Investing experiment: results after 2 months

Two months ago I started an investing experiment and during this time market has been very volatile, but overall still going up. So how is my portfolio performing so far?

On July 16th my only negative position was Bitcoin, gold was +5% and stocks were up from 5% to 50%:

Did I beat S&P 500 or Warren Buffett?

After 1st month on June 15th I was barely ahead when comparing to both benchmarks - S&P 500 Index and Warren Buffett’s Berkshire Hathaway, but after 2nd month the situation has changed - now my portfolio is underperforming:

But to be honest - I am not worried at all and expect to get ahead again. As you can see from categories - the underperforming part of my portfolio are 2 assets that should do well in near future - Bitcoin and Gold.

If anyone is interested in Bitcoin, I recommend to read following post about it: 3 Reasons I’m Investing in Bitcoin. Not everyone should have 40% of portfolio in Bitcoin like in my example, but having 2-5% can be something to consider.

What are my July stock picks?

I followed the same rules described in first post about this experiment and in July I invested another $2k, so $1.4k or 70% went to:

10% in $VOO (Vanguard 500 Index Fund)

10% in $BRK.B (Berkshire Hathaway Inc. Class B)

10% in $GLD (ETF to invest in physical gold)

40% in Bitcoin

And the rest $600 were split evenly among these stocks:

ETF: $KRE, SPDR S&P Regional Banking ETF

Small company: $AIR.PA, Airbus Group

Big company: $WFC, Wells Fargo & Co

Reasons behind my portfolio selection

As time goes on, I am more worried about the stock market in general. So many things just don't make sense and start reminding of crazyness that happened in the dot-com bubble in 1999. One example is $NKLA - it looks like a bad joke, a company that has not produced anything and describes itself in following way:

We incurred a net loss of $88.7 million for the year ended December 31, 2019 and have incurred net losses of approximately $188.5 million from our inception through December 31, 2019. We believe that we will continue to incur operating and net losses each quarter until at least the time we begin significant deliveries of our trucks, which is not expected to begin until 2021 for our Nikola Tre BEV and 2023 for our Nikola Two FCEV, and may occur later. Even if we are able to successfully develop and sell or lease our trucks, there can be no assurance that they will be commercially successful. Our potential profitability is dependent upon the successful development and successful commercial introduction and acceptance of our trucks and our hydrogen station platform, which may not occur.

Source: sec.report/Document/0001047469-20-004141/#ca70501_summary

In short - some guys are hoping to build cool trucks after couple of years, so everyone should invest in it with idea that this will be the next Tesla? According to Nikola investors - it is valued at $17.6 billion, and at one point was worth even $35 billion. To provide a context, here are valuations of some other car companies:

General Motors: $36 billion

Ferrari: $32.8 billion

Ford: $25.9 billion

Fiat Chrysler: $21.2 billion

So on one side we have car manufacturers with $100B+ revenue each year, on other hand - a startup with some ideas, and both are valued the same? How is that possible? Unless Elon Musk becomes their CEO, I have a feeling that $NKLA will end up just like Wirecard - with lot of bad news and value going to 0.

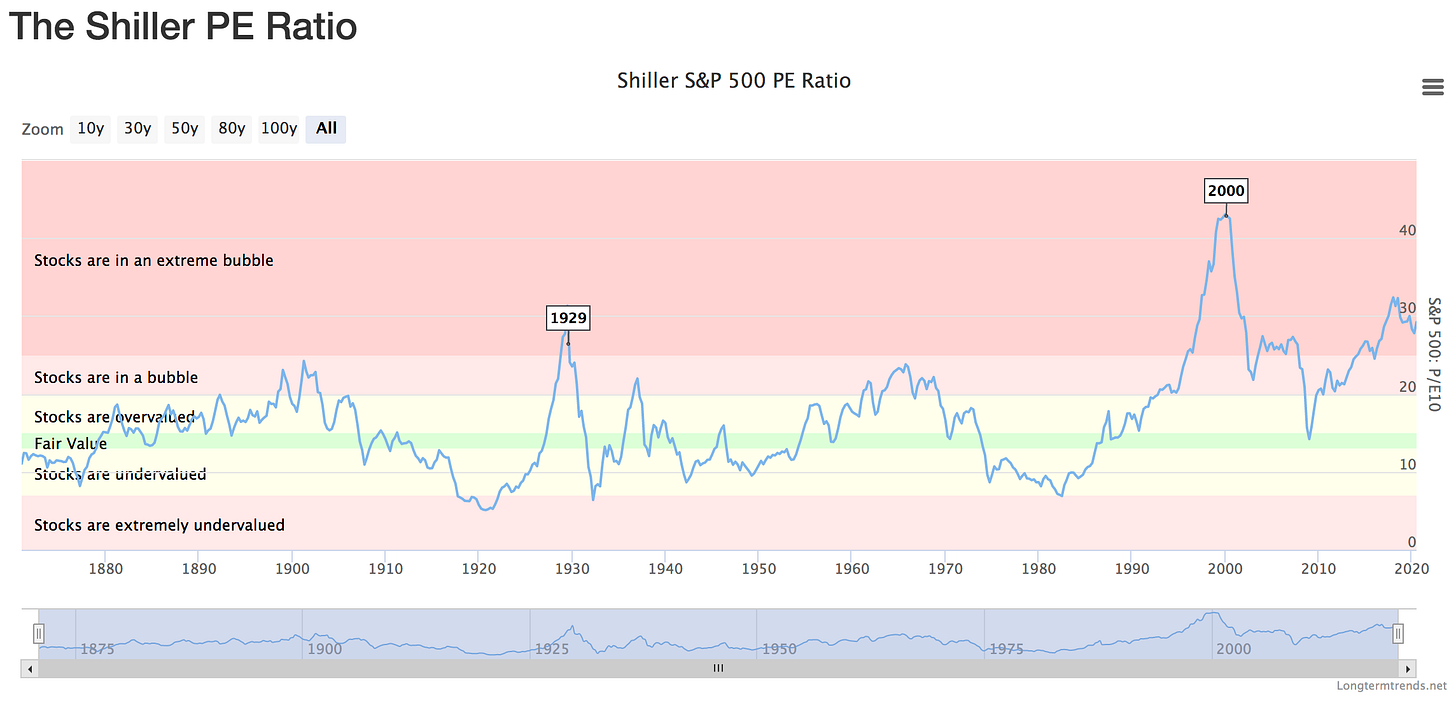

But even if we distance from one specific company, just look at couple of these charts - and ask yourself, if these numbers go together with a stock market very close to all-time highs?

Record unemployement rate in US:

Source: fred.stlouisfed.org

Covid-19: 600k deaths so far, 5k die each day, 1k from US & growing:

Source: worldometers.info/coronavirus/

Stock market in bubble according to Shiller PE Ratio:

Source: longtermtrends.net

I am worried that the next stock market crash might be around the corner, so this month stock picks are companies that have already suffered quite a lot recently. In a bad scenario they might not lose as much value as others, but if I am wrong and economy recovers fast - they might appreciate in value faster.

ETF: $KRE

KRE tracks an equal-weighted index that covers US regional banks exclusively. KRE’s regional focus combined with equal weighting produces a major bias toward mid- and small-caps, which dominate the portfolio. Still, the equal weighting reduces single stock risk in the smaller names, and helps to draw further distinctions from peers with big positions in large-cap names.

Source: etf.com/KRE

YTD Return: -37%, Yield: 3.61%, Expense Ratio: 0.35%

Banks are the “bag holders“ of all kind of toxic assets that maybe looked fine a year ago, but will produce big losses this year. This risk can be seen in the stock prices as well - most tech companies have regained their previous market valuations, but banks are still suffering. Some of them might go out of business, some will get rescued, but overall - investing in an ETF that covers 132 regional banks should provide a good diversification and hopefully also a good return later.

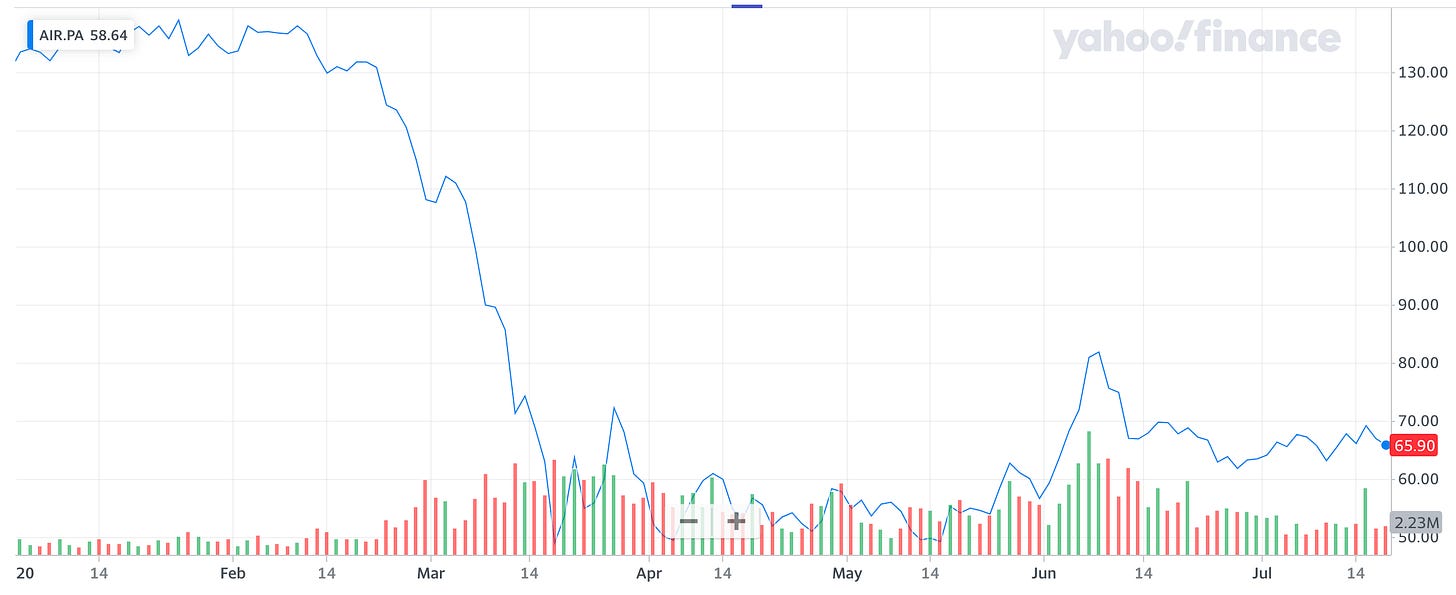

Small company: $AIR.PA

YTD Return: -50%

Investing in airlines is a big gamble - with high competition, huge fixed costs and big losses each month several airlines will go bankrupt. Even Buffett sold all his airline stocks. On other hand - many Robinhood investors are happy to take the risk and are buying airline stocks as crazy. Who will end up winning? No idea, but a bit less risky way to get exposure to same sector is companies that produce planes.

The key players here are 2: Airbus and Boeing. Taking into account that Boeing had financial and technical problems already before Covid-19 started, I decided to pick Airbus. But maybe it would make sense to buy both, so I might buy $BA as well in a different month, if the price still looks attractive.

Big company: $WFC

YTD Return: -53%

Wells Fargo is the top pick in last quarter among the so called “superinvestors“, who are using the opportunity to increase their $WFC positions, when the price is low:

Just like many other banks, it’s price has decreased by half this year, but being a $100B+ company, I would not expect that $WFC goes out of business.

And if I can buy it cheaper than Warren Buffet, then that is one way how to outperform him.

All investments made during this experiment

If you want to read more about this investing experiment from beginning, check out previous posts:

Or you can see all investments made during this experiment:

And an overview of total portfolio value, and how it changes each month:

If you want to follow my portfolio, you can do it here.

P.S. Join “High-risk investments“ Telegram group for an informal discussion.