Getting a loan to invest in loans? Results

More than 2 months ago I did a stupid experiment - took out a 3000 EUR loan to invest it in Mintos loans. The upside was very limited - at best case I could make maybe 50 EUR, but downside was much bigger. So how did it go? Worse than expected.

Initial plan

Take a 3000 EUR loan on Feb 26th (interest free for first 2 months)

Invest these 3000 EUR in a Mintos test account for almost 2 months

Sell all Mintos loans in secondary market couple of days before April 26th

Repay my own loan until April 26th

Profit?

What went wrong?

As I mentioned in my previous post, there are many risks involved with this plan, one of them:

Liquidity can disappear (problems with Loan Originators or a global downturn)

And this is exactly what happened - only 2 weeks later after I started this experiment, Covid-19 crisis started to have a huge impact on all P2P platforms - Loan Originators starting having problems and many investors wanted to get out.

Mintos actually did a survey about this topic, 2294 investors participated and here you can see the results:

How did it impact my plan?

Up till March 12th or so it was possible to sell Mintos loans to other investors with only 0.1% discount, but after that the situation with liquidity got bad very fast and to sell anything in Mintos secondary market, discounts of 5% to 15% were needed.

On top of that, Mintos also introduced a secondary market fee of 0.85%.

So when I sold most of my loans on 23rd and 24th of April, these are the discounts I needed to use:

With discounts up to -3%, I managed to get €500

With discounts up to -7%, I managed to get €1528

With discounts up to -9%, I managed to get €2241€

With discounts up to -12%, I managed to sell everything

Final results

My test account on April 23rd, right before selling loans:

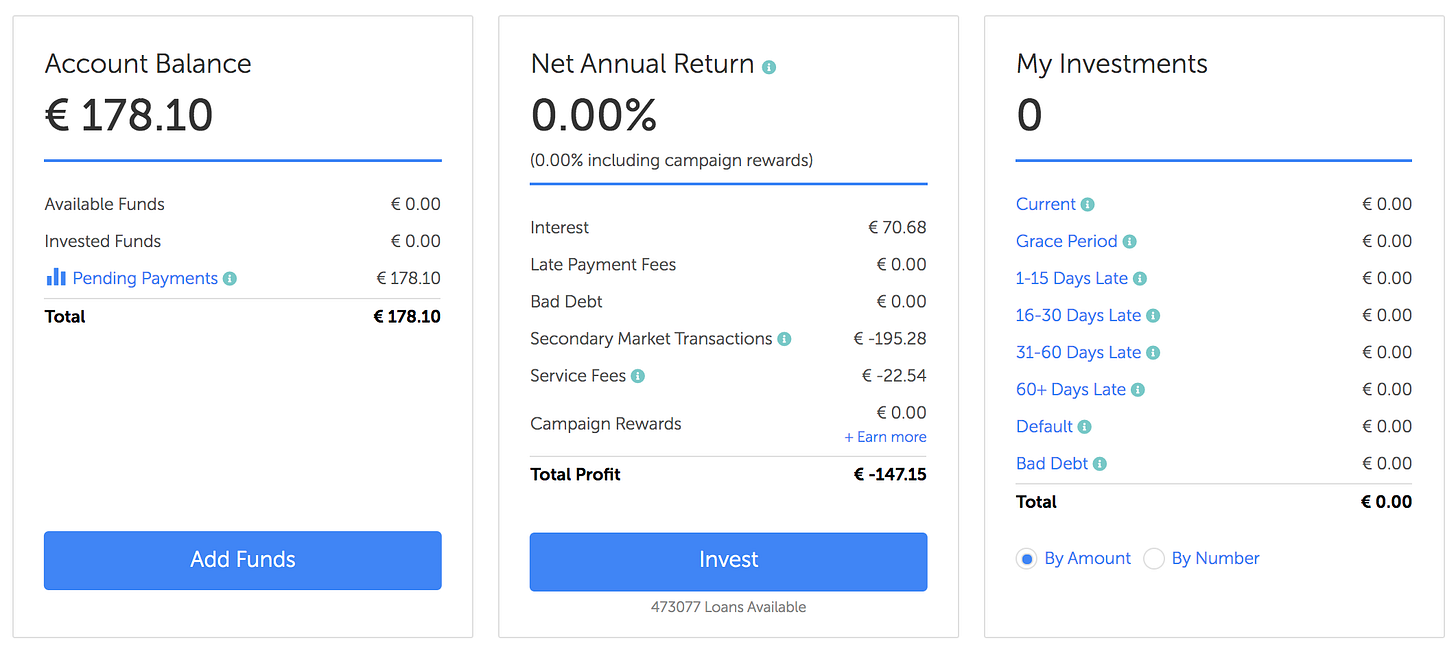

And how it looked like 1 day later, after selling all loans:

So instead of making €50 I lost about 3x more: €147.15

Key takeaways

Do not borrow money for investing - it is a very dangerous and stupid idea

Even if Covid-19 would not have happened, the time spent and risks taken for a very small reward would not make sense

In an economic downturn even the biggest P2P platforms have liquidity issues

P.S. Join “High-risk investments“ Telegram group for an informal discussion.

Kristaps, generally your posts are very biased and structured in a way to prove your overall thesis that all P2P is crap, but this one beats them all. Whole setup and timing is severely biased. I will explain why.

1. Too short term. P2P is not cash account in bank - so making experiment for only 2 months with loans with 60 days buyback and cashing out 100% before loans being repaid or bought back is just something you do to prove some thesis you are aiming at.

2. You are setting example with getting a loan with 51% annual interest?!? - of course it will go wrong. Who gets leverage at 50%?!?

3. Cashing out at the worst possible moment.

Don't get me wrong me - I totally support the idea that getting a loan to invest in loans is majorly stupid and many things can go wrong especially for average Joe that thinks P2P is safe investment.

But for such an experiment to be concise and have any valid conclusions I think that it needs to be setup in a totally different way:

1. At least 1 year

2. Get widely available consumer loan at 3-5%

3. Cash out only as much as needed to cover the loan repayments.

4. See what is left at the end of the year.

As you would like to put this guide with the banner - Prove me wrong

I have a draft post in my blog about borrowing to invest.

I intended to take a 1 year loan, invest it until the end of the loan, and use some of my own money to pay back the loan. I intended to make a profit a year later, at the end of the loan.

I reach conclusion number 2 : too much hassle for too little profit.