Investing in Somalia? What can go wrong?

In last 3 months already 4 Latvian P2P platforms have shut down. If this continues, Latvia might get famous as the P2P scam centre of Europe. But lucky for Latvia - at least the 5th shut down was from a different country - Somalia. You might ask - who invests in Somalia? Let’s find out.

The P2P platform I am talking about is called Agrikaab. When I first heard about it couple of days ago - I thought it was some kind of joke. Why? Well, just read their shut down statement:

Even without looking at the platform, just the idea about investing in Somalia seems insane to me. And I am not a very conservative investor - I would see no problem to invest in Iran, for example.

Why is it crazy to invest in Somalia?

Read the Doing Business report about Somalia. Some highlights:

Since 2015 Somalia is ranked as the last: 190th from 190 countries

For many things that normal countries require permits/procedures, Somalia don't have any practice at all

There is some kind of attempt of a tax system, but it does not work

Other interesting things about Somalia:

Sometimes tax collectors are targeted or killed in bomb explosions

Somalia is famous for their pirates

Even journalists are kidnapped:

In short - Somalia is a failed state. It is a dangerous place to visit, and the last place in the world where to do business or invest your money.

Dividends from camels? WTF?

So who were the brave guys that invested in Somalia? Couple of P2P bloggers, of course. The best story is from The Wealthy Finn, just read his review.

Let me quote some highlights:

How it works in a nutshell:

You buy a camel for its 12-month lactation period

You get 70% of profits from selling the milk until 60% return on investment

Agrikaab buys the camel back for the same price you bought it

With camels, to be eligible for dividends you must own at least 30% of the animal. The lactation period of a camel is about 12 months, so that is how long Agrikaab will pay dividends for it.

Sounds legit, right? And the returns are great, so The Wealthy Finn bought one:

I actually own a camel that I could go pick up and take with me. Back when I invested, camels had a 32% return, but now it is expected to be 20%.

So how did it end? Not good, P2P bloggers got scammed by Somalis. Or not? Wealthy Finn is still optimistic:

Agrikaab has announced they will close due to the dire economic situation, which is unfortunate. They will still try to find a buyer for my camel. Fingers crossed someone will buy her and I can recoup some of my investment...

And he is not alone. The other guy who invested in this platform? p2p-millionaire.com

How are P2P bloggers doing?

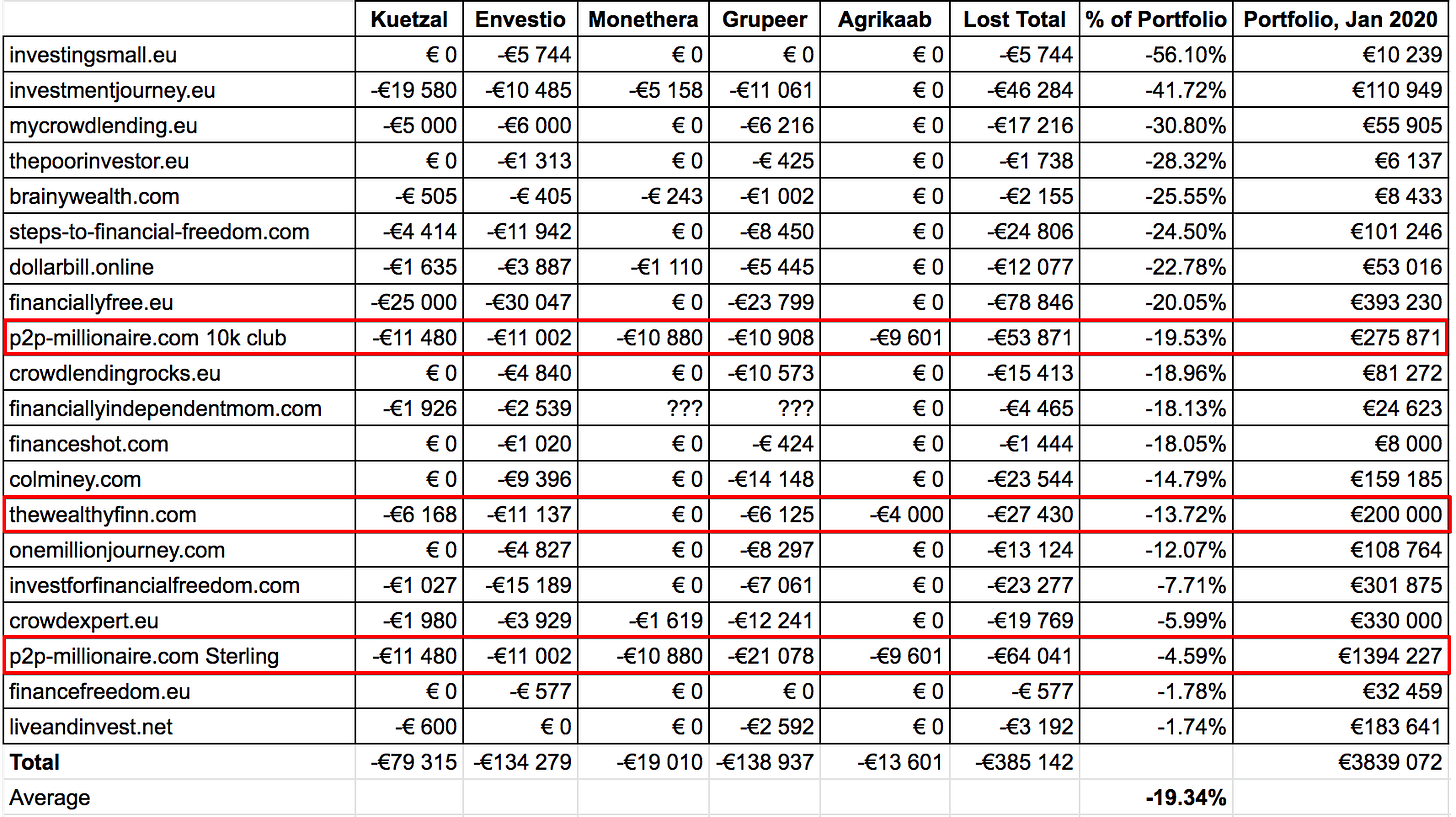

Only 2 bloggers invested in this exotic P2P platform. Wealthy Finn lost 2% of his portfolio, and p2p-millionaire.com lost only 0.68%.

Note that I've added 2 new rows in blogger table:

p2p-millionaire.com 10k club portfolio - this is a “small“/test portfolio, created with idea to invest 10k in many platforms and check performance over time

p2p-millionaire.com Sterling portfolio - this is the “big“ portfolio

An interesting thing to note - the “10k club“ portfolio is just as big disaster as the average portfolio of other P2P bloggers, both have lost on average about 20% this year.

Key takeaways

Do not invest in Somalia

Another reminder - diversification in P2P does not work

If you do crazy “investments“, spend small % of portfolio

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Amazing post!! Love it!! I don't understand why people in comment section are so negative. (Perhaps some bloggers?)

You are doing an incredible job! What I would like to see is what does a blogger earn with interest vs their affiate earnings. Their business is not P2P Investing, their business is selling affiliate Links.