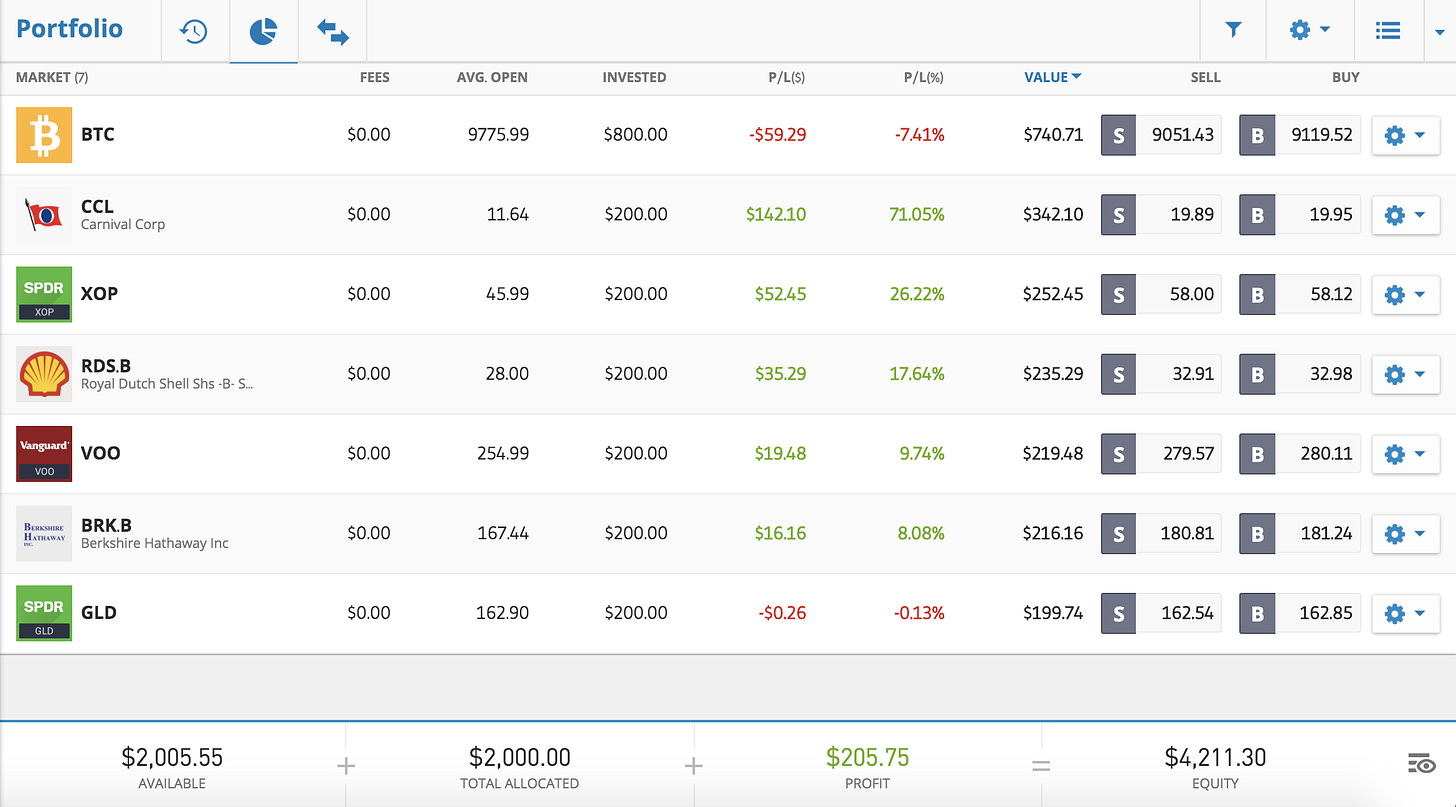

Investing experiment: results after 1 month

One month ago I started an investing experiment and during this time market has been very volatile, but overall just going up. So how is my portfolio performing so far?

On June 15th my Bitcoin position was -7.41%, gold position about the same, but stocks were up from 8% to 71%:

Did I beat S&P 500 or Warren Buffett?

Yes, but only barely. And of course - I don't think we can draw any big conclusions only after 1 month, so let’s see what will happen in 6 months or later.

But considering that stocks are only 50% of my portfolio and Bitcoin went even negative, then getting similar return to S&P 500 seems like a good sign.

My overall expectation is that Bitcoin might underperform in short term, but over longer period it should outperform other asset categories, so if my stock selection performs similar or better than benchmarks and I get upside from Bitcoin, results should be good.

On the other hand - for gold my expectation is that in long term it should underperform Bitcoin and stocks, but in next couple of months or years - if we get another stock market crash, gold should outperform stocks.

What are my June stock picks?

I followed the same rules described in first post about this experiment and in June I invested another $2k, so $1.4k or 70% went to:

10% in $VOO (Vanguard 500 Index Fund)

10% in $BRK.B (Berkshire Hathaway Inc. Class B)

10% in $GLD (ETF to invest in physical gold)

40% in Bitcoin

And the rest $600 were split evenly among these stocks:

ETF: $VGT, Vanguard Information Technology ETF

Small company: $WORK, Slack Technologies

Big company: $AMZN, Amazon.com

Questions asked in first post

Why did you opt exactly for $VOO in your portfolio - there are also other alternatives for S&P500 tracking.

There is no big difference between $VOO or others, the main thing to check when choosing: expense ratio. For example, in eToro I could invest in one of these ETFs:

$VOO, Vanguard S&P 500 ETF, 0.03% in fees per year

$IVV, iShares S&P 500 Index, 0.04% in fees per year

$SPY, SPDR S&P 500 ETF Trust, 0.0945% in fees per year

Vanguard ETFs are famous for having very low fees, and also in this case their $VOO is the cheapest one.

Why exactly S&P500 as a benchmark, have you considered other markets as well, say emerging markets or MSCI World index?

Partly, because Warren Buffett has recommended S&P 500 for an average investor, and he used S&P 500 in his bet with hedge funds. Also - the biggest US listed companies are doing business all over the world, so with S&P 500 you get the safety of US with wide exposure.

What about bond funds? Local banks in Latvia offer various investment funds - would you advice to consider them as well?

I would avoid them or when considering - really focus on fees. Usually you would need to pay bank fees + fund fees, and it can get expensive very fast, which in turn would mean lower returns in the end, even if the bonds/stocks or other assets in these funds perform good. To compare, ask 2 questions: 1) is the bank/fund manager able to outperform S&P 500 over long period of time? If so, then is it because bad performing funds were closed and you get to see only the lucky ones? Or are all their funds performing very well and have good track record? 2) what are all the fees you pay for it? Often they are hidden. And after you discount the fees, is the performance still better than S&P 500 or another benchmark that you select?

Reasons behind my portfolio selection

10% gold: $GLD

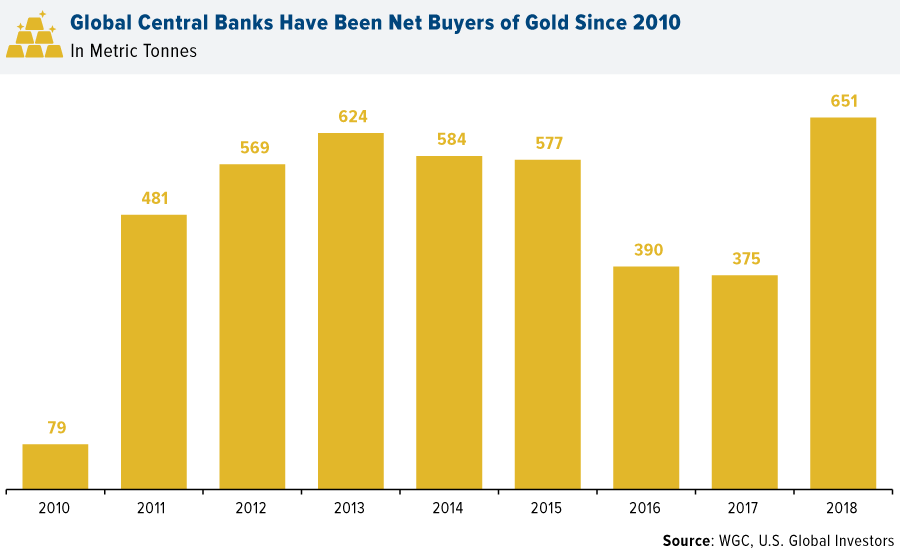

Some investors compare gold to a dumb rock, some see it as a hedge in case the financial system collapses, but whatever your view - I don't think we can ignore that most countries still have their own gold reserves - and since 2010 these reserves have just increased:

Beginning in 2010, central banks around the world turned from being net sellers of gold to net buyers of gold.

Source: www.usfunds.com

And if US, Germany and China think it is important to hold & buy more gold, a retail investor should consider it as well.

Of course, gold is not a productive asset and in long-term just a store of value, but if we look at last 15 years, then compared to top currencies - it gives an impression of actually increasing in value:

Why is gold outperforming currencies? Check what Ray Dalio has written in his Linkedin post: Paradigm Shifts, and if you read James Rickards Currency Wars, your interest in gold might increase as well.

Anyway, my view is that the insane money printing and debt bubble cannot end well. Shorting the market is very risky as part of equation is math, part is politics (FED). I have no idea when something really “bad“ will happen, but when it does, having 10% in gold should help.

40% Bitcoin: $BTC

Some investors see Bitcoin as digital version of Gold, and there are some similarities:

Limited supply: no central bank can print more gold or Bitcoin

Store of value: both gold and Bitcoin are seen as store of value

But Bitcoin has several advantages:

Easy to verify if it is “real“: if someone gives you a gold coin, how can you know if it is really made from gold? You need skills, tools and time. With Bitcoin anyone can verify transactions as they are stored in blockchain.

Hard to confiscate: in 1934 US confiscated all gold and it was a criminal offense for U.S. citizens to own or trade gold. That can repeat, but if any government would try to do the same with Bitcoin - it would get very complicated. Because you can store Bitcoin in an online exchange (bad idea), hardware wallet (better idea), your computer or a mobile phone or in extreme case - just remember the seed phrase - so you can even store it in your head.

Easy to transport: if you want to move a big amount of gold, it can get expensive and risky. Imagine a scenario, where a civil war breaks out - would you want to carry around gold coins with you while you try to escape to a safer place? And that is assuming - you can even get to your gold. Maybe it is stored in a bank vault, and banks are closed.

Transactions are irreversible: if you pay someone with Bitcoin, you can be 100% sure, that transaction will happen. No 3rd party like bank, payment processor, government or anyone else can reverse the transaction, stop it or freeze your funds. And no personal info about sender or receiver is sent with the transaction. So if you do it in a correct way, you can keep your privacy.

Pay to anyone in the world: with Bitcoin you can pay to someone in Venezuela, Iran, Somalia or wherever you need. No sanctions, no politics, no limits.

Low fees: international payments are expensive, and if you would use gold - also complicated. But with Bitcoin you will have low fees all the time no matter where the receiver is located.

Fast payments: it can take 10-30 min to pay with Bitcoin. Compare it to 1-2 weeks if you want to send money to some exotic countries outside of SEPA. Or if you want to send gold - might take even longer.

Of course, there are some disadvantages to Bitcoin as well - gold is here for thousands of years, but Bitcoin exists only since 2008. Bitcoin similar to most cryptocurrencies is very volatile: $BTC can go -40% in one day or -80% in a year, but over time with bigger adoption the volatility should decrease.

My expectation is that simlar to Gold, at some point Bitcoin will become an important part of country reserves as well. The main difference - first adopters and geeks can get Bitcoin for lower price than the big players, who will act later.

And note that total Bitcoin market cap is less than $200B, so it is a small and speculative thing when compared to other asset classes.

10% S&P 500 index ETF: $VOO

If most hedge funds cannot beat S&P 500 index, then it is very likely that I won't beat it either. In that scenario having 10% of portfolio in $VOO will just help me.

Also - I want to invest part of portfolio in $VOO to have a real benchmark to compare my overall portfolio.

10% Warren Buffett's Berkshire Hathaway: $BRK.B

In case I manage to outperform S&P 500 index, I want to have another challenge - getting better results than Warren Buffett's Berkshire Hathaway, so just like in $VOO case - I am investing 10% of my portfolio in $BRK.B to have a benchmark.

And if I cannot outperform it, this is not a bad thing to have in your portfolio.

10% custom selected ETFs: $XOP, $VGT

There are thousands of ETFs where you can invest in a fund that covers specific sector like energy or airlines, or country - like Nigeria or India, etc., and their big advantage - if you have confidence in some specific slice/sector of stock market, but don't want to bet on just 1 or couple of companies, an ETF can provide you exposure to this specific sector and you will get it’s average return + diversification just by buying one position.

For example, in last months energy sector is having a bad time. I wanted to take advantage of it, but not pick only 1 smaller company - as many of them will go to 0. So instead I bought $XOP:

XOP tracks an equal-weighted index of companies in the US oil & gas exploration & production space.

But it still is a risky bet, taking into account that over longer time period energy companies on average might have negative or very low returns:

The same can be seen for Vanguard energy ETF - it has returned on average 2.3% per year since 2004, but if you would have invested 1y ago, 5y ago or 10y ago - you would have negative return right now:

So my $XOP position that I opened on May 15th is a short term bet - that sector will somewhat recover and it will most likely be the first position I close.

But on June 15th I bought the complete opposite: Vanguard Information Technology ETF, $VGT:

Seeks to track the performance of a benchmark index that measures the investment return of stocks in the information technology sector.

Includes stocks of companies that serve the electronics and computer industries or that manufacture products based on the latest applied science.

Top 10 holdings: Apple, Microsoft, Visa, Mastercard, Intel, Nvidia, Cisco, Adobe, PayPal, Salesforce. So this ETF is something I could hold forever to get exposure to IT sector.

Sidenote: the main problem with ETFs in eToro - I can get access only to 153 ETFs, and some of them overlap - for example, there are 3 different ETFs for S&P 500 index. That is less than 10% of ETFs that should be available in Interactive Brokers or other more serious stock brokers.

10% small companies: $CCL, $WORK

On May 15th I invested in $CCL - Carnival Corp, with idea that cruising industry might survive the Covid crisis a bit better than airlines, and I selected Carnival as the biggest player and supposedly the best balance sheet, but considered $RCL - Royal Caribbean Cruises Ltd. as well.

I got the idea from @profgalloway, and his timing was not good - stock was at $33.5, when he suggested it, and later it went down to $8, but for me - buying it at $11.64 seems to be working OK so far: +71% in 1 month.

The cruise industry is the fastest-growing segment in the leisure travel market with demand increasing 62% between 2005 and 2015. And cruisers just want to keep on cruising. 92% of cruisers will book a cruise as their next vacation.

Carnival has reported accelerating revenue growth for the last four years and 40% gross margins.

Source: www.profgalloway.com/carnivirus

Note: @profgalloway is famous for bad calls as well, so don't follow anyone blindly.

The top risk for Carnival - no one is going to bailout cruise companies as they are operating from offshores. If recovery is fast, they will be fine, but if we get more waves of Covid and restrictions for travel are renewed, cruise companies will be in lot more trouble.

Interesting article from Bloomberg: Carnival Executives Knew They Had a Virus Problem, But Kept the Party Going

In short, this is a high risk gamble. Carnival bonds are rated just above “junk“ status, and they had hard time raising additional $6 billion to survive the downtime:

Carnival only managed to sell $500 million of shares, and they did so at just $8 each. (..) The company raised $4 billion in senior loans at a punishing 11.5% interest rate. That alone will add nearly half a billion dollars a year of interest expenses to Carnival’s operations. Even worse, the bonds are due in 2023, meaning that Carnival only has a couple of years to get its operations back on track before it owes the principal on that $4 billion.

Source: www.investorplace.com/2020/04/carnival-avoids-bankruptcy-but-sell-ccl-stock/

On June 15th I invested in $WORK - Slack Technologies. Part of reason - it is one of few tech companies which you can buy for cheaper price than at it was at IPO:

And I really like the news about partnership between Amazon and Slack:

Slack is partnering with Amazon in a multiyear agreement that means all Amazon employees will be able to start using Slack. The deal comes just as Slack faces increased competition from Microsoft Teams, and it will also see Slack migrate its voice and video calling features over to Amazon’s Chime platform alongside a broader adoption of Amazon Web Services (AWS).

Source: www.theverge.com/2020/6/4/21280829/slack-amazon-aws-partnership-amazon-chime-voice-video-calls

My first impression was - if that goes well, Amazon might later acquire Slack, and only couple of days later after I bought it, the same prediction was published by Business Insider:

“Amazon's new partnership with Slack is a 'testing ground' to get 'under the hood' and see whether it's a good fit for an acquisition, analyst says.“

The scary thing for Slack? Microsoft Teams:

10% big companies: $AMZN, $RDS.B

On May 15th I bought $RDS.B - Royal Dutch Shell plc ADR Class B, one of few oil companies that I view as “too big to fail“ and that might take over cheap assets of those smaller companies, that go to zero.

But this crisis is not easy for them as well:

In April, Royal Dutch Shell cut its dividend to US$0.16 per ordinary share from US$0.47, for a 66% cut. That marked the first time the company cut the dividend since WWII, a testament of just how severe the oil massacre has been, which is what Shell blamed in its press release. However, another culprit could be to blame for the dramatic cut: the company's 2016 acquisition of BG Group, which set it back $60B.

Anyway, my view is that at some point Shell will want to return back to previous dividend and that alone might provide 10+% yield.

On June 15th I bought $AMZN - Amazon.com - the stock price is almost at all time high, but I have always viewed them as too expensive, with ridicoulus P/E and I've been always wrong - it just keeps growing in size and valuation.

And considering the huge growth in e-commerce that happened during Covid and that it might repeat again, I want to use the opportunity to buy it before it reaches $2T valuation. So this is kind of a “fear of missing out” buy.

Key takeaways

Stock market and economy are disconnected. Thanks to insane money printing, we have now an army of Robinhood traders that believe in ideas like “stocks only go up“ and “buy the dip“. A very visible example is Dave Portnoy:

On the other hand, if printing more money would solve all problems, then why should anyone pay taxes? And why did not it work in countries like Venezuela and Zimbabwe? Some are more skeptical than others, but this party cannot go on forever:

What to do? Well, a balanced portfolio might help. In this experiment I've set the allocation to 50% stocks, 40% Bitcoin, 10% gold and I plan to find out if it really can be called an “all weather portfolio“ or not.

But someone else might feel more comfortable in owning real estate, farm land or something else that is “real“. Or holding a big position of cash to buy stocks & other assets when “there is blood in the streets“.

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

I just wondered if taking away the profits from carnival might be a good idea... I will start personally to travel again in 3 weeks, to an airbnb in Spain, but nobody will book a cruise in 2020, maybe more cause of hating the idea of being imprisioned on the ship than because of fear of the virus... this share's curve might be a W-type...