 million in 2019—a 96% increase. In even more impressive growth, net profits grew by 2,184% to €2.3 million.

So if Bondora is doing so well - making 2 million in profit, then investors are having good results as well, right? Depends, who you ask. According to Bondora expected return is from 10 to 14%:

What is the real return?

If you ask P2P bloggers, who have tried to verify Bondora’s claims about expected return, situation looks a bit different:

I strongly recommend to read these 2 blog posts:

Bondora: In search of promised returns, invertirmisahorros.es, 03.05.2020

Bondora Portfolio Profitability Revisited, rahafoorum.ee, 04.08.2020

Here are best parts about historic return:

With the exception of the 60-month loans in Estonia that may become profitable, the rest of the portfolios (these 6 portfolios analyzed represent 93.1% of the loans issued in 2019, 87.7% of the issued in 2018 and 86.2% of those issued in 2017) are unlikely to achieve positive profitability.

The big question after all this analysis is, if we cannot trust the return that Bondora gives, what is the current real return of the portfolio?

In the event of provisioning for loans that are overdue for more than 180 days, portfolios from 2015 to 2018 would have a negative return of between -5% (2015) and -16% (2017). The 2018 portfolio would already have a negative return of -8% and 2019 would still be positive because the loans are still young and there has not been time to accumulate 180 days of delay.

If we provision for loans that are overdue for more than 60 days (the date on which the guarantee jumps on other platforms) we see that the profitability of the most mature portfolios (2013-2017) barely moves with respect to the previous scenario while the profitability of the younger people would continue to decline.

Source: invertirmisahorros.es

What about Bondora’s ratings and max expected loss?

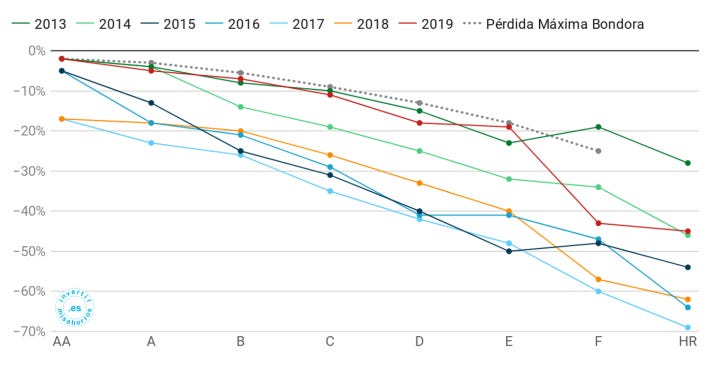

Bondora announced with great fanfare the launch of the ratings in 2014 and in 2015 they published an entry on blog showing how they were meeting the maximum loss they had calculated. From then on, they have never written a similar entry again, since in all years and for all ratings they have had greater losses (provision from 60 days late) than the maximums they estimated.

In the meantime, they have continued to issue longer-term loans to inflate short-term returns and to be able to continue saying that "The profitability of the most recent years is above the target return.

Source: invertirmisahorros.es

How is that possible?

How can Bondora claim that they have generated 40+ million in profit for their investors, but some of them refuse to believe it? Turns out, you can achieve quite a lot with some creative accounting:

You probably have seen this Bondora portfolio profitability table, if you have visited Bondora’s statistics page.

While interesting, this table uses Bondora’s creative way to account for overdue principal. In other words, for anything but the very old defaults, it barely accounts for overdues.

Source: rahafoorum.ee

Bondora’s math and policy how to calculate profit for investors does not make any sense. Investors might see profit estimates in the beginning, but when they stop investing and wait until the loans reach maturity, the profit will most likely disappear.

So what is the correct way how to calculate real return? Taavi tried doing calculations based on Bondora's own write-down policy that is used in their annual reports. And what a surprising result:

Turns out that using Bondora’s write-down policy, the whole portfolio issued since 2009, is about -€2.6 million in loss, instead of €46 million in profit.

Although it may initially seem that the F and HR ratings are causing the loss, this is actually not the case. Loss is simply driven by non-Estonian markets where the volume of F and HR is higher.

The only profitable market has been the Estonian market. For every other market every single Rating has given investors a loss so far.

Source: rahafoorum.ee

It basically confirms the same calculations done by invertirmisahorros.es - Bondora’s portfolio is in a bad shape, and to get any profit, you really have to be lucky. Or a shareholder of Bondora.

What about other platforms?

Bondora is not the only P2P platform using shady accounting to present their own distorted version of reality, but in Bondora’s defense - anyone can take their loan book, analyze it and come to his/her own conclusions.

The sad situation with P2P - except Mintos, all other platforms have very limited or no ability to export loan data. Some platforms go even further in other direction - limit access to info only to project investors and hide all info as soon as project/loan is funded.

If Bondora is “successfully“ losing investor money for 10+ years, while generating profit for themselves, and doing that by sharing all loan data, can we expect that other platforms will behave better? Probably not.

Key takeaways

Bondora’s portfolio issued since 2009, is about -€2.6 million in loss, so average Bondora’s investor is losing money and instead of +10% has negative return.

Bondora is kicking can down the road by issuing longer term loans

If platform uses creative accounting, it can take many years for investors to notice that platform’s promises and calculations don't match with reality

Expect other P2P platforms to repeat the same business model

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

You forgot to mention that Bondora manages to do this by paying the highest referral bonus out of every platform ever - even higher than the scam platforms.

Lars Wrobbel earns 5% commission from every new customer he refers to Bondora and so he promotes go and grow like crazy. He has 100,000 page views per month from German visitors.

Can you imagine how much that earns him if Jorgen can make €20k in a month promoting scams with ‘only’ 2.5% commission to just 10,000 page views per month...

Invested in bondora since summer 2015. In Feb 2020 sold everything to g&g and exited just before they put restrictions on g&g withdrawals. Final XIRR was just above 6%

Now Į only have bondora account where my bot is looking for defaulted loans which is looking promising with 50% or higher discount. Its hard to calculate real return for this account but if i calculate portfolio value at its buy price then im getting XIRR about 100%. And thats why: Bondora dont need borrowers which are paying in time, because bondora isn't making a lot profit on them. Most profit they are making on defaulted loans. They are taking insanely 35% from each defaulted loans payment as "debt servicing cost" and i very doubt that ir all goes to bailiffs.