Investing experiment: results after 3 months

Three months ago I started an investing experiment to see if I can create an “all weather portfolio” that would perform well in different market conditions, and at the same time beat S&P 500 index and Warrent Buffett’s Berkshire Hathaway.

So how is my portfolio performing so far? On Aug 14th I had 2 positions with negative return: Slack (-4.6%), Wells Fargo (-1.32%), other stocks were up from 5% to 28%, Bitcoin +24.7% and gold +11.4%.

And here you can see the performance split by calendar months as well:

All months look green so far, but the important thing is - what will happen in the next market downturn? From one side I am a bit worried what it would mean for my stock positions, from other side - I am keen to find out, if Bitcoin and Gold will be able to lessen the fall, or will everything go in one direction?

Did I beat S&P 500 or Warren Buffett?

During these 3 months situation is different each time, so obviously much more time is needed to make any conclusions:

After 1st month my portfolio was barely ahead when comparing to S&P 500 Index or Warren Buffett’s Berkshire Hathaway

After 2nd month the situation had changed - my portfolio was underperforming, mainly because of Bitcoin and Gold

After 3rd month situation has changed again - Bitcoin and Gold had a big run up, some of my stocks went down, in result I am beating S&P 500 and quite close to Buffett:

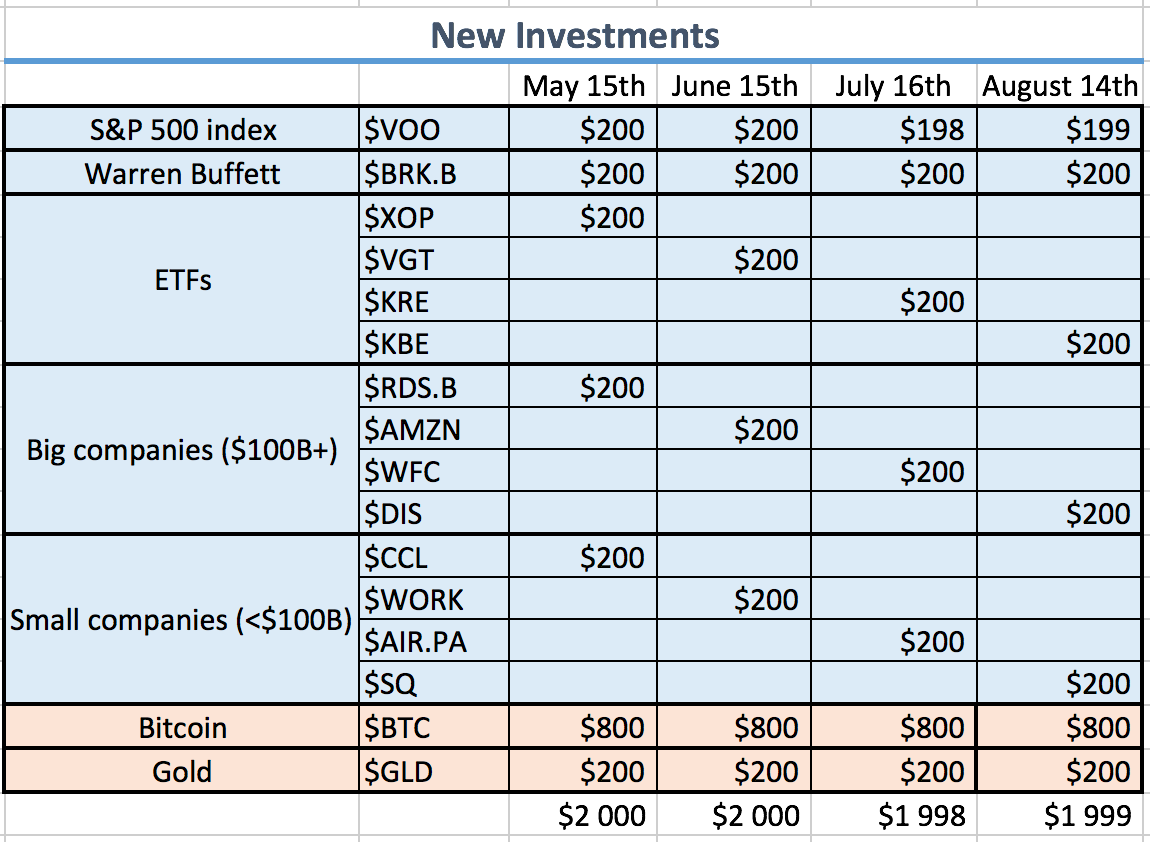

What are my August stock picks?

I followed the same rules described in first post about this experiment and in August I invested another $2k, so $1.4k or 70% went to:

10% in $VOO (Vanguard 500 Index Fund)

10% in $BRK.B (Berkshire Hathaway Inc. Class B)

10% in $GLD (ETF to invest in physical gold)

40% in Bitcoin

And the rest $600 were split evenly among these stocks:

Reasons behind my portfolio selection

ETF: $KBE

KBE tracks an equal-weighted index of US banking firms.

YTD Return: -36%, Yield: 3.29%, Expense Ratio: 0.35%

$KBE is very similar to the previously bought $KRE, there probably is some overlap in holdings, but the main difference: $KRE holdings are smaller, regional banks, but $KBE holdings are all US banks that match S&P Banks Select Industry Index.

The reason behind picking up another banking ETF is the same:

Banks are the “bag holders“ of all kind of toxic assets that maybe looked fine a year ago, but will produce big losses this year. This risk can be seen in the stock prices as well - most tech companies have regained their previous market valuations, but banks are still suffering. Some of them might go out of business, some will get rescued, but overall - investing in an ETF that covers many banks should provide a good diversification and hopefully also a good return later.

Interesting thing to note - while am I buying bank related ETFs (and also Wells Fargo last month), Warren Buffett seems to be doing the opposite:

Dumping bank shares and investing in a gold miner? It certainly doesn’t sound like a Warren Buffett move, but that’s exactly what the investing guru’s company did in the second quarter, according to a regulatory disclosure Friday. It’s not a good sign for markets.

Buffett’s Berkshire Hathaway Inc. sold 62% of its stake in JPMorgan Chase & Co. and cut 26% of its Wells Fargo & Co. holdings last period amid the Covid-19 crisis. The conglomerate also pared back positions in other financial-services firms including PNC Financial Services Group Inc., M&T Bank Corp., Bank of New York Mellon Corp., Mastercard Inc. and Visa Inc. Berkshire all but exited Goldman Sachs in the first quarte and finished the deed in the second.

Source: Warren Buffett Sours on Banks and Likes (Gulp!) Gold, Bloomberg, 15.08.2020

To me it suggests that Buffett is not very optimistic about economic recovery and probably expects lot of suffering ahead.

But instead of buying $GOLD, he should have followed MicroStrategy, who bought $250M worth of Bitcoin as Primary Treasury Reserve Asset:

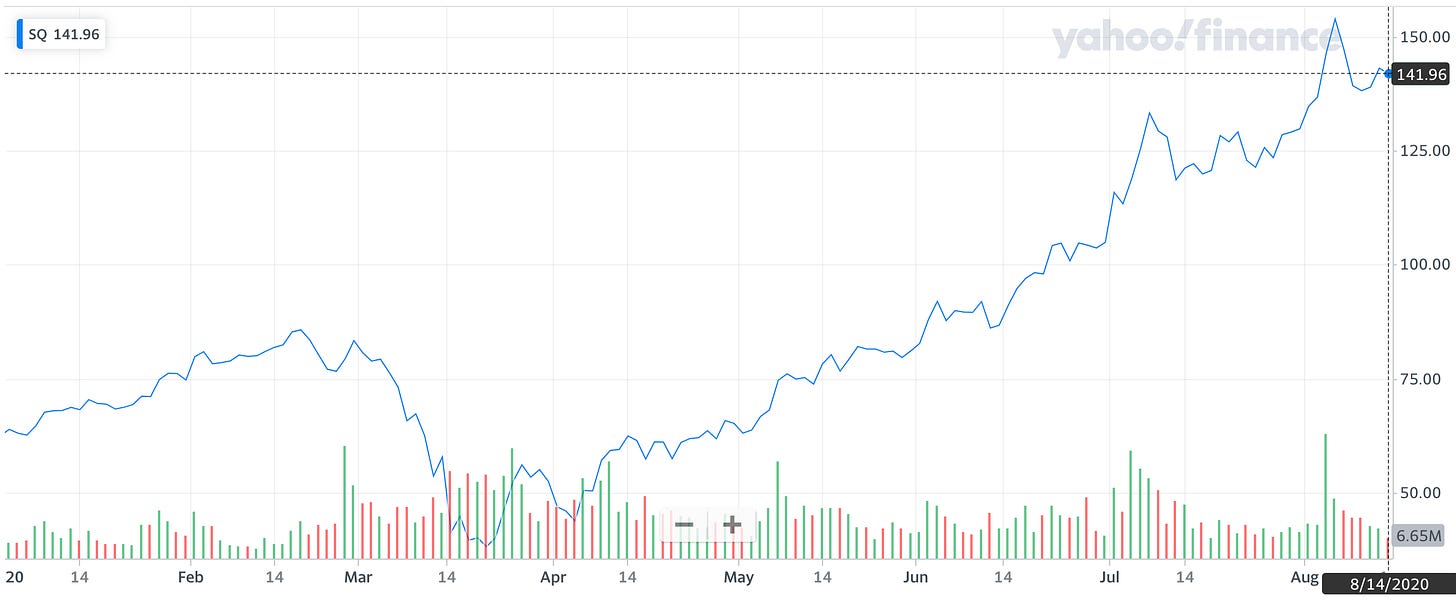

Small company: $SQ

YTD Return: +126%

Square has been on my watchlist for months, and it just keeps going up, so similar to Amazon - this is kind of a FOMO buy. I would like to have it portfolio, but don't want to wait when it gets past $100B mark in valuation.

One of the things I like about Square - it has offered it's Cash App users to buy Bitcoin since 2017, and the volume is growing quite a lot:

“Revenue made from selling bitcoin to its Cash App customers in Q2 came to a total of $875 million, six times the amount in the same period in 2019.”

And Square recently started an experiment with offering short term loans for consumers:

Cash App is starting out by offering loans for any amount between $20 and $200. You’ll be expected to pay the loan back in four weeks, along with a flat fee of 5%. (Multiplied over a year, that turns into a 60% APR — which sounds high, but at least it’s significantly lower than the average payday loan.)

Source: “Square’s Cash App tests new feature allowing users to borrow up to $200“, Techcrunch, 12.08.2020

If this feature becomes permanent, my guess is that it could provide a significant revenue boost in next couple of years.

Big company: $DIS

YTD Return: -9.7%

The Walt Disney Company from one side is suffering quite a lot:

Walt Disney Co. DIS -0.33% posted its first quarterly loss since 2001, nearly $5 billion, as the majority of its business segments reeled from government efforts to corral the coronavirus by shutting down public spaces around the world.

Source: Disney Earnings Report Reveals Rare Loss, WSJ, 04.08.2020

But from other side Covid is helping new CEO move faster:

Chapek -- less than six months after succeeding longtime CEO Bob Iger -- is using the Covid-19 crisis to transform Disney much faster than expected, all with an eye toward making the company an online juggernaut that reaches far more people worldwide.

The biggest strategic shift is unquestionably Disney’s push into online video. Company said it was removing the Disney Channel TV networks from pay-TV systems operated by Virgin Media and Sky in the U.K. and putting the programming on the new Disney+ streaming service instead.

Source: Disney’s CEO Is Scrapping Once-Sacred Businesses, Bloomberg, 12.08.2020

And their Disney+ streaming service is growing at insane speed - it was launched only at end of 2019, but already has more than 60.5 million paying subscribers!

This is one of few companies, that can be held forever.

All investments made during this experiment

If you want to read more about this investing experiment from beginning, check out previous posts:

Or you can see all investments made during this experiment:

An overview of total portfolio value, and how it changes each month:

If you want to follow my portfolio for this experiment, you can do it here.

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

To beat the stockmarket, wouldn’t it be an option to go all-in on Estateguru as the risk return ratio seems favorable..?

Thank you Kristaps for your work.

I was surprised you use eToro as investment platform. They seem to be a flat-out criminal organization, only google reviews once and you’ll see. I wouldn’t trust them with anything... do you see this differently?