How to invest in Mintos?

I've been asked by many to share my Mintos investment strategy. So today I will try to give an insight, what is my approach to investing in Mintos and what I consider to be the main risks & advantages.

Mintos as a high-risk savings account

I view Mintos as a good alternative where to temporary place my spare cash. Why is it better than a standard bank savings account?

High return: it can potentially generate about 10% return per year

High liquidity: it is easy, cheap & fast to convert loans back to cash

Low limits: I can invest 10, 100 or 10 000 EUR

Risk/reward in normal market conditions

Of course, all the benefits mentioned above come with certain risks. I will decribe those below, but the main question is - do the benefits outweigh the risks? Is the risk/reward ratio good? In my opinion, it depends on timing.

I like the comparison with turkey - as long as it grows, it’s well being increases as well. And investing in loans on Mintos is about the same - if economy is doing good, then the math for most of Loan Originators should work fine - part of borrowers won't be able to repay the loans, but others paying hundreds of % in APR will cover it. Getting funding from Mintos investors is cheap. And in these kind of “normal“ market conditions the risk/reward ratio for investors is good as well.

Risk/reward in difficult market conditions

But what happens when the Thanksgiving day comes? Turkey is killed. And the same thing can happen to some of the Loan Originators on Mintos. If they already are extremely risky in “normal“ market conditions, then in a crisis like we have now with Covid, some of these companies might not survive.

In difficult market conditions the risk/reward ratio for a platform like Mintos is not good anymore. Situation is different:

Limited upside. Investor can still expect about 10% return in best case.

Uncertain downside. If you have a portfolio of 20 Loan Originators, each 5% and in next 12 months one of them fails completely, then the real return goes from 10% to 5%. If 2 of 20 Loan Originators fail, then return goes to 0%. In difficult market conditions it is almost guaranteed that some “junk“ rated companies will shut down, so the question is - do you want to gamble & measure the quality of Mintos Loan Originators with your investment?

Worse liquidity. Investors are losing money in stocks, bonds, some - in P2P scams, so part of them get scared and run to safety/cash and try to liquidate the riskiest assets. That can be seen in all of P2P platforms. In case of Mintos liquidity is still there, but instead of 0.1% now you have to pay 5-15% to sell your loans. On top of that Mintos has added a secondary market fee of 0.85%

Higher risk. One or several of things like these can happen:

Politicians might be forced to protect consumers - stricter regulation (limiting advertising, limiting interest rates), moratorium for borrowers, etc.

Math no longer works - suddenly lot of people lose jobs and cannot repay their loans, and it can take months to measure the quality of existing loan portfolio and to set rules for issuing new loans

Capital for issuing new loans gets more expensive

If a Loan Originator gets into a really difficult situation where it needs to decide - shut down or do some creative accounting, motivation to do some shady stuff will increase. And that can turn into more losses for investors.

Better alternatives with the same risk. Some Loan Originators on Mintos have also issued bonds with similar yields - about 10% per year. But the difference is that these bonds can be bought with a 30% or higher discount. So you can get exposure to the same companies and their portfolios as on Mintos, but with much higher returns.

Better alternatives with lower risk. With global economy crashing there are other alternatives (bonds, stocks) that can offer similar yield as P2P, but with lower risk.

My auto invest strategy

Before this whole Covid stuff started, I had a 20k EUR Mintos portfolio. My latest Auto Invest strategy was following:

Auto Invest portfolio Nr 1: invests in loans from 10%, higher priority

Auto Invest portfolio Nr 2: invests in loans from 8%, this portfolio has lower priority and is used as “backup“ to avoid any cash drag

For both of these portfolios settings are following:

Selected only those loans that come with BuyBack guarantee

Selected all Loan Originators with A, A-, B+, B ratings

Removed GetBucks and Peachy (too low rating on ExploreP2P)

Added Dziesiątka Finanse, Dozarplati, Esto, LF Tech (high rating on ExploreP2P)

Selected loans with at least 10% for primary portfolio, 8% for secondary portfolio

Verified that at least 20 Loan Originators matched my settings

Loan term up to 12 months

Set Portfolio size to 20 000 EUR

Set max 5% share for each Loan Originator in the Diversification settings

Set investment size in One Loan from 10 EUR to 100 EUR

Why these specific settings? Goal was to:

Select about 20-30 Loan Originators, focusing more on their quality instead of offered return

Ideally aim for splitting money at 5% or less per Loan Originator, in worst case one Loan Originator can get up to 10% of investment (because of 2 portfolios with same settings)

Everything should be working without need to monitor/adjust settings often. Idea is to get it as close as possible to passive investing

Shorter term loans to get money back faster if it is needed at some point later and there is some kind of issue with secondary market

Final result looked like this:

As you can see - diversification worked quite good, the worst case was Kredit Pintar that got 8.8% of total investment. Estimated return is not bad either.

How has it performed so far?

I have avoided all the problematic Loan Originators so far: Monego, Peachy, Iute Kosovo, Rapido, Alex Credit, Capital Service, etc., so I am quite happy with that.

What did I do with my Mintos portfolio?

One month ago I sold 25% of my Mintos portfolio with a 0.1% discount, but it was not so easy with the rest. I needed to use 5% discount to sell another 50% or 10k, so I took about 500 EUR loss, and I still have about 25%/5k in Mintos.

Why did I sell 75% of my portfolio?

Risk/reward is not good anymore

I wanted to move money from Mintos to Interactive Brokers to do some gambling with options & stocks

Do I plan to use Mintos at some point later? Sure, when this Covid stuff goes away and economy improves, then I will use Mintos as my high-risk savings account again.

Risks to consider before investing in Mintos

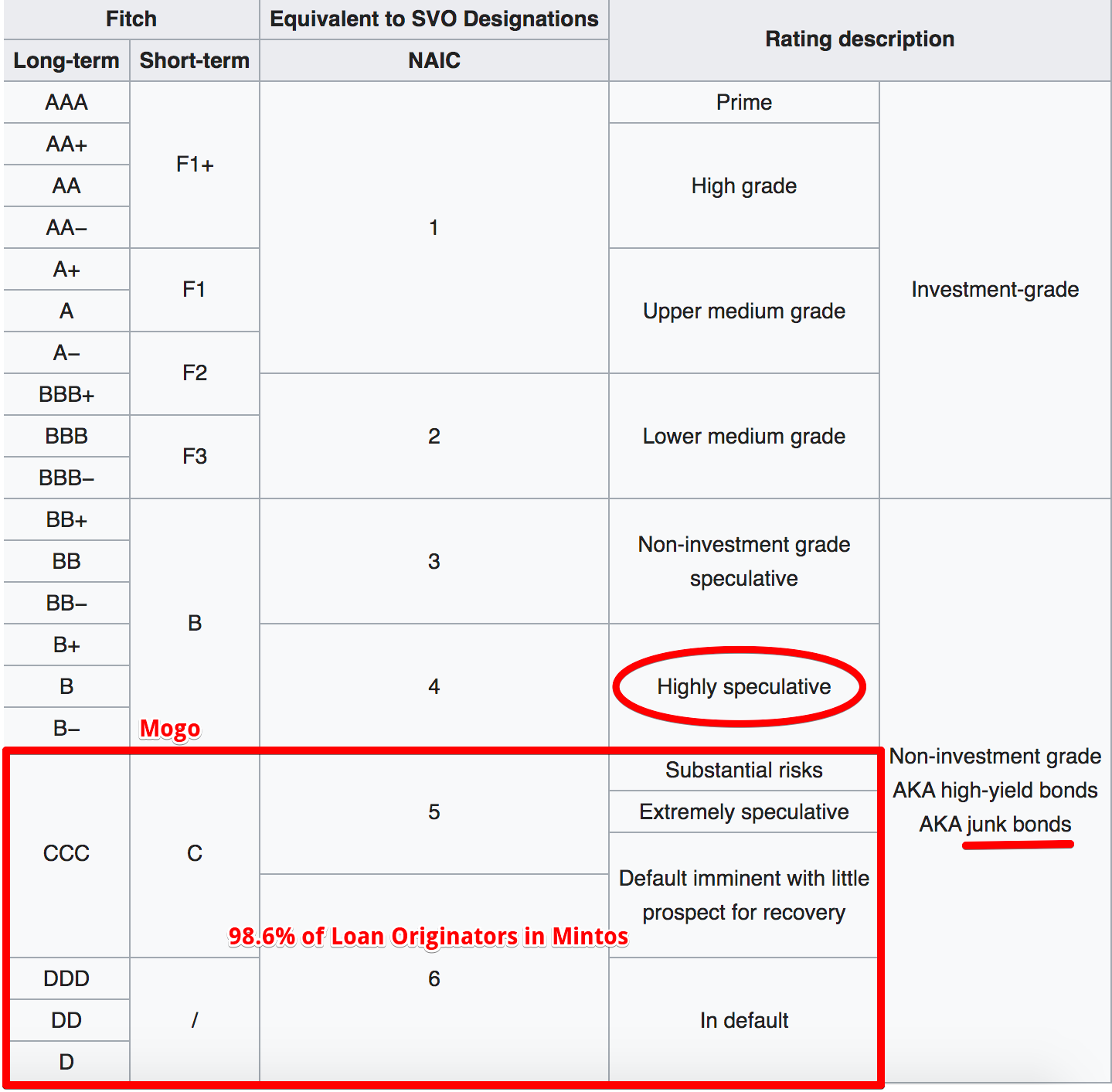

Loan Originator ratings are inflated. For example, Fitch rated Mogo as B-, but at the same time Mogo is the only “A” rated company in Mintos. If Fitch would rate all Mintos Loan Originators, result would probably be B- for Mogo, C and worse for everything else. What does it mean? I will let Fitch do the explaining:

Uninvested cash in Mintos platform can be lost. In February 2020 Mintos investors had about 30 million in cash. That is split among about 5-6 banks, so even if this money is distributed evenly and one of these banks shut down, then up to 30/6 = 5 million EUR can be lost in total. Solution = don't hold cash in Mintos. Invest it or withdraw it.

Every Loan Originator can run into issues. 95.6% of outstanding loans on Mintos are personal, car or short-term loans. All have extremely high interest rates for consumers and that always ends with stricter regulation - limits on advertising, limits on max APR, etc. and if a Loan Originator’s business model is built on idea to issue loans with 500% APR, it might fail when max APR is set to 20%.

Mintos interests are not aligned with investor interests. Mintos as a business needs volume and as many Loan Originators as possible, and it is not important - if some of Loan Originators fail or not. Bad side effect for investors - Mintos is heavily promoting their “Invest & Access“ product that no educated investor would use, adding extremely risky Loan Originators to platform, overselling junk loans with inflated ratings, not requiring frequent financial reports from Loan originators, etc.

Related Loan Originators get special treatment. There is a strong suspicion that at least some of the Loan Originators that have the same shareholders as Mintos, have special attitude - not so strict requirements to be listed, better ratings, and slower rating downgrades when issues arise.

Many find out about the real risk too late. Because of good marketing and few problematic Loan Originator cases in the first couple of years, many investors expect similar performance in future. But when we get an economic downturn & crisis like now with Covid, then chance of many Loan Originators blowing up gets so high, that investors might lose big part or all of their previous gains.

Mintos is not regulated, so it can change rules any time. And we have seen lot of that recently:

Pending payments were launched, which solved one Mintos problem, but created several new problems for investors: lower returns, frozen money, unpredictable returns for short term loans

Loan extensions - changing terms for new & previously issued loans

Adding a 0.85% fee to secondary market

Mintos advantages

Biggest P2P platform in Europe. Lower cost to attract new investors, bigger influence over Loan Originator partners, who want to access the huge Mintos investor base.

Great liquidity. In normal conditions it is possible to sell loans with 0.1% or similar discount, but even in extreme market conditions like now investors can exit the platform by offering a 5-15% discount in secondary market.

Committed investors. Mintos biggest shareholders are also connected to at least 13 Loan Originators on Mintos, so for them Mintos is a very important funding source and they are motivated to keep Mintos alive & well even if some of their Loan Originator companies fail.

Mintos is a marketplace - so in theory Mintos as a platform can be “fine“ even if 90% of their Loan Originators fail. Of course, that would come with losing trust from some investors and less revenue, but Mintos is not dependant on one specific funding source.

Many Loan Originators. If you have no problem investing part of your money in what others would describe as “extremely speculative“ or “junk“, then in Mintos you can get quite a good diversification of this high-risk category.

No cash drag. Some smaller platforms have cash drag issue - when there are not enough loans where to invest, and that increases the risk for investor (if bank holding the cash goes bust, your cash might be lost) and lowers the expected return. Mintos had this problem in the beginning as well, but not anymore. Market conditions change, average expected returns goes up and down, but there are always enough loans.

Alternative view

I personally think that investing in Mintos is a good idea when economy is doing good, and not so good idea in difficult times. But there are some investors who like to take on more risk and do the opposite - buy loans in secondary market with 5-15% discounts, or invest more money in Mintos - because now Loan Originators are forced to increase interest rates for new loans, some offer even 20% or more.

I don't think there is one correct approach, everyone has his own strategy. I look at Mintos as a high risk savings account for temporary usage, others might see it as an investing platform. I don't think it is a good idea to invest in Mintos more than 20% of your capital, others will invest 100% in Mintos & other P2P platforms.

Interview with Mintos CEO

If you want to learn more about the shareholders behind Mintos and some other interesting questions, I suggest to watch my interview with Martins Sulte. It is available in audio or text format as well.

Key takeaways

Mintos ratings are inflated, all Loan Originators are speculative

In difficult market conditions risk/reward is not good anymore

Mintos as a platform will be fine, even if some Loan Originators fail

Mintos has great liquidity even in an economic crisis

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Hi Kristaps, where can you buy this:

Better alternatives with the same risk. Some Loan Originators on Mintos have also issued bonds with similar yields - about 10% per year. But the difference is that these bonds can be bought with a 30% or higher discount. So you can get exposure to the same companies and their portfolios as on Mintos, but with much higher returns.

Very interesting. I have small amount in mintos 4000eur. I won't touch, i want to see what will happen through the pandemic. At the moment i mostly invest in stocks. Disney, Google, first solar, Amazon, Airbus, Alibaba, Microsoft, Swedbank, Apple, USO, Goldman sacks.