Let’s review one of the P2P investment blogging superstars and how he has gotten so successful that he even spends money on paid Google ads:

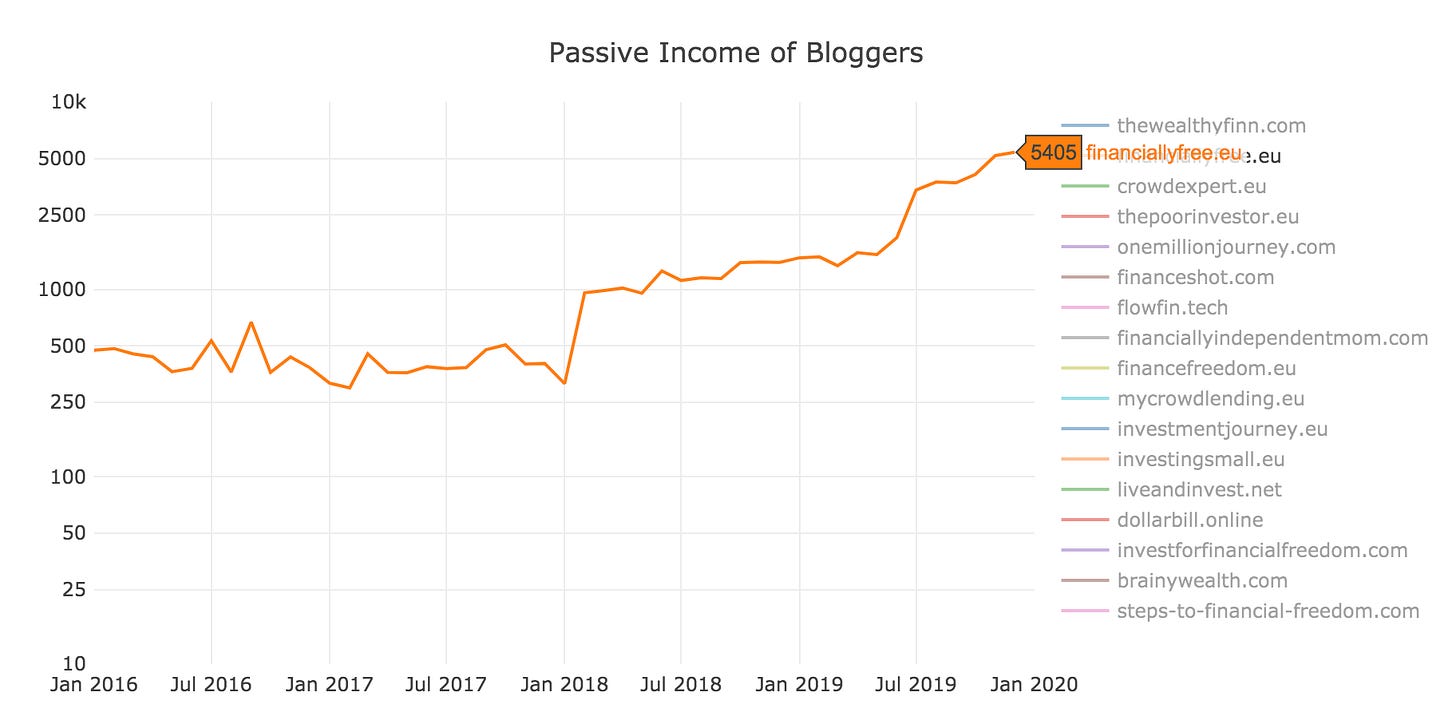

Of course, I am talking about Jørgen Wolf, the IT guy that decided: why work, if you can promote financial independence, “safe” investments and at the same time get referral commissions from people you “help”. Right now he makes 5405 EUR of passive income per month from investments, but according to data I was provided with - even more from referral fees.

Of course, not all P2P platforms are scams, but I think it is obvious now to everyone - that Kuetzal was a scam and it was super easy to spot it to anyone who would care to do any research.

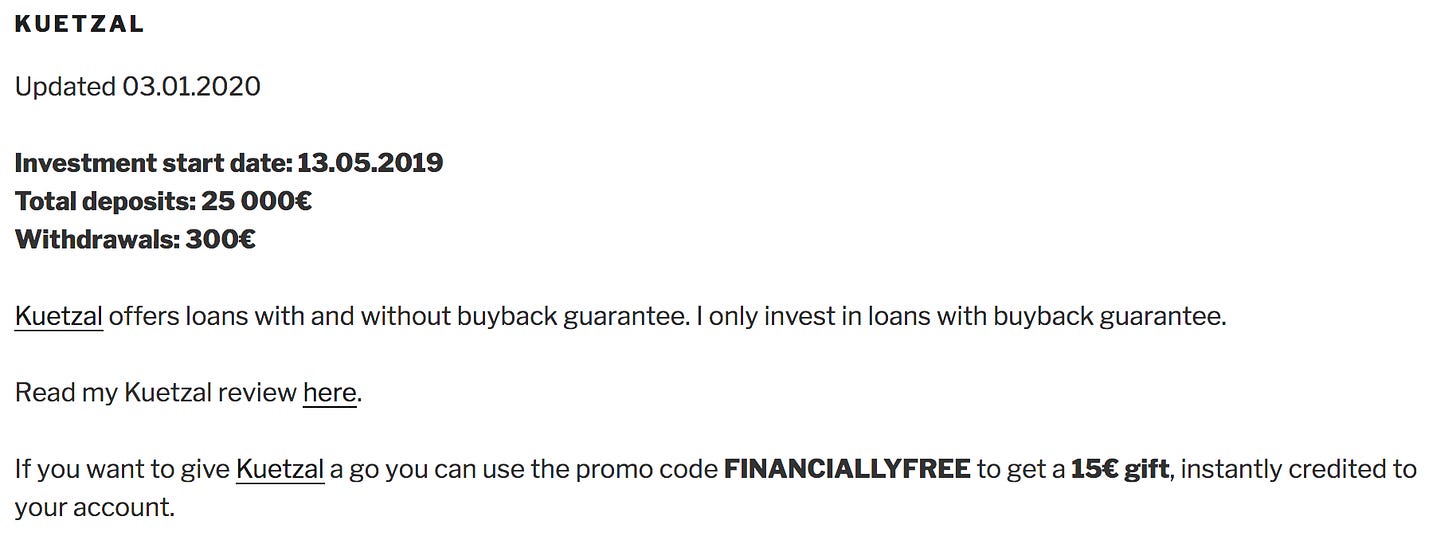

What about Jørgen? Did he do any research? Did he warn his followers? Let’s look at his Kuetzal page, screenshot taken 16.01.2020:

So withdrawals stopped working in mid-december, Jørgen met Kuetzal and could not get any proper explanation to many issues raised on Dec 18th (better report here), and Kuetzal was shut down on January 13th, but we can still read about his promo code to get a 15 EUR gift. Thanks!

And even Dec 18th was already too late for anyone, some research should have been done before promoting this. Maybe you think - “how could he know, everything seemed so good”? Well, there were some red flags:

The registered owner of Kuetzal is Viktoria Gortsak, a 29 year old female. She was not listed as owner or even a co-founder. But those who checked further, found her husband was connected to money laundering.

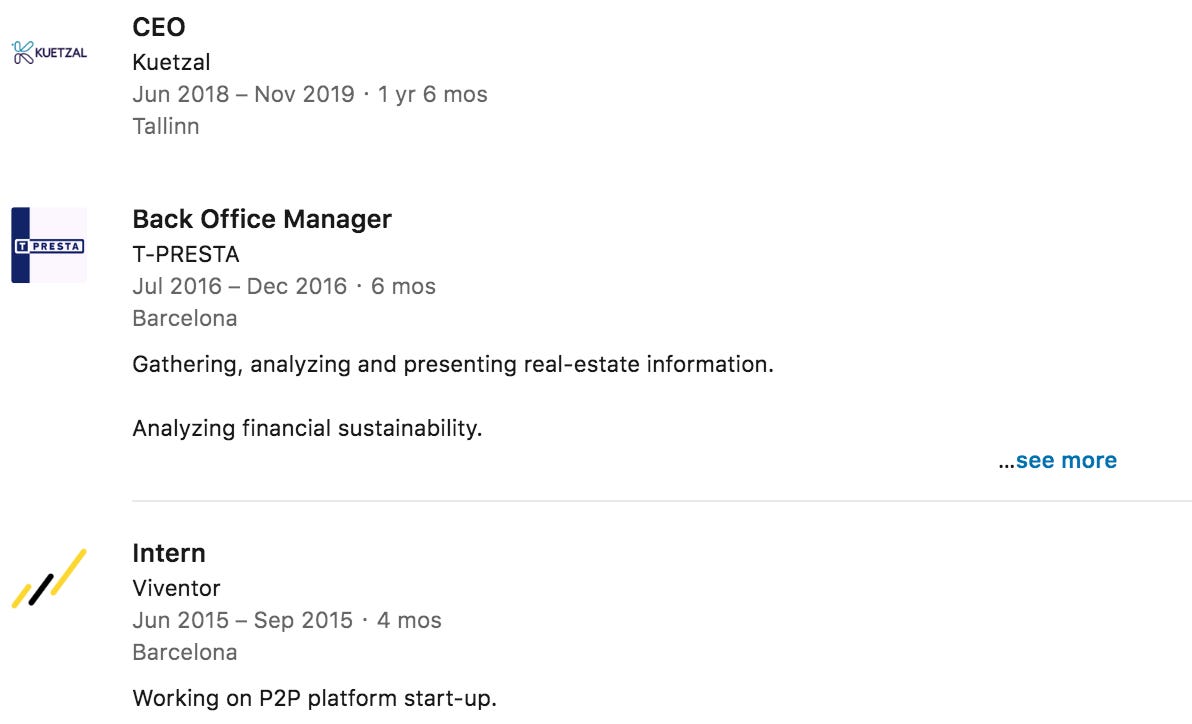

Alberts Cevars had no experience running a business before. Intern and back office manager - these were his roles before becoming the CEO of Kuetzal:

Kuetzal Care - impossible bullshit, described as “Our projects and clients have the unique advantage, which guarantees additional funding in amount of X % of the total project value to those projects that have not been able to obtain the necessary funding within the specified time frame.“. Of course, no proof for this.

High interest rates for funding businesses that don't have high margin. It just makes no sense.

CEO was changed in November 2019

Impossible combination: high interest (20%+) together with Buyback guarantee.

No contracts for investors

No proof of collaterals, guarantees, pledges that investors can verify

Fake projects, for example: Alberg Petrol

Not enough info about investment projects

Another impossible promise with no math or proof behind: “Our core values are honesty, transparency and precision. Therefore, we guarantee our customers an opportunity to pull out of the investment at any time.“

Info from Alberts that buyback is not covered in any way and he would personally pay for it. So company is owned by Viktoria, he is just an employee, but would pay for investor losses? Sure, totally makes sense.

Was it that hard to think a bit? Not really. Just check out these two guys who did their homework and decided not to touch Kuetzal:

Sure, also these two were too late - not much help to write about a platform when withdrawals are not working anymore. And Georg omitted the bad parts of his interview when he actually met them, published only later.

But if you want to follow someone’s advice - then listen to guys, who at least have some ability to think for themselves. And they might not tell you what NOT to do, but at least they should be wise enough to not invest in & promote completely stupid shit.

And Jørgen had plenty of chances to do some proper research himself, his journey with Kuetzal started already in May, 2019:

He visited many projects, but mainly for taking photos, not actually doing any research. Let me quote, what he actually wrote about two red flag items, further legitimising Kuetzal impossible promises to his audience:

What is Kuetzal Care?

Kuetzal care currently has two purposes:

To give investors interest payments from the day they invest. They don’t have to wait for the project to be fully funded.

Projects marked with Kuetzal Care will be fully funded – in not by investors, then by Kuetzal’s own funds.

We don’t know much about the people behind Kuetzal Care. According to Alberts, it’s 4 private investors and an investment fund.

The investment fund is mainly attracting funds of investors from Asia and using them for investments in Europe. Overall participation of that fund in Kuetzal Care is ~30% of overall cap.

Alberts knows investors prefer 100% transparency – so does he. He hopes to be able to introduce all the parties within Kuetzal Care one day.

Buyback Guarantee

Most projects have Buyback Guarantee as well, which again has two purposes:

To give investors an option to exit a project early by selling the investment back to Kuetzal for a 10% fee. (Contact Kuetzal by mail if you want to use this option)

To secure any principal invested and return it to the investors in case a project defaults.

Note that Kuetzal promises to cover 100% of your investment in case of default.

I have suggested Alberts to include buyback guarantee as a corner stone in Kuetzal care. That would make the concept a lot stronger (and much easier for new investors to understand). I hope they will consider this.

Maybe next time don't suggest what to do to a scammer, but try to ask things like:

why would Kuetzal need retail investors, if they already have 4 private investors and an investment fund that would invest in any project, any amount without asking any questions? Makes no sense.

who are these 4 investors and investment fund? Can you meet them or verify their identities, or check their reputation? See any agreements? Why not?

how can Kuetzal provide a buyback guarantee? How big is their reserve? If they have projects for 500k and even 1+ million EUR, and even 1 of them fail, from where is this money coming from? Not possible, unless they charge not only 20% interest to pay investors, but also 10%+ fee for themselves, and who could afford paying so high interest rates and still make money?

But OK, as it should be clear by now - this is obviously too complicated task for Jørgen - to do any due diligence, math or research. And who can blame him - if you would make 10-15k EUR per month just by taking photos and smiling, why ask questions?

But actually this is the part, where it gets interesting. Well, at least for me. Because for a while I could not understand - if Jørgen is just unaware of the stuff he is promoting? Or does this passive income and financial independence stuff has clouded his judgement so far, that even if someone would point him to a scam, he would still ignore it? Let’s see.

One of the reasons I was sure there was something off about Kuetzal - the impossible bullshit these mining guys were promoting - buying some crappy old CPUs and mining shitcoins.

I know how the math works behind crypto mining - with my partner we had invested $150k into miners and crypto containers, and we have run operations in Latvia, Lithuania and Middle East. In short - crypto mining is insanely competitive, capital intensive and you need a perfect combination of low cost energy, reliable & fast shipping of miners, good quality containers and a stable operation. Getting all of these factors right is extremely difficult and one of reasons it does not make sense to run any operation in Europe anymore - energy prices are too high to generate any profit.

The only way I could explain this crypto mining crap project - OK, maybe the mining guys are just using money from Kuetzal to buy old CPUs, set them up and sell to some client, who has no idea what he is doing. And this could be done once, but not two times, because no client would buy anything like that anymore.

Well, the laws of math don't matter when it comes to Kuetzal - the second mining project was still active in end of December:

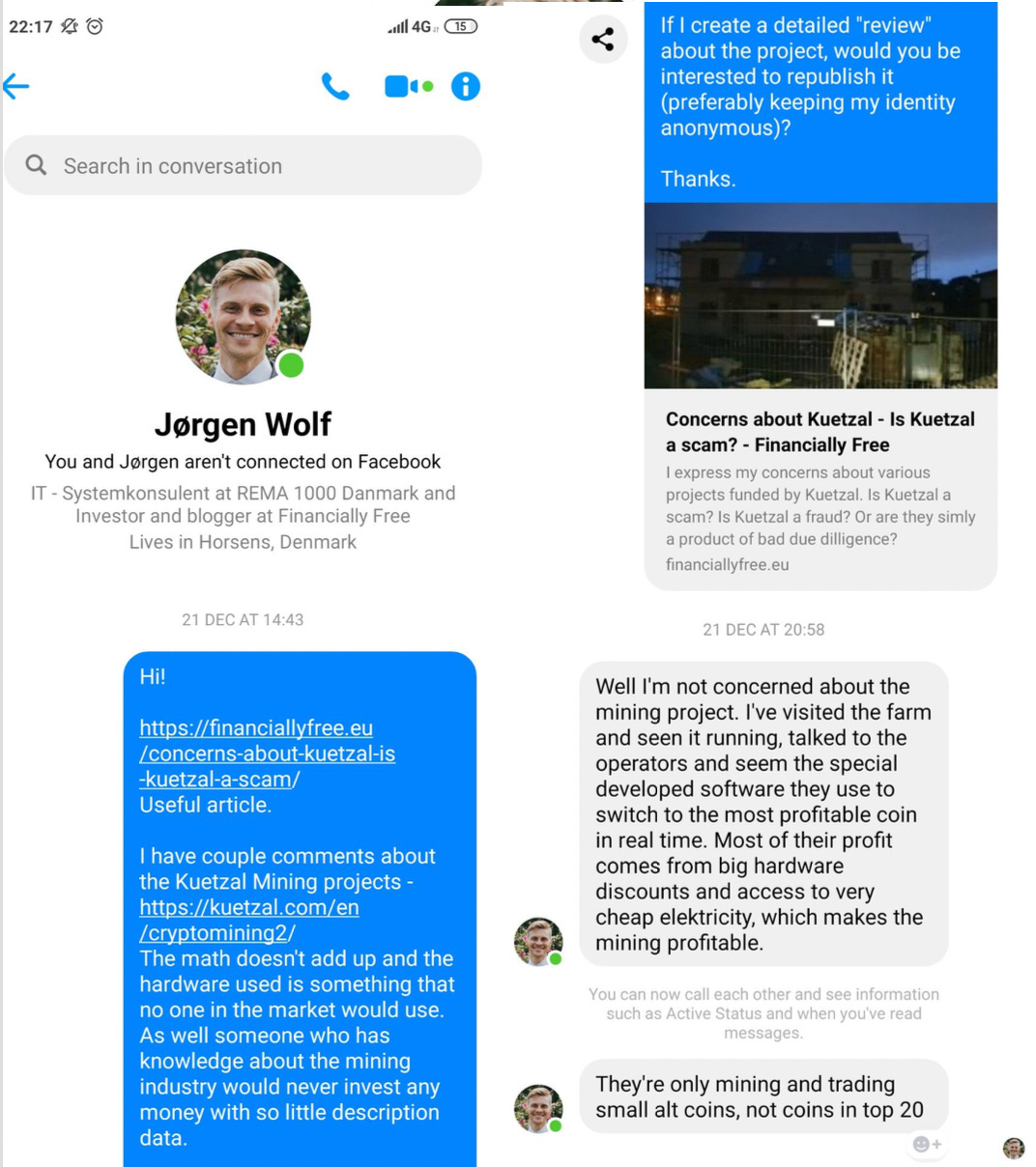

I had no idea about this at the time, but it turns out - someone also noticed that this project is 100% bullshit and actually sent a warning to Jørgen that Kuetzal has a scam project and if needed, additional review can be created to explain it.

Notice that this was on Dec 21st - after it was clear, that there is no Kuetzal office, no team, no answers to important questions, including about other fake projects. Let’s see what was Jørgen’s response?

Obviously, no need for details. Everything is fine - Jørgen had visited the mining guys in person and is an expert both in finances, business and crypto mining.

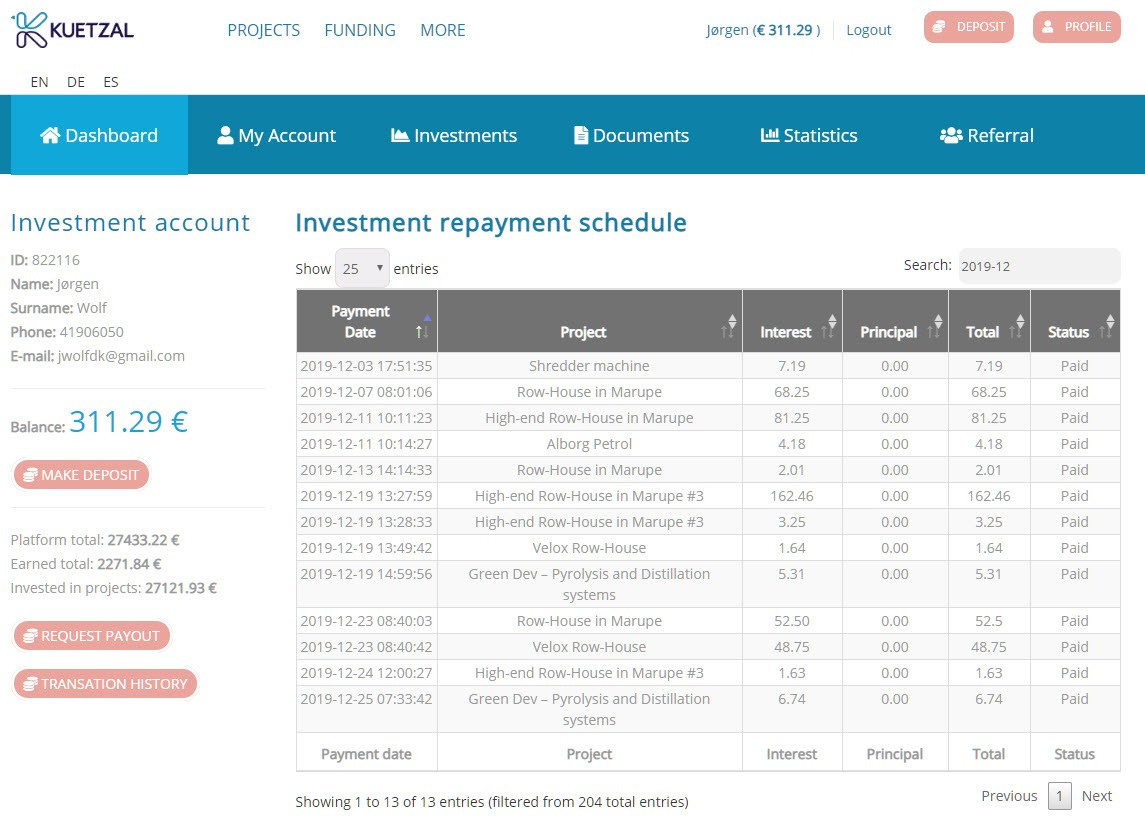

And of course, everyone knows how it ended. Jørgen has lost about 25k EUR, and his followers - most likely even more.

Sad story, right? Well, I am sure - that this is only the beginning of suffering for all the investors who follow Jørgen and other finance bloggers who focus more on their promo codes instead of actually providing any value.

Key takeaways

Following bloggers who rehash the same stuff they hear from platforms will lead you to the same result we see here. A lot of suffering.

If something seems off, stay away or do proper research.

If any investing platform - P2P, crypto, forex or whatever - promises both high returns and both - 100% safety or any kind of similar guarantee, run as fast as you can.

Want to get access to exclusive content? Become a paid subscriber:

Or join “High-risk investments“ Telegram group for an informal discussion.

Great post - thanks for writing it.

Scams are everywhere and you seldom get the truth especially when there are so many fanboys