Are banks getting too unstable?

In recent weeks several US banks failed:

March 8th: Silvergate Capital announced that it will wind down operations and liquidate its bank.

March 10th: Silicon Valley Bank—the 16th largest bank in the United States—was shut down by federal regulators

March 12th: Signature Bank closed by New York State Regulators

After that on March 13th many bank stocks started trading like crypto shitcoins:

Western Alliance Bancorp -75%

First Republic Bank -66%

Customers Bancorp -54%

PacWest Bancorp -46%

Zions Bancorp -44%

Bank of Hawaii -42%

Comerica -39%

East West Bancorp -32%

Since then they have somewhat recovered, but situation has not improved:

There are 186 banks across the country that could fail if half of their depositors quickly withdraw their funds, a new study published on the Social Science Research Network found.

Even insured depositors — those with $250,000 or less in the bank — could have problems getting their cash if these institutions face the sort of run that Silicon Valley saw a week ago.

Source: “Nearly 200 banks at risk for same fate as SVB: study“

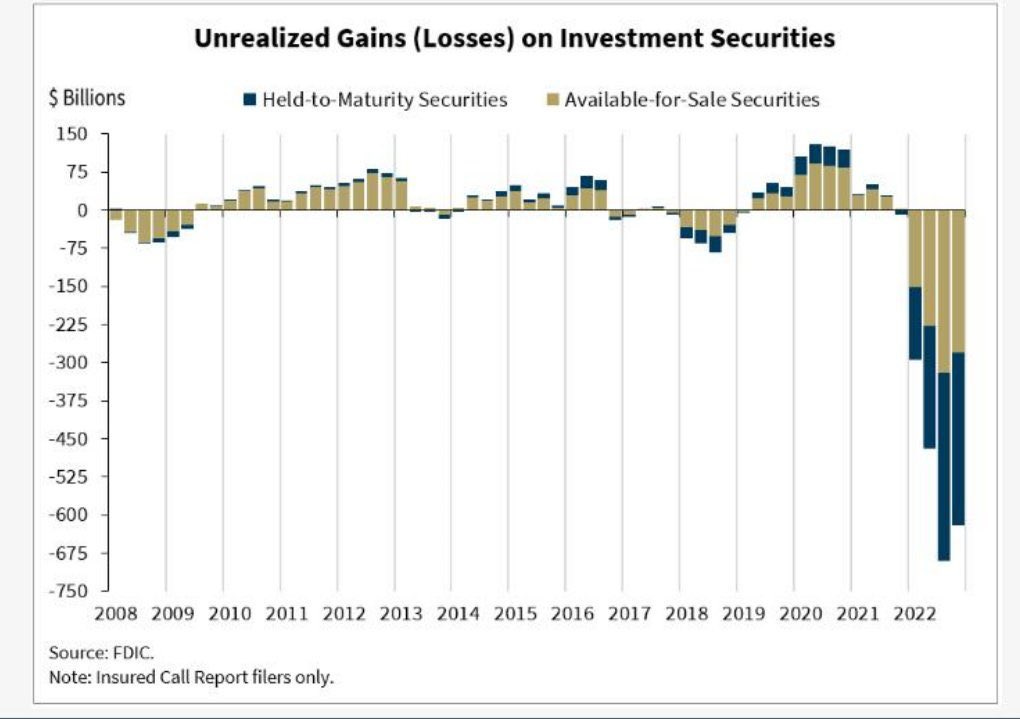

And it is not that surprising if you look at unrealized losses of US banks:

This is a good description of situation:

From a depositor perspective, banks are basically highly-leveraged bond funds with payment services attached, and we treat it as normal to keep our savings in them.

To help normalize that and make it seem less weird, the FDIC provides insurance against deposit losses up to $250,000 which mitigates some of the risk. However, at any given time, FDIC only has about 1% of bank deposits’ worth of insurance in their fund. They can protect depositors against individual bank failures, but they don’t have enough to prevent against system-wide banking failures, unless they draw in aid from elsewhere or are backstopped by Congress with a fiscal bailout.

Also interesting that while FDIC is very limited in their ability to provide insurance, they still decided to cover all deposits of Silicon Valley Bank and Signature Bank (also those above $250k), and Janet L. Yellen explained that it was done because of systemic risk:

In short - couple of people will decide again which banks will get bailouts, which will burn down, but in the meantime - deposits will flow from small, regional banks to one of the “Too big to fail“ banks.

And not surprising that with a small delay bank failures continue in Europe:

What will happen next?

Increasing interest rates at such a fast pace as it was done in last year is seen as one of reasons for bank failures, so if bank runs continue, then fighting inflation might get postponed and trying to restore faith in banking system might become top priority. That would mean lowering interest rates, providing liquidity and continuing with money printing.

But that can also work only for a limited time, the whole fractional-reserve banking system is not sustainable, and even US Treasury admits it:

How to escape?

Since March 12th when first 3 banks collapsed, Bitcoin exploded from $20k to $28.5k, +40% in 8 days:

In same period Gold went from €1755 to €1886 per Troy Ounce, +7.5%:

Recommended reading:

Nic Carter: Operation Choke Point 2.0 Is Underway, And Crypto Is In Its Crosshairs

Lyn Alden: How the Fed “Went Broke”

Arthur Hayes: Kaiseki

Also enjoyed this discussion:

Key Takeaways:

Money deposited in smaller banks is not as safe as many believed. Rational thing to do is buying short-term Treasury bills and keeping money in the “too big to fail” banks.

Whole fiat system feels like house of cards, it is not sustainable, even US Treasury admits it.

Hard to believe that the fight against inflation will continue, if trust in banking system continues to fall. At some point inflation might even be a neccessary evil to reduce government debt.